- United States

- /

- Biotech

- /

- NasdaqCM:BIOC

Biocept (NASDAQ:BIOC) Shareholders Have Enjoyed An Impressive 104% Share Price Gain

Biocept, Inc. (NASDAQ:BIOC) shareholders might be concerned after seeing the share price drop 19% in the last month. But that doesn't detract from the splendid returns of the last year. We're very pleased to report the share price shot up 104% in that time. So some might not be surprised to see the price retrace some. More important, going forward, is how the business itself is going.

See our latest analysis for Biocept

Given that Biocept didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Biocept grew its revenue by 133% last year. That's stonking growth even when compared to other loss-making stocks. And the share price has responded, gaining 104% as we previously mentioned. That sort of revenue growth is bound to attract attention, even if the company doesn't turn a profit. Given the positive sentiment around the stock we're cautious, but there's no doubt its worth watching.

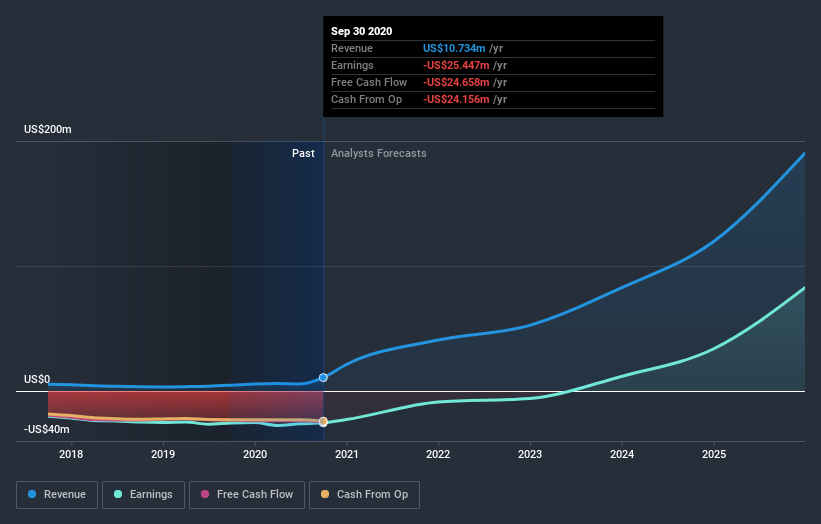

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Biocept's financial health with this free report on its balance sheet.

A Different Perspective

We're pleased to report that Biocept shareholders have received a total shareholder return of 104% over one year. That certainly beats the loss of about 15% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand Biocept better, we need to consider many other factors. To that end, you should learn about the 4 warning signs we've spotted with Biocept (including 2 which are potentially serious) .

We will like Biocept better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade Biocept, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Biocept might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:BIOC

Biocept

Biocept, Inc., a molecular oncology diagnostics company, develops and commercializes proprietary clinical diagnostic laboratory assays designed to identify rare tumor cells and cell-free tumor DNA from blood and cerebrospinal fluid, or CSF in the United States.

Limited growth with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026