- United States

- /

- Biotech

- /

- NasdaqGS:BIIB

Where Does Biogen Stand After Recent 7% Rally Amid Alzheimer’s Drug Developments?

Reviewed by Bailey Pemberton

If you own Biogen stock, or are thinking about buying in, you might be wondering what to make of all the recent movement in its share price. Over the last month, Biogen has shown encouraging signs with its price up 6.8%. But that follows a bumpy ride: down 2.1% over the last week, and still nursing some longer-term wounds, sitting nearly 19% below where it was a year ago. Stretch that out even further and Biogen is down about 48% over the last five years. So, what’s driving these waves?

Some of the price shifts have tracked broader market trends, especially as investors recalibrate their risk appetite in light of new developments in the biotech sector. Optimism around innovation continues, even though competitive and regulatory forces spark volatility. When the market gets a jolt of positive data or a new therapeutic breakthrough is in the headlines, you can see Biogen inch up as investors reassess its future potential. At the same time, any whiff of risk or uncertainty can push the price lower in a hurry.

Given this backdrop, the big question is whether the current share price is actually a bargain. Out of six major value checks, Biogen comes in strong with a value score of 5, meaning it looks undervalued by most yardsticks. But numbers and ratios only tell part of the story. Up next, let’s break down these valuation methods in detail, and at the end, I’ll share an even more practical way to judge if Biogen is right for your portfolio.

Why Biogen is lagging behind its peers

Approach 1: Biogen Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by projecting a company's expected future cash flows and then discounting those amounts back to their present value. This method helps estimate what a stock should be worth today based on how much cash it could generate over time.

For Biogen, the current Free Cash Flow is $1.85 Billion. Analysts forecast that Biogen's annual cash flows will grow, with projections climbing to $2.80 Billion by 2029. While analyst predictions typically only cover the next five years, further estimates are extrapolated to complete a 10-year outlook and provide a fuller picture of long-term value.

After crunching the numbers using this 2 Stage Free Cash Flow to Equity model, the DCF approach calculates an intrinsic value of $365.65 per share for Biogen. Given where the stock currently trades, this suggests the shares are 58.7% undervalued by the market.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Biogen is undervalued by 58.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Biogen Price vs Earnings

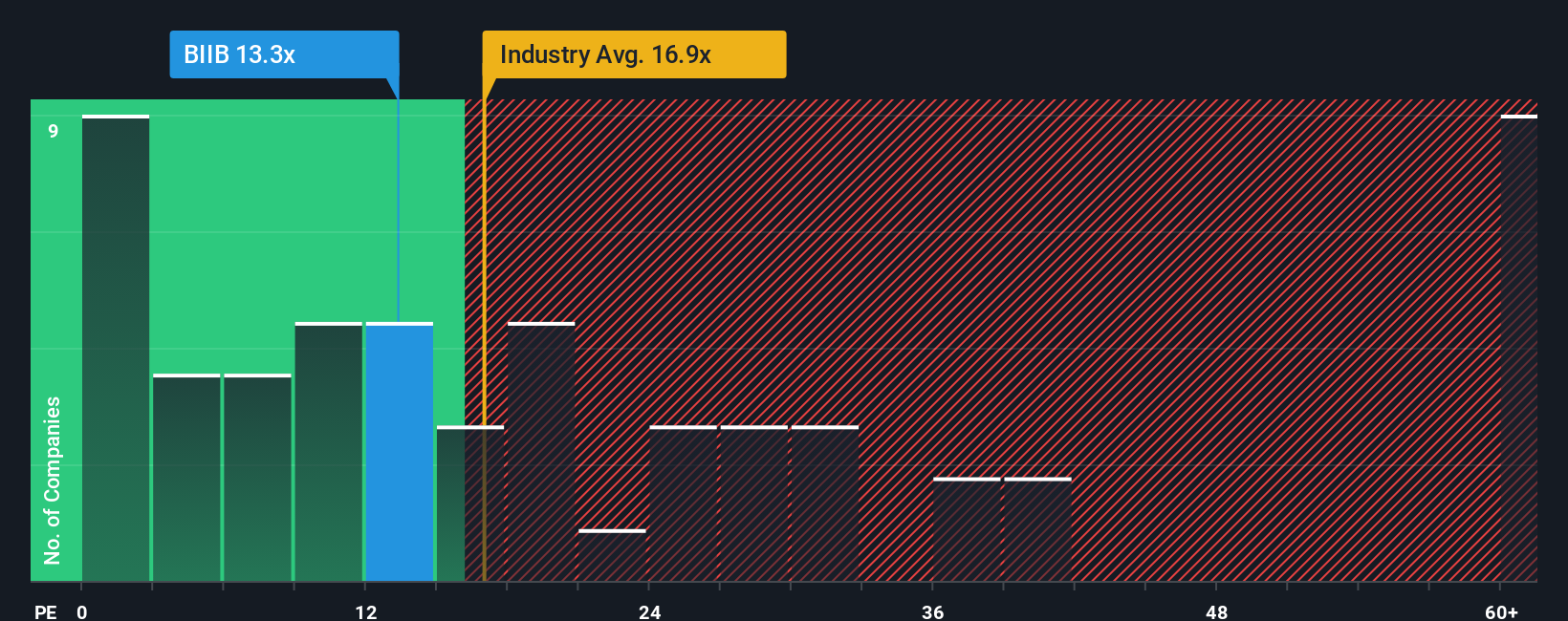

When analyzing a profitable company like Biogen, the Price-to-Earnings (PE) ratio is a widely used tool for gauging whether its shares might be attractive. The PE ratio tells investors how much they are paying today for each dollar of current earnings, so it is especially useful for established businesses with steady profits.

It is important to remember that what qualifies as a “normal” or “fair” PE ratio can vary across industries and over time. If a company is expected to grow quickly or is considered lower risk, a higher PE ratio may be entirely justified. Conversely, slower growth or higher risk could warrant a lower PE multiple from investors.

Biogen’s current PE ratio stands at 14.46x, which is noticeably below both the biotech industry average of 16.70x and the peer group average at 22.05x. While these benchmarks provide useful context, they do not always reflect the full picture, especially since companies within the same sector can differ significantly in quality, growth prospects, and scale.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio, here at 19.87x, is designed to offer a more nuanced view by accounting for factors like Biogen’s expected earnings growth, profit margins, industry sector, market capitalization, and company-specific risks. By tailoring the benchmark to Biogen’s precise circumstances, this approach offers a richer assessment than just stacking it up against industry or peer averages.

Since Biogen’s current PE (14.46x) is well below its Fair Ratio (19.87x), this suggests that the stock is undervalued based on this methodology.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Biogen Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personalized story about a company, the story behind the numbers, where you lay out your assumptions about Biogen’s future revenue, earnings, and margins to arrive at your own fair value estimate.

Unlike static ratios, Narratives link your view of Biogen's business strategy and market trends directly to a numeric forecast, making the financial side much more intuitive. This feature is easily accessible on Simply Wall St's Community page, empowering millions of investors with a dynamic tool that brings together financial modeling and real-world events.

With Narratives, you can quickly compare Biogen’s fair value (based on your story) to the current market price, so you can see at a glance whether the stock looks like a buy, hold, or sell for you. Plus, these Narratives automatically update as new data arrives, so your investment thesis stays relevant, whether that is fresh clinical trial results, updated earnings, or major news.

For example, some investors are optimistic and see a fair value for Biogen near $260 if growth accelerates, while others are more cautious with estimates down at $128, showing how your unique perspective shapes your investment decisions.

Do you think there's more to the story for Biogen? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Biogen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BIIB

Biogen

Biogen Inc. discovers, develops, manufactures, and delivers therapies for treating neurological and neurodegenerative diseases in the United States, Europe, Germany, Asia, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives