- United States

- /

- Biotech

- /

- NasdaqGS:BCRX

BioCryst Pharmaceuticals, Inc.'s (NASDAQ:BCRX) Price Is Right But Growth Is Lacking After Shares Rocket 34%

BioCryst Pharmaceuticals, Inc. (NASDAQ:BCRX) shareholders would be excited to see that the share price has had a great month, posting a 34% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 28% over that time.

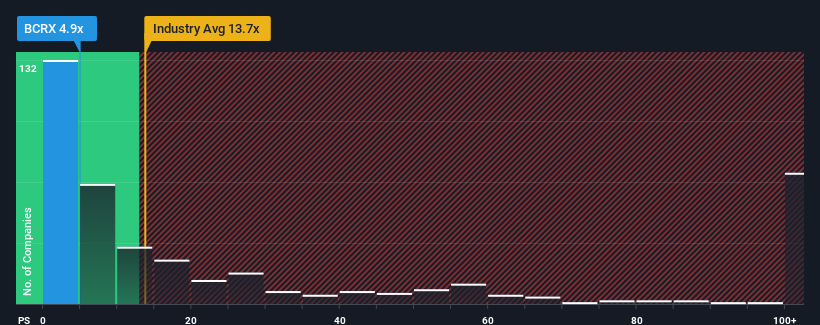

Although its price has surged higher, BioCryst Pharmaceuticals may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 4.9x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 13.7x and even P/S higher than 56x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for BioCryst Pharmaceuticals

What Does BioCryst Pharmaceuticals' Recent Performance Look Like?

Recent revenue growth for BioCryst Pharmaceuticals has been in line with the industry. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

Keen to find out how analysts think BioCryst Pharmaceuticals' future stacks up against the industry? In that case, our free report is a great place to start.How Is BioCryst Pharmaceuticals' Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like BioCryst Pharmaceuticals' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 33% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 23% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 240% per annum, which is noticeably more attractive.

With this information, we can see why BioCryst Pharmaceuticals is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

BioCryst Pharmaceuticals' recent share price jump still sees fails to bring its P/S alongside the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that BioCryst Pharmaceuticals maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about these 3 warning signs we've spotted with BioCryst Pharmaceuticals (including 1 which makes us a bit uncomfortable).

If you're unsure about the strength of BioCryst Pharmaceuticals' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if BioCryst Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:BCRX

BioCryst Pharmaceuticals

A biotechnology company, develops oral small-molecule and protein therapeutics to treat rare diseases.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives