- United States

- /

- Biotech

- /

- NasdaqGS:BBIO

How Positive Phase 2 Data for Encaleret Could Shape Investor Confidence in BridgeBio Pharma (BBIO)

Reviewed by Simply Wall St

- BridgeBio Pharma announced that its therapy encaleret achieved parathyroid hormone (PTH)-independent normalization of blood and urine calcium in post-surgical hypoparathyroidism patients, based on Phase 2 trial results presented at the 2025 ASBMR Annual Meeting.

- The data also revealed promising preclinical results for infigratinib in rare skeletal conditions, suggesting potential for future treatment options beyond the company's current commercial focus.

- We’ll examine how encouraging Phase 2 results for encaleret may influence confidence in BridgeBio Pharma’s pipeline-driven growth story.

Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

BridgeBio Pharma Investment Narrative Recap

BridgeBio Pharma’s investment appeal rests on belief in the company’s ability to transform its late-stage pipeline into future revenue streams and diversify beyond its dependence on Attruby. The latest Phase 2 results for encaleret signal pipeline progress, but as it stands, they do not materially change the immediate outlook for BridgeBio’s main near-term catalysts or its biggest risk, exposure to Attruby as the core revenue driver.

Of the recent announcements, the upcoming ESC Congress presentation on acoramidis data stands out. This is particularly relevant, as ongoing clinical and real-world evidence for Attruby serves as the primary short-term catalyst and will likely have a greater impact on financial performance and investor confidence than the new encaleret results for now.

In contrast, investors should be aware that further concentration risk remains if late-stage pipeline programs do not achieve regulatory or commercial...

Read the full narrative on BridgeBio Pharma (it's free!)

BridgeBio Pharma's outlook anticipates $1.7 billion in revenue and $297.7 million in earnings by 2028. This is based on a forecasted annual revenue growth rate of 92.3% and an earnings increase of $1.07 billion from current earnings of -$776.4 million.

Uncover how BridgeBio Pharma's forecasts yield a $65.10 fair value, a 26% upside to its current price.

Exploring Other Perspectives

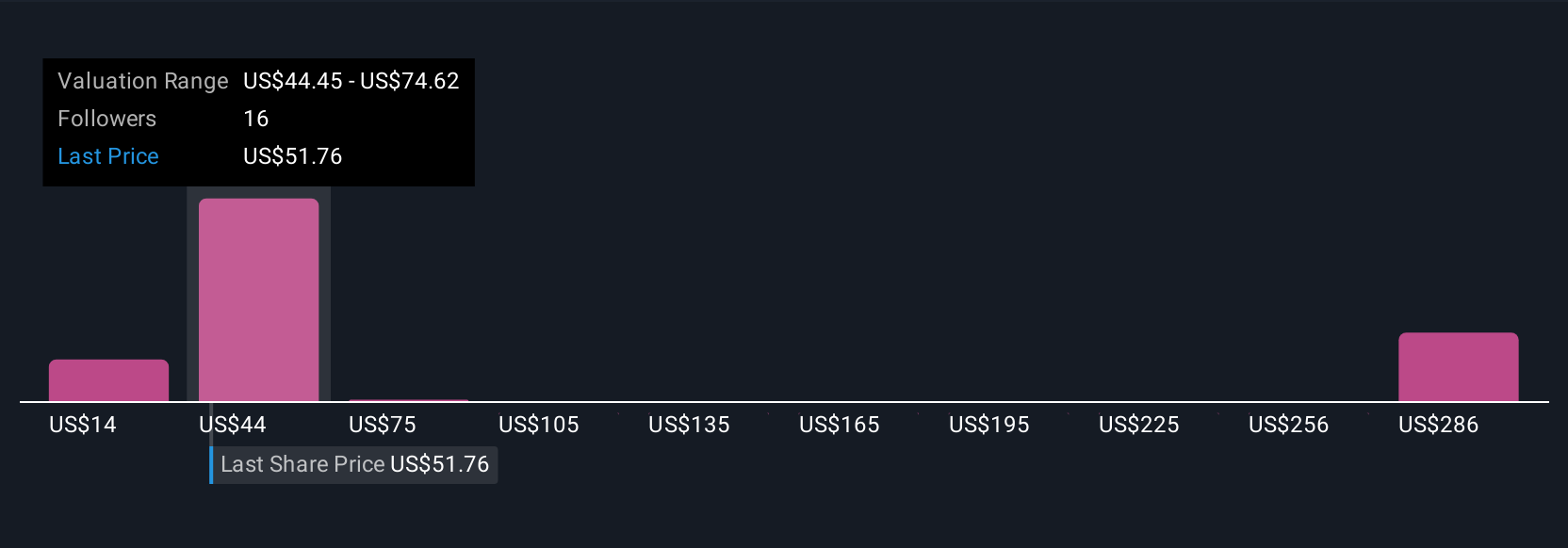

Seven retail fair value opinions from the Simply Wall St Community range from just US$14.28 up to US$310.98 per share. With so much variance, keep in mind that BridgeBio’s progress toward late-stage regulatory approvals is central to shaping future returns, so explore several viewpoints before making up your mind.

Explore 7 other fair value estimates on BridgeBio Pharma - why the stock might be worth less than half the current price!

Build Your Own BridgeBio Pharma Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BridgeBio Pharma research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free BridgeBio Pharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BridgeBio Pharma's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BridgeBio Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BBIO

BridgeBio Pharma

A commercial-stage biopharmaceutical company, discovers, creates, tests, and delivers transformative medicines to treat patients who suffer from genetic diseases and cancers.

High growth potential and slightly overvalued.

Market Insights

Community Narratives