- United States

- /

- Life Sciences

- /

- NasdaqGS:AZTA

Revenue Downgrade: Here's What Analysts Forecast For Azenta, Inc. (NASDAQ:AZTA)

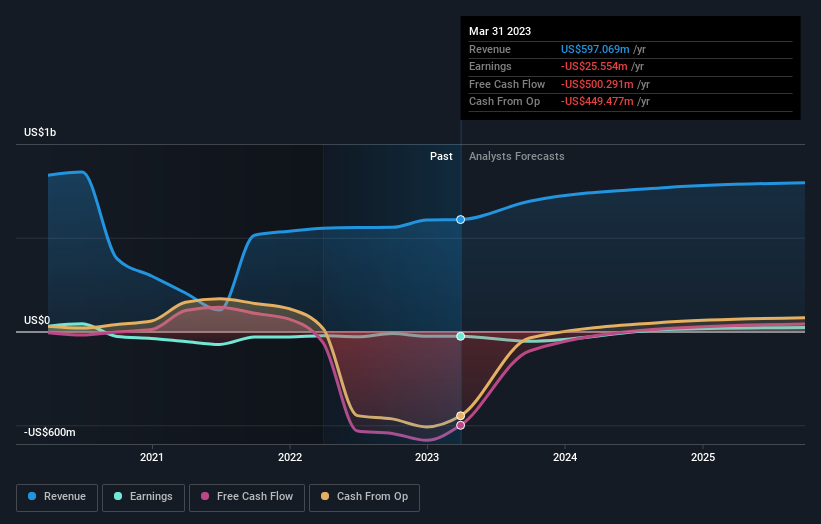

Market forces rained on the parade of Azenta, Inc. (NASDAQ:AZTA) shareholders today, when the analysts downgraded their forecasts for this year. Revenue estimates were cut sharply as analysts signalled a weaker outlook - perhaps a sign that investors should temper their expectations as well.

Following the downgrade, the consensus from four analysts covering Azenta is for revenues of US$555m in 2023, implying a small 7.0% decline in sales compared to the last 12 months. Prior to the latest estimates, the analysts were forecasting revenues of US$693m in 2023. It looks like forecasts have become a fair bit less optimistic on Azenta, given the substantial drop in revenue estimates.

Check out our latest analysis for Azenta

There was no particular change to the consensus price target of US$62.00, with Azenta's latest outlook seemingly not enough to result in a change of valuation. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. Currently, the most bullish analyst values Azenta at US$70.00 per share, while the most bearish prices it at US$44.00. This shows there is still some diversity in estimates, but analysts don't appear to be totally split on the stock as though it might be a success or failure situation.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. Over the past five years, revenues have declined around 4.4% annually. Worse, forecasts are essentially predicting the decline to accelerate, with the estimate for an annualised 14% decline in revenue until the end of 2023. Compare this against analyst estimates for companies in the broader industry, which suggest that revenues (in aggregate) are expected to grow 8.1% annually. So it's pretty clear that, while it does have declining revenues, the analysts also expect Azenta to suffer worse than the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their revenue estimates for this year. They also expect company revenue to perform worse than the wider market. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on Azenta after today.

Of course, this isn't the full story. At least one of Azenta's four analysts has provided estimates out to 2025, which can be seen for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AZTA

Azenta

Provides biological and chemical compound sample exploration and management solutions for the life sciences market in the United States, Africa, China, the United Kingdom, rest of Europe, the Asia Pacific, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives