- United States

- /

- Pharma

- /

- NasdaqGM:AXSM

Does Axsome Therapeutics Still Offer Upside After 35% Rally and DCF Forecasts in 2025?

Reviewed by Bailey Pemberton

If you’ve been debating whether to make a move on Axsome Therapeutics stock, you’re in good company. Investors aren’t the only ones watching. This is a biotech name that’s shown both striking returns and plenty of twists along the way. With Axsome’s share price closing at $118.64 recently, you might be wondering if the recent pullback spells risk, or if the past year’s almost 40% rise means you’ve already missed out.

Let’s zoom in for a moment. Over the past week the stock dipped about 2.3%, sliding 5.2% through the last month, even as year-to-date gains remain a robust 35.9%. Take a step back further and Axsome’s three-year return clocks in at an eye-popping 178.7%. The long-term story here looks like growth, with flashes of volatility that reveal shifting expectations among investors as new therapies progress and the broader health sector faces waves of changing sentiment.

So, is Axsome still undervalued after all that upward momentum, or have buyers already baked in too much optimism? By one widely watched valuation framework, the company racks up a value score of 5 out of 6, which is a good sign for bargain-hunters. But numbers alone rarely tell the full story. Next, we’ll dissect the methods used to arrive at this value score and hint at an even more revealing way to think about what Axsome might truly be worth.

Approach 1: Axsome Therapeutics Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting future cash flows and then discounting those cash flows back to their value today. For Axsome Therapeutics, this model takes into account the company’s current free cash flow, future growth expected by analysts, and calculated projections for the years ahead.

Axsome’s last twelve months free cash flow stands at -$121.37 million, reflecting ongoing investment in its product pipeline. Looking ahead, analysts forecast rapid improvement. By the end of 2029, projected free cash flow could reach $886.13 million. Estimates for 2030 and beyond climb even higher, with projections reaching $1.89 billion by 2035 according to extrapolations. The model combines these estimates and applies a discount rate to reflect today’s value.

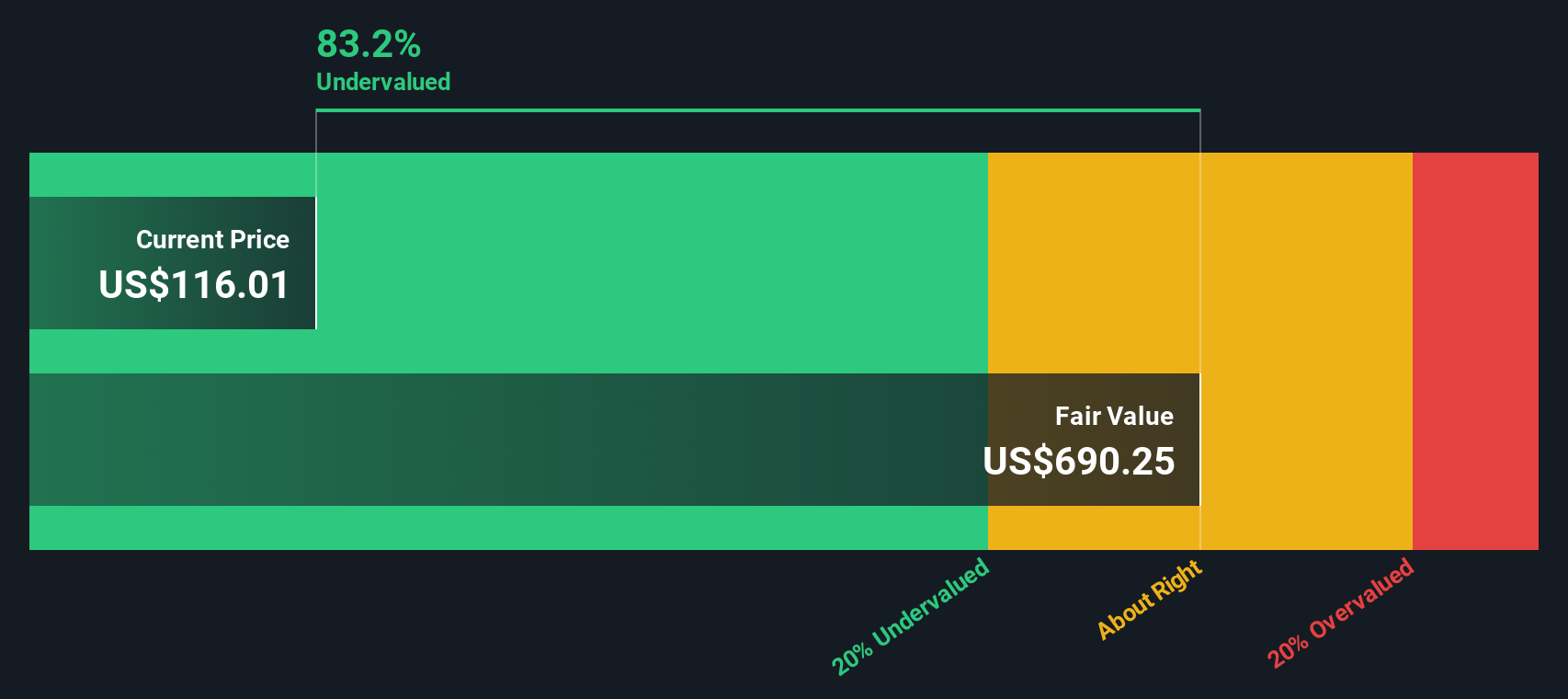

The final DCF calculation produces an intrinsic value of $689.82 per share. Compared to Axsome’s current share price of $118.64, this implies the stock is trading at an 82.8% discount, significantly undervalued relative to the underlying cash flow potential predicted by this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Axsome Therapeutics is undervalued by 82.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Axsome Therapeutics Price vs Sales (P/S)

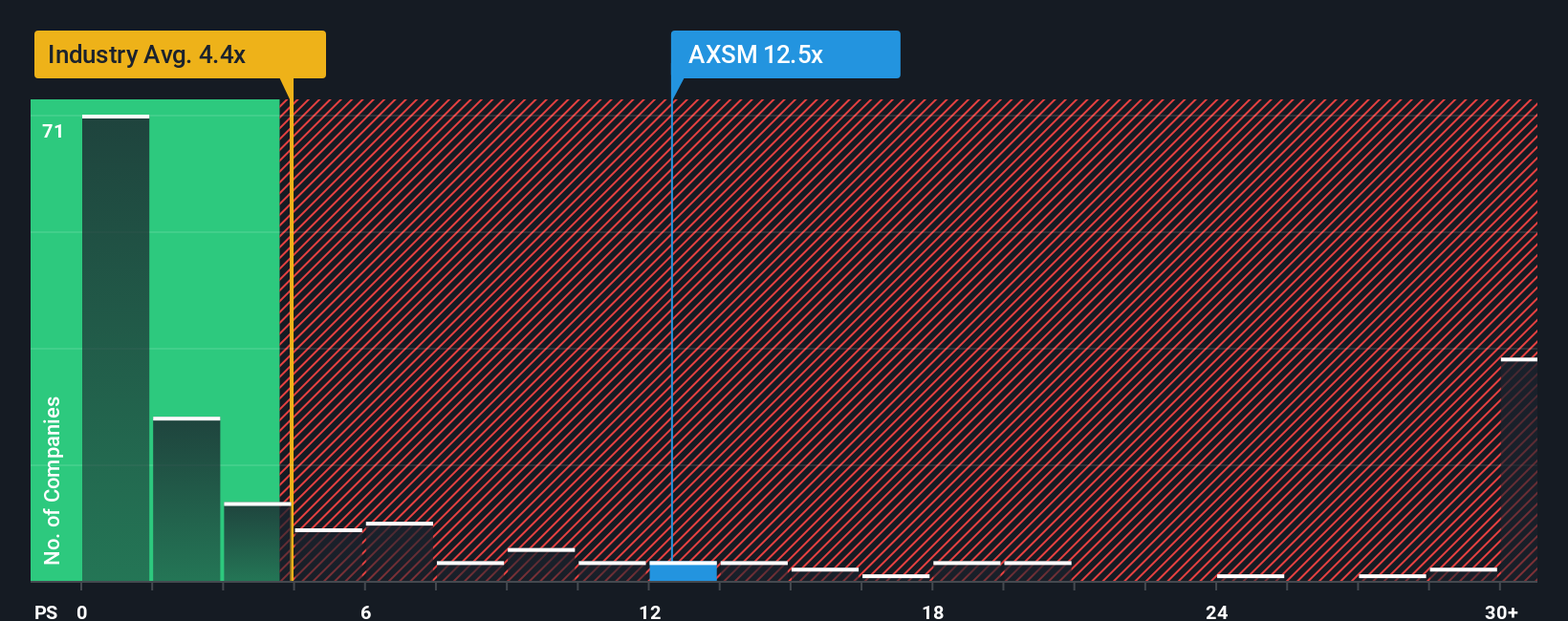

The Price-to-Sales (P/S) ratio is often considered a reliable yardstick for valuing companies that are not yet profitable, such as many biotech firms in an early growth phase. While earnings can be negative during periods of heavy investment, revenue gives a clearer sense of customer traction and market potential. This makes P/S a suitable metric for Axsome Therapeutics at this stage.

In fast-growing sectors like pharmaceuticals, investors often expect to pay a higher P/S ratio when future growth potential outweighs current profitability. However, factors such as competitive risk and the likelihood of successful product launches also play a critical role in deciding what counts as a "normal" or "fair" P/S multiple.

Currently, Axsome trades at a 11.96x P/S ratio. This figure is notably above the industry average of 4.83x, yet below the peer group average of 16.67x. To offer a more nuanced benchmark, Simply Wall St calculates a “Fair Ratio” for each company, which, for Axsome, stands at 15.46x. Unlike standard comparisons with industry or peers, the Fair Ratio accounts for the company’s growth outlook, profit margins, business model, risks, and relative market cap, providing a more tailored portrait of where the multiple should land.

Given that Axsome’s current P/S ratio (11.96x) is well below its Fair Ratio (15.46x), the stock appears undervalued by this metric.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Axsome Therapeutics Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story behind the numbers; it’s how you connect what you know or believe about a company to real financial forecasts and, ultimately, a fair value estimate.

Instead of relying on rigid formulas alone, a Narrative lets you factor in your own perspective: you decide what you expect for Axsome’s revenue, margins, and future, and then map that outlook directly into a fair value calculation. Narratives tie together the company’s potential, its financial trajectory, and your assumptions, guiding you to a buy or sell decision by comparing fair value against the current share price.

This approach is available to everyone through the Simply Wall St Community page, making sophisticated forecasting practical and accessible, with no spreadsheets or expert skills required. Thanks to millions of fellow investors updating Narratives as new earnings or news emerge, your view is always dynamic and up to date.

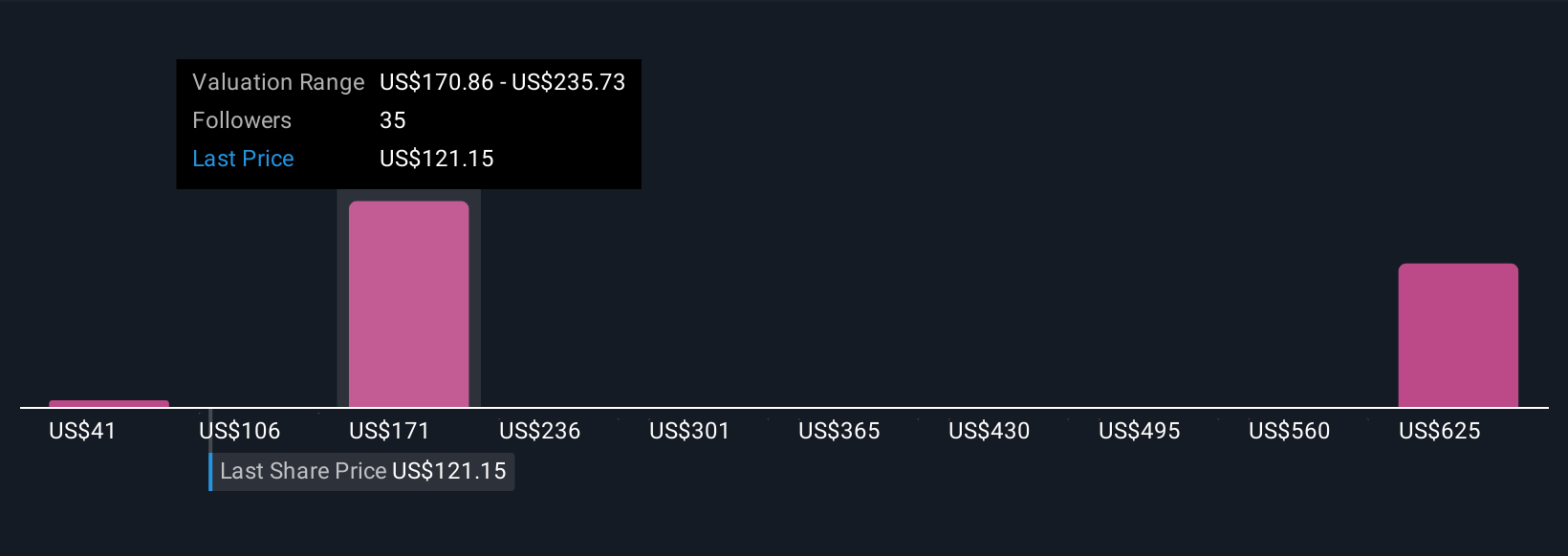

For example, on Axsome Therapeutics, some investors run with the most optimistic Narrative, projecting rapid CNS drug adoption and targeting a fair value above $200, while others remain cautious about payer risks and competitive threats, arriving at a more conservative value near $144. No matter your view, Narratives help you make sense of market swings and invest with purpose.

Do you think there's more to the story for Axsome Therapeutics? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AXSM

Axsome Therapeutics

A biopharmaceutical company, develops and delivers novel therapies for the management of central nervous system (CNS) disorders in the United States.

Exceptional growth potential and undervalued.

Similar Companies

Market Insights

Community Narratives