- United States

- /

- Pharma

- /

- NasdaqGS:AVIR

A Look Into The Ownership Structure of Atea Pharmaceuticals (NASDAQ:AVIR)

This article first appeared on Simply Wall St News.

Now and then, the volatility of the pharmaceutical sector rears its ugly head, leaving the hordes of investors running for the hills.

Leading the decline this week was Atea Pharmaceuticals (NasdaqGS: AVIR) that lost over two-thirds of its value. We will look into this severe decline and reflect on the state of the ownership.

Check out our latest analysis for Atea Pharmaceuticals

One year after announcing a collaboration with Roche on oral antiviral treatment for COVID-19, AT-527 – Atea Pharmaceuticals announced that it did not meet the primary endpoint of reduction in the amount of virus for the patient with mild or moderate symptoms compared to placebo.

Critics are pointing out a design flaw in the study that included vaccinated patients, potentially skewing the results. Two companies continue the collaboration as there are suggestions for reducing viral load in high-risk patients with underlying health conditions.

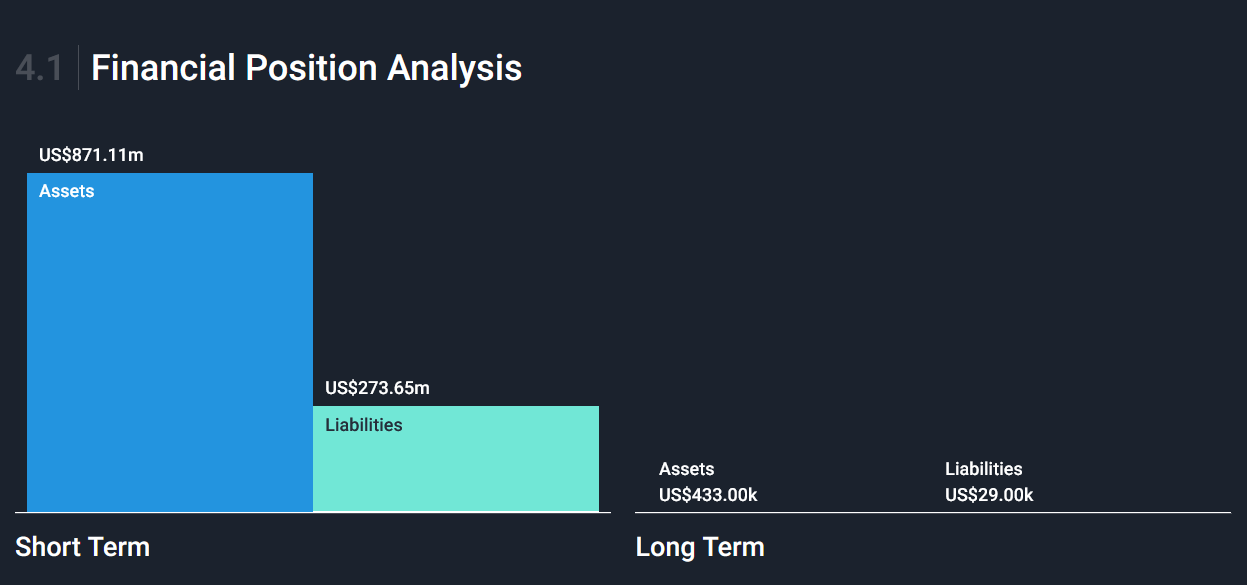

Despite the significant drop, the company remains in a very good financial position, sitting on the pile of cash and having no debt.

A Look Into the Ownership

Atea Pharmaceuticals has a market capitalization of US$1.1b, so we would expect some institutional investors to have noticed the stock. Looking at our data on the ownership groups (below), it seems that institutional investors have bought into the company.

What Does The Institutional Ownership Tell Us About Atea Pharmaceuticals?

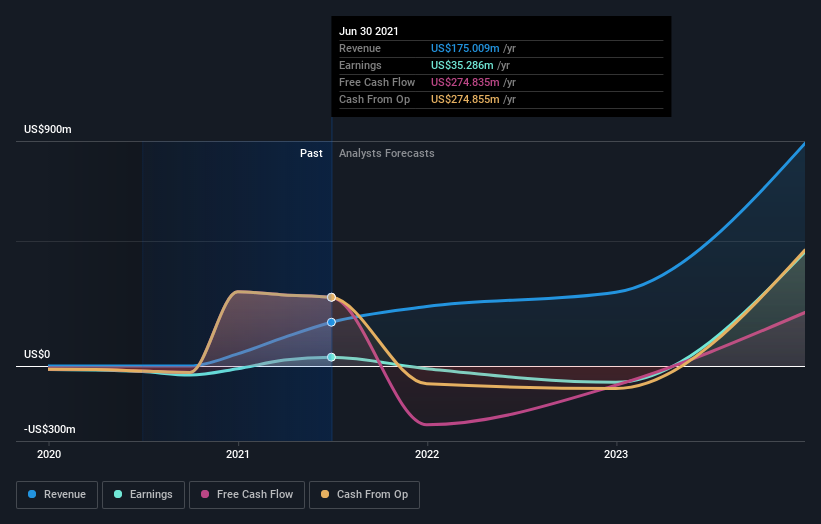

As you can see, institutional investors have a fair amount of stake in Atea Pharmaceuticals. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. When multiple institutions own a stock, there's always a risk of being in a "crowded trade." When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth.

You can see Atea Pharmaceuticals' historical earnings and revenue below, but keep in mind there's always more to the story.

Since institutional investors own more than half the issued stock, the board will likely have to pay attention to their preferences. Our data indicates that hedge funds own 7.7% of Atea Pharmaceuticals. That is worth noting since hedge funds are often quite active investors who may try to influence management. Many want to see value creation (and a higher share price) in the short term or medium term.

The company's largest shareholder is FMR LLC, with ownership of 15%. For context, the second-largest shareholder holds about 8.0% of the shares outstanding, followed by ownership of 7.7% by the third-largest shareholder. In addition, we found that Jean-Pierre Sommadossi, the CEO has 7.2% of the shares allocated to their name.

We did some more digging and found that 7 of the top shareholders account for roughly 54% of the register, implying that along with larger shareholders, there are a few smaller shareholders, thereby balancing out each other's interests somewhat.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understanding of a stock's expected performance. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of Atea Pharmaceuticals

The definition of an insider can differ slightly between different countries, but the board of directors members always count. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions, too much power is concentrated within this group.

It seems insiders own a significant proportion of Atea Pharmaceuticals, Inc. Insiders own US$111m worth of shares in the US$1.1b company. That's quite meaningful. Most would say this shows a reasonable degree of alignment with shareholders, especially in a company of this size. You can click here to see if those insiders have been buying or selling.

General Public Ownership

With a 12% ownership, the general public has some degree of sway over Atea Pharmaceuticals. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Private Equity Ownership

Private equity firms hold a 15% stake in Atea Pharmaceuticals. This suggests they can be influential in key policy decisions. Some investors might be encouraged by this since private equity can sometimes promote strategies that help the market see the value in the company. Alternatively, those holders might be exiting the investment after taking it public.

Further Considerations

Although the company didn't reach the goal regarding its oral COVID-19 treatment - the research continues. There is a possibility of another trial with a better structure - perhaps without vaccinated subjects this time.

Furthermore, the company remains involved in other research (most notably 2 experimental medications for hepatitis C), well-funded, and with no debt.

To truly gain insight, we need to consider other information, too. Be aware that Atea Pharmaceuticals is showing 1 warning sign in our investment analysis, you should know about...

If you would prefer to discover what analysts are predicting in terms of future growth, do not miss this free report on analyst forecasts.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12 months ending on the previous date of the month the financial statement is dated. This may not be consistent with full-year annual report figures.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:AVIR

Atea Pharmaceuticals

A clinical-stage biopharmaceutical company, discovers, develops, and commercializes antiviral therapeutics for patients with viral infections.

Excellent balance sheet and fair value.