- United States

- /

- Biotech

- /

- NasdaqGM:AUPH

Aurinia Pharmaceuticals Inc. (NASDAQ:AUPH) Surges 30% Yet Its Low P/S Is No Reason For Excitement

Aurinia Pharmaceuticals Inc. (NASDAQ:AUPH) shareholders have had their patience rewarded with a 30% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 30% over that time.

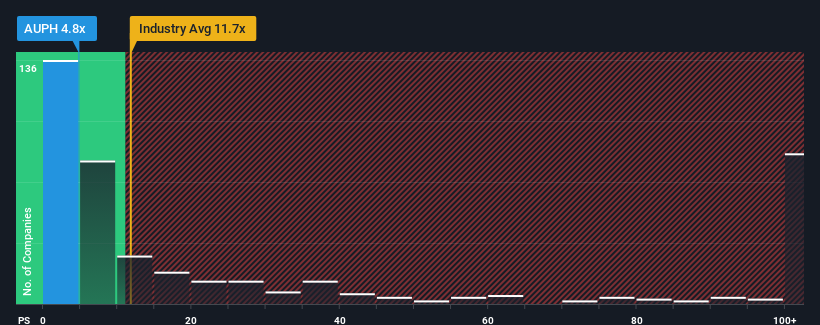

Even after such a large jump in price, Aurinia Pharmaceuticals may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 4.8x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 11.7x and even P/S higher than 77x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Aurinia Pharmaceuticals

What Does Aurinia Pharmaceuticals' Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Aurinia Pharmaceuticals has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Aurinia Pharmaceuticals' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Aurinia Pharmaceuticals' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 29%. The strong recent performance means it was also able to grow revenue by 260% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 23% per annum as estimated by the seven analysts watching the company. That's shaping up to be materially lower than the 139% per annum growth forecast for the broader industry.

With this information, we can see why Aurinia Pharmaceuticals is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Even after such a strong price move, Aurinia Pharmaceuticals' P/S still trails the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As expected, our analysis of Aurinia Pharmaceuticals' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Aurinia Pharmaceuticals with six simple checks on some of these key factors.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:AUPH

Aurinia Pharmaceuticals

A biopharmaceutical company that engages in delivering therapies to people living with autoimmune diseases with high unmet medical needs.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives