- United States

- /

- Biotech

- /

- NasdaqGS:ARWR

Some Arrowhead Pharmaceuticals, Inc. (NASDAQ:ARWR) Shareholders Look For Exit As Shares Take 27% Pounding

Arrowhead Pharmaceuticals, Inc. (NASDAQ:ARWR) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. The last month has meant the stock is now only up 4.1% during the last year.

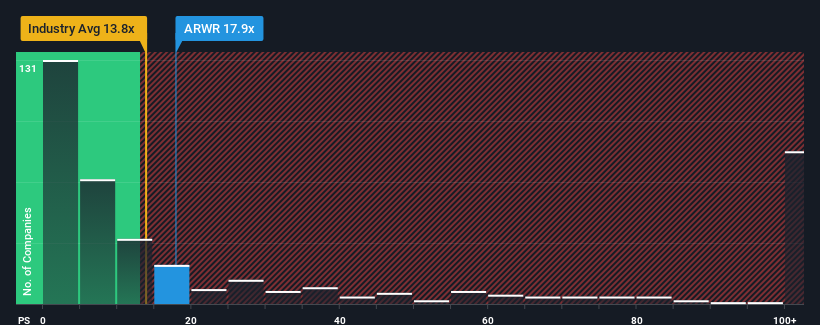

Even after such a large drop in price, Arrowhead Pharmaceuticals may still be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 17.9x, since almost half of all companies in the Biotechs in the United States have P/S ratios under 13.8x and even P/S lower than 5x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Arrowhead Pharmaceuticals

What Does Arrowhead Pharmaceuticals' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Arrowhead Pharmaceuticals' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Arrowhead Pharmaceuticals will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Arrowhead Pharmaceuticals?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Arrowhead Pharmaceuticals' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 35%. Even so, admirably revenue has lifted 128% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 21% per annum over the next three years. With the industry predicted to deliver 164% growth each year, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that Arrowhead Pharmaceuticals' P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Arrowhead Pharmaceuticals' P/S Mean For Investors?

Despite the recent share price weakness, Arrowhead Pharmaceuticals' P/S remains higher than most other companies in the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Arrowhead Pharmaceuticals, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you take the next step, you should know about the 3 warning signs for Arrowhead Pharmaceuticals that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ARWR

Arrowhead Pharmaceuticals

Develops medicines for the treatment of intractable diseases in the United States.

Slight with mediocre balance sheet.

Market Insights

Community Narratives