- United States

- /

- Biotech

- /

- NasdaqGS:ARWR

Arrowhead Pharmaceuticals, Inc.'s (NASDAQ:ARWR) Shares Climb 25% But Its Business Is Yet to Catch Up

Those holding Arrowhead Pharmaceuticals, Inc. (NASDAQ:ARWR) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 31% in the last twelve months.

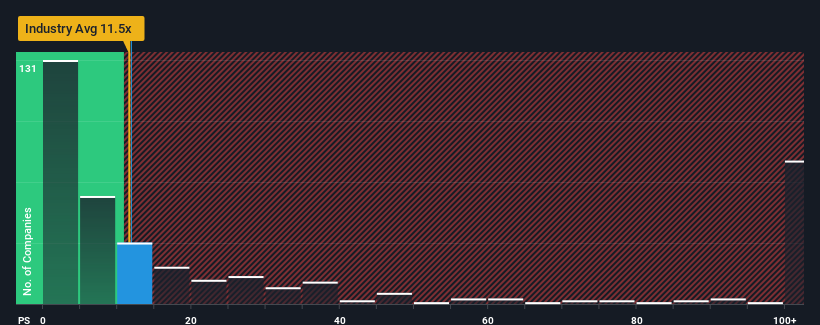

Even after such a large jump in price, it's still not a stretch to say that Arrowhead Pharmaceuticals' price-to-sales (or "P/S") ratio of 11.9x right now seems quite "middle-of-the-road" compared to the Biotechs industry in the United States, where the median P/S ratio is around 11.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Arrowhead Pharmaceuticals

What Does Arrowhead Pharmaceuticals' Recent Performance Look Like?

Recent times have been advantageous for Arrowhead Pharmaceuticals as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Arrowhead Pharmaceuticals.Is There Some Revenue Growth Forecasted For Arrowhead Pharmaceuticals?

In order to justify its P/S ratio, Arrowhead Pharmaceuticals would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 93% gain to the company's top line. Pleasingly, revenue has also lifted 70% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue growth is heading into negative territory, declining 1.4% per year over the next three years. Meanwhile, the broader industry is forecast to expand by 92% per annum, which paints a poor picture.

With this information, we find it concerning that Arrowhead Pharmaceuticals is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Bottom Line On Arrowhead Pharmaceuticals' P/S

Its shares have lifted substantially and now Arrowhead Pharmaceuticals' P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It appears that Arrowhead Pharmaceuticals currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

You need to take note of risks, for example - Arrowhead Pharmaceuticals has 4 warning signs (and 1 which can't be ignored) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ARWR

Arrowhead Pharmaceuticals

Develops medicines for the treatment of intractable diseases in the United States.

Slight with limited growth.