- United States

- /

- Biotech

- /

- NasdaqGM:ARDX

Sue Hohenleitner’s CFO Appointment Could Be a Game Changer for Ardelyx (ARDX)

Reviewed by Sasha Jovanovic

- On October 13, 2025, Ardelyx announced that Sue Hohenleitner, an accomplished executive with over 30 years of experience at Johnson & Johnson, was appointed as Chief Financial Officer, effective November 4, 2025.

- Hohenleitner’s extensive background in finance leadership across commercial, innovation, and supply chain functions at a major pharmaceutical company brings significant depth to Ardelyx during a transitional period for the company.

- We’ll explore how Hohenleitner’s appointment as CFO could influence Ardelyx’s investment narrative and future growth outlook.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Ardelyx Investment Narrative Recap

For investors to remain confident in Ardelyx, the core belief centers on the company's ability to drive long-term revenue growth through its tenapanor-based drugs while managing both market access and balance sheet risk. The appointment of Sue Hohenleitner as CFO is expected to bring financial discipline and big company expertise, but her hiring does not materially change the near-term focus on restoring XPHOZAH's Medicare coverage or the critical uncertainty tied to ongoing legal and reimbursement-related challenges. Among recent news, Ardelyx’s August guidance upgrade for IBSRELA net sales to US$250 million to US$260 million in 2025 stands out, underpinning management’s expectation of continuing top-line momentum. This context emphasizes that while executive transitions are important, the most immediate factors for the company remain its commercial execution and ability to secure broader and more reliable payer access. In contrast, one key area that investors should be aware of is the company’s ongoing exposure to market access and reimbursement risk, particularly if...

Read the full narrative on Ardelyx (it's free!)

Ardelyx's outlook anticipates $704.6 million in revenue and $178.8 million in earnings by 2028. This scenario assumes a 22.2% annual revenue growth rate and a $235.2 million increase in earnings from the current level of -$56.4 million.

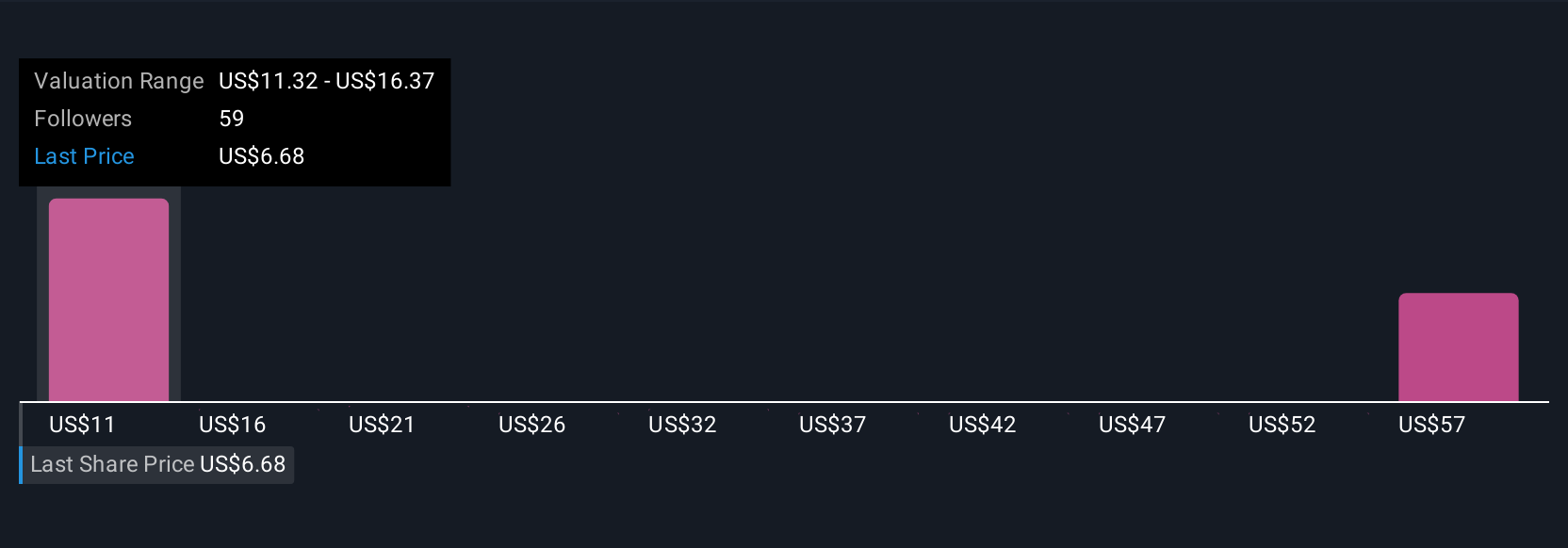

Uncover how Ardelyx's forecasts yield a $11.36 fair value, a 126% upside to its current price.

Exploring Other Perspectives

Ten independent fair value estimates by the Simply Wall St Community span US$8 to US$25 per share. Despite varying outlooks, uncertainty about reimbursement access remains front of mind for Ardelyx’s future performance.

Explore 10 other fair value estimates on Ardelyx - why the stock might be worth over 4x more than the current price!

Build Your Own Ardelyx Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ardelyx research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ardelyx research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ardelyx's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ARDX

Ardelyx

Ardelyx, Inc. discovers, develops, and commercializes medicines to treat unmet medical needs in the United States and internationally.

Undervalued with high growth potential.

Market Insights

Community Narratives