- United States

- /

- Biotech

- /

- NasdaqGM:ARDX

Pinning Down Ardelyx, Inc.'s (NASDAQ:ARDX) P/S Is Difficult Right Now

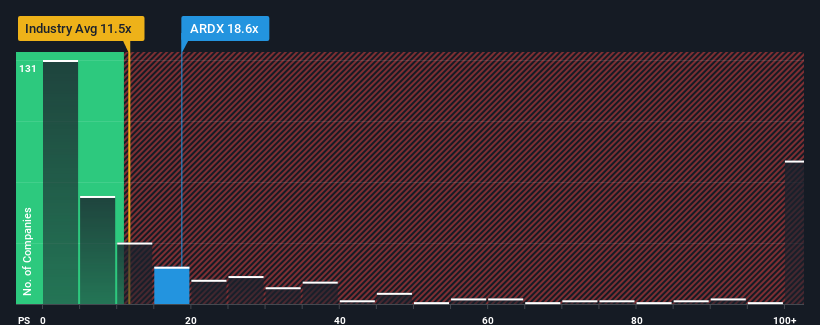

Ardelyx, Inc.'s (NASDAQ:ARDX) price-to-sales (or "P/S") ratio of 18.6x might make it look like a strong sell right now compared to the Biotechs industry in the United States, where around half of the companies have P/S ratios below 11.5x and even P/S below 3x are quite common. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Ardelyx

What Does Ardelyx's P/S Mean For Shareholders?

Recent times have been advantageous for Ardelyx as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Ardelyx will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

Ardelyx's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered an explosive gain to the company's top line. Spectacularly, three year revenue growth has also set the world alight, thanks to the last 12 months of incredible growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 80% per year as estimated by the seven analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 92% per year, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that Ardelyx's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Ardelyx's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It comes as a surprise to see Ardelyx trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You need to take note of risks, for example - Ardelyx has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

If you're unsure about the strength of Ardelyx's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:ARDX

Ardelyx

Ardelyx, Inc. discovers, develops, and commercializes medicines to treat unmet medical needs in the United States and internationally.

Exceptional growth potential and undervalued.

Market Insights

Community Narratives