- United States

- /

- Biotech

- /

- NasdaqGM:ARDX

Ardelyx, Inc.'s (NASDAQ:ARDX) Popularity With Investors Is Under Threat From Overpricing

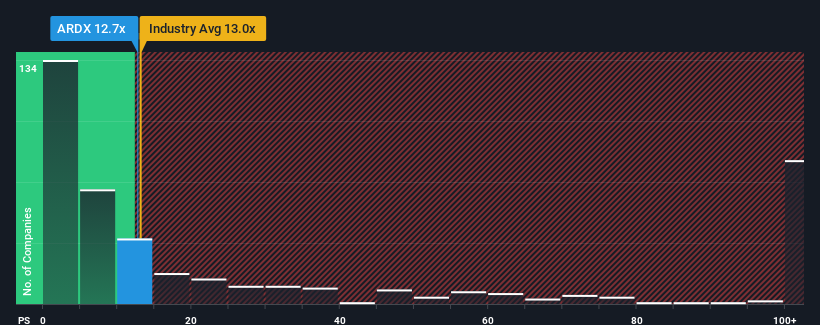

It's not a stretch to say that Ardelyx, Inc.'s (NASDAQ:ARDX) price-to-sales (or "P/S") ratio of 12.7x right now seems quite "middle-of-the-road" for companies in the Biotechs industry in the United States, where the median P/S ratio is around 13x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Ardelyx

How Has Ardelyx Performed Recently?

With revenue growth that's inferior to most other companies of late, Ardelyx has been relatively sluggish. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Ardelyx will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Ardelyx would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 139% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 65% per year as estimated by the ten analysts watching the company. With the industry predicted to deliver 165% growth each year, the company is positioned for a weaker revenue result.

With this information, we find it interesting that Ardelyx is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look at the analysts forecasts of Ardelyx's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Ardelyx you should know about.

If you're unsure about the strength of Ardelyx's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:ARDX

Ardelyx

Ardelyx, Inc. discovers, develops, and commercializes medicines to treat unmet medical needs in the United States and internationally.

Undervalued with high growth potential.

Market Insights

Community Narratives