- United States

- /

- Biotech

- /

- OTCPK:ARDS

Can You Imagine How Aridis Pharmaceuticals' (NASDAQ:ARDS) Shareholders Feel About The 32% Share Price Increase?

A diverse portfolio of stocks will always have winners and losers. Of course, the aim of the game is to pick stocks that do better than an index fund. Aridis Pharmaceuticals, Inc. (NASDAQ:ARDS) has done well over the last year, with the stock price up 32% beating the market return of 27% (not including dividends). We'll need to follow Aridis Pharmaceuticals for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

See our latest analysis for Aridis Pharmaceuticals

We don't think Aridis Pharmaceuticals' revenue of US$1,000,000 is enough to establish significant demand. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. For example, they may be hoping that Aridis Pharmaceuticals comes up with a great new product, before it runs out of money.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized).

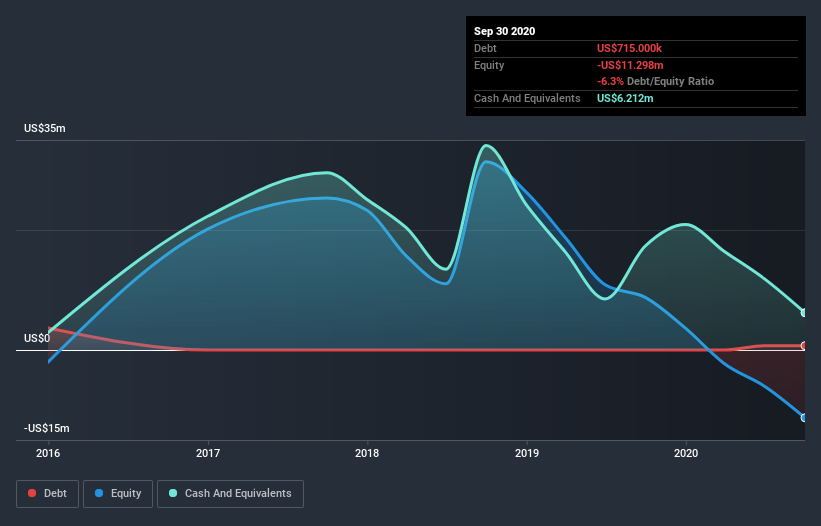

Aridis Pharmaceuticals had liabilities exceeding cash by US$17m when it last reported in September 2020, according to our data. That puts it in the highest risk category, according to our analysis. So the fact that the stock is up 138% in the last year shows that high risks can lead to high rewards, sometimes. It's clear more than a few people believe in the potential. You can click on the image below to see (in greater detail) how Aridis Pharmaceuticals' cash levels have changed over time.

Of course, the truth is that it is hard to value companies without much revenue or profit. One thing you can do is check if company insiders are buying shares. It's usually a positive if they have, as it may indicate they see value in the stock. You can click here to see if there are insiders buying.

A Different Perspective

With a TSR of 32% over the last year, Aridis Pharmaceuticals shareholders would be reasonably content, given that's not far from the broader market return of 30%. And the stock has been on a nice little run lately, with the price climbing 19% higher in 90 days. This suggests the share price maintains some momentum, and investors are taking a more positive view of the stock. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 7 warning signs with Aridis Pharmaceuticals (at least 3 which are concerning) , and understanding them should be part of your investment process.

But note: Aridis Pharmaceuticals may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade Aridis Pharmaceuticals, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:ARDS

Aridis Pharmaceuticals

A late-stage biopharmaceutical company, discovers and develops targeted immunotherapy using fully human monoclonal antibodies (mAb) to treat life-threatening infections.

Very low with weak fundamentals.

Market Insights

Community Narratives