- United States

- /

- Biotech

- /

- NasdaqGS:ARAV

Did Business Growth Power Aravive's (NASDAQ:ARAV) Share Price Gain of 121%?

When you buy shares in a company, there is always a risk that the price drops to zero. But if you pick the right stock, you can make a lot more than 100%. For example, the Aravive, Inc. (NASDAQ:ARAV) share price has soared 121% return in just a single year. On top of that, the share price is up 28% in about a quarter. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report. Zooming out, the stock is actually down 24% in the last three years.

View our latest analysis for Aravive

Aravive isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last twelve months, Aravive's revenue grew by 20%. That's a fairly respectable growth rate. The revenue growth is decent but the share price had an even better year, gaining 121%. Given that the business has made good progress on the top line, it would be worth taking a look at its path to profitability. Of course, we are always cautious about succumbing to 'fear of missing out' when a stock has shot up strongly.

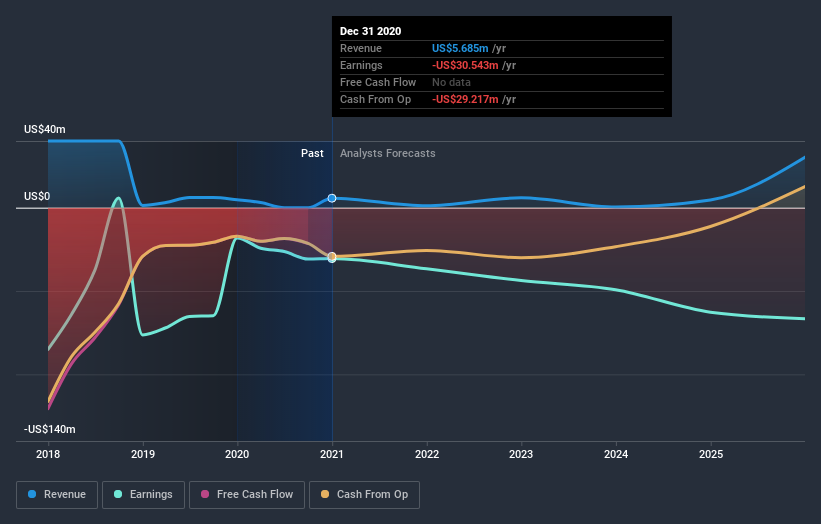

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We're pleased to report that Aravive shareholders have received a total shareholder return of 121% over one year. That certainly beats the loss of about 12% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Aravive has 4 warning signs (and 1 which is potentially serious) we think you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade Aravive, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Aravive, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:ARAV

Aravive

Aravive, Inc., a clinical-stage biopharmaceutical company, develops transformative treatments for life-threatening diseases, including cancer and fibrosis in the United States.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives