- United States

- /

- Pharma

- /

- NasdaqGS:AMRX

Is It Too Late To Consider Amneal Pharmaceuticals After Its 425.4% Three Year Surge?

Reviewed by Bailey Pemberton

- Wondering if Amneal Pharmaceuticals is still a smart buy after its big run, or if most of the upside is already priced in? Here is a breakdown of what the recent market action is really telling us about its value.

- The stock has cooled slightly in the last week, down 2.6%, but that comes after a strong 8.9% gain over 30 days, a hefty 57.1% year to date, and an impressive 425.4% over three years.

- Those moves follow a steady stream of developments around Amneal strengthening its position in generics and specialty pharmaceuticals, including new product launches and regulatory milestones that widen its addressable market. At the same time, investors have been paying closer attention to companies with large established portfolios and pipelines, which puts Amneal in a more prominent spot on the radar.

- On our valuation checks, Amneal scores a solid 5 out of 6, suggesting it still looks undervalued on most measures, but not all. Next, we will unpack those different valuation approaches, then finish with a more holistic way to judge whether the current price truly reflects the long term story.

Approach 1: Amneal Pharmaceuticals Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it can generate in the future and discounting those cash flows back to their value in the present.

For Amneal Pharmaceuticals, the latest twelve month free cash flow stands at about $245.7 Million. Analysts and extrapolations suggest this could rise to roughly $1.15 Billion in annual free cash flow by 2035, with intermediate projections such as $500 Million in 2027 as the business scales. Simply Wall St uses a 2 Stage Free Cash Flow to Equity approach, combining near term analyst forecasts with longer term growth assumptions to build this trajectory.

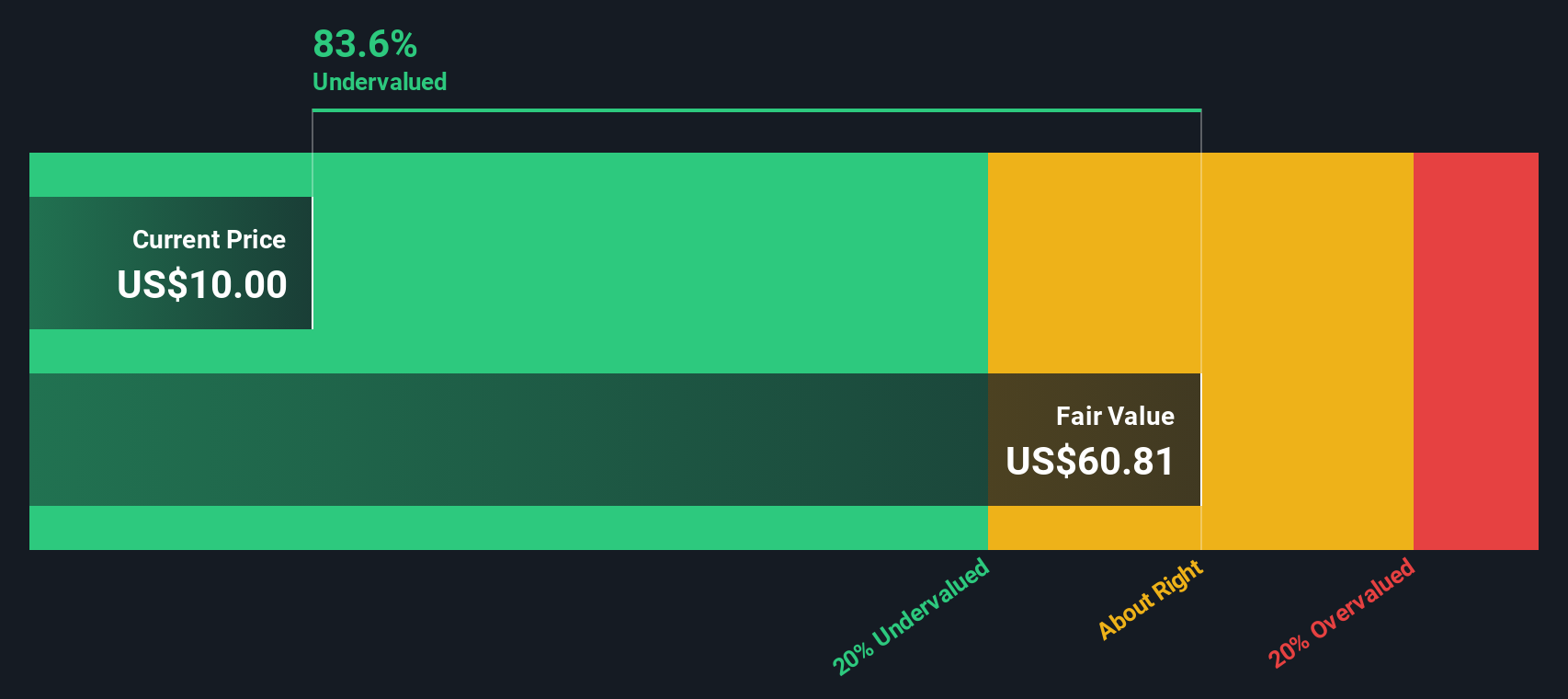

On this basis, the model arrives at an intrinsic value of $69.18 per share. Compared with the current share price, the DCF implies an 82.4% discount, indicating the market is pricing in far weaker cash flow performance than these projections assume.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Amneal Pharmaceuticals is undervalued by 82.4%. Track this in your watchlist or portfolio, or discover 919 more undervalued stocks based on cash flows.

Approach 2: Amneal Pharmaceuticals Price vs Sales

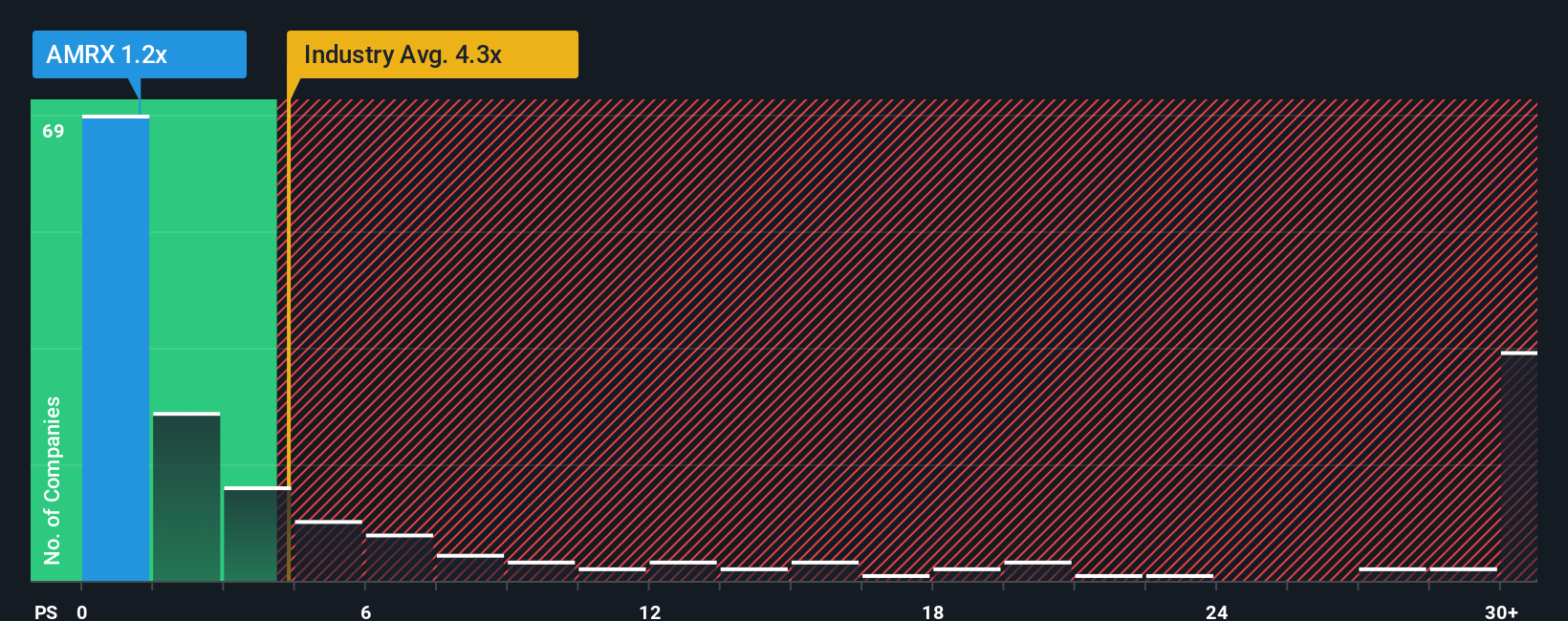

For companies like Amneal that are growing and reinvesting heavily, the price to sales, or P S, ratio is often a more reliable yardstick than earnings based metrics, because it is less distorted by short term swings in profitability and accounting items.

In general, faster revenue growth and stronger competitive positions can justify a higher P S multiple. Elevated leverage, regulatory risk, or margin pressure tend to cap what investors are willing to pay. Against that backdrop, Amneal currently trades on a P S ratio of about 1.31x, well below both the Pharmaceuticals industry average of roughly 4.04x and a broader peer group that averages around 16.08x.

Simply Wall St also calculates a proprietary Fair Ratio for Amneal of 3.06x, which reflects its specific growth outlook, profitability profile, risk factors, industry positioning, and market capitalization. This tailored benchmark is more informative than a simple peer or sector comparison because it adjusts for what makes Amneal different rather than assuming all drug makers deserve the same multiple. Comparing the Fair Ratio of 3.06x with the current 1.31x suggests the market is still applying a meaningful discount to the shares.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1439 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Amneal Pharmaceuticals Narrative

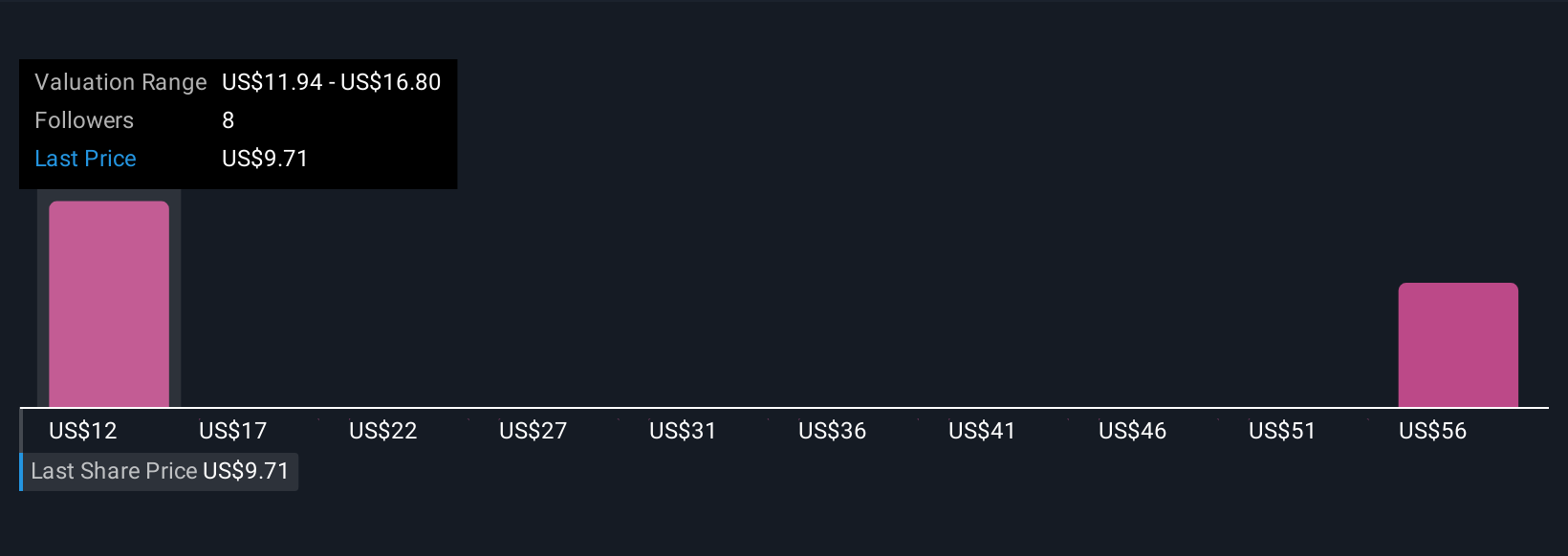

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to attach your story about Amneal, including your assumptions for future revenue, earnings, margins and risks, to a financial forecast that flows through to a Fair Value you can compare with today’s share price. On Simply Wall St’s Community page, used by millions of investors, you can choose or create a Narrative that captures how you think Amneal’s pipeline launches, debt profile and exposure to U.S. generics will play out, then see how that story translates into projected cash flows, earnings, and ultimately a Fair Value that signals whether it might be time to buy, hold or sell. Because Narratives update dynamically as new information like FDA decisions, earnings results or guidance changes come in, your view does not stay static, and you can see in real time how a more bullish Narrative that leans into successful biosimilar launches and a Fair Value around $13.50 per share compares with a more cautious Narrative that assumes slower growth, tighter margins and a Fair Value closer to today’s market price.

Do you think there's more to the story for Amneal Pharmaceuticals? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMRX

Amneal Pharmaceuticals

A global biopharmaceutical company, develops, manufactures, markets, and distributes generics, injectables, biosimilars, and specialty branded pharmaceutical products worldwide.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026