- United States

- /

- Pharma

- /

- NasdaqGS:AMLX

Lacklustre Performance Is Driving Amylyx Pharmaceuticals, Inc.'s (NASDAQ:AMLX) 31% Price Drop

Unfortunately for some shareholders, the Amylyx Pharmaceuticals, Inc. (NASDAQ:AMLX) share price has dived 31% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 93% share price decline.

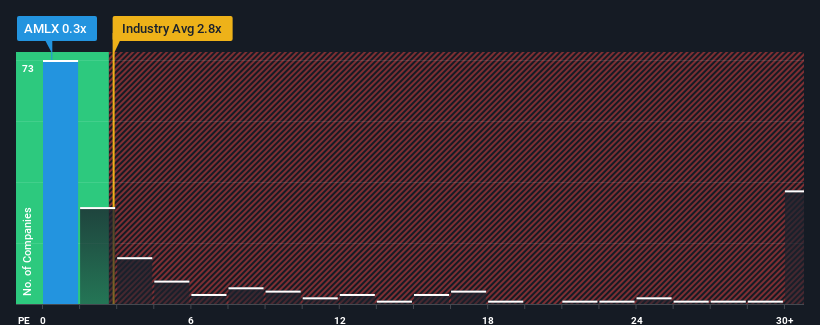

After such a large drop in price, Amylyx Pharmaceuticals may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.3x, since almost half of all companies in the Pharmaceuticals industry in the United States have P/S ratios greater than 2.8x and even P/S higher than 15x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Amylyx Pharmaceuticals

What Does Amylyx Pharmaceuticals' P/S Mean For Shareholders?

Amylyx Pharmaceuticals certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Amylyx Pharmaceuticals will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Amylyx Pharmaceuticals would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered an explosive gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 90% per year during the coming three years according to the six analysts following the company. With the industry predicted to deliver 17% growth per year, that's a disappointing outcome.

In light of this, it's understandable that Amylyx Pharmaceuticals' P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Amylyx Pharmaceuticals' P/S?

Shares in Amylyx Pharmaceuticals have plummeted and its P/S has followed suit. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Amylyx Pharmaceuticals' P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, Amylyx Pharmaceuticals' poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 4 warning signs for Amylyx Pharmaceuticals (2 are significant!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AMLX

Amylyx Pharmaceuticals

A commercial-stage biotechnology company, engages in the discovery and development of treatment for amyotrophic lateral sclerosis (ALS) and neurodegenerative diseases.

Flawless balance sheet slight.