- United States

- /

- Biotech

- /

- NasdaqGS:AMGN

Will Strong Q3 Beat And Pipeline Updates Change Amgen's (AMGN) Future Earnings Narrative?

Reviewed by Sasha Jovanovic

- In late November 2025, Amgen reported stronger-than-expected Q3 results, lifted by very large Repatha sales growth, solid contributions from Prolia and rare disease drugs, and raised full-year 2025 revenue and earnings guidance.

- Investors also focused on encouraging updates for obesity candidate MariTide and lung cancer therapy Imdelltra, which management highlighted as potential meaningful future growth drivers.

- Next, we’ll examine how Amgen’s upbeat earnings and raised guidance could reshape its investment narrative around future earnings growth.

Find companies with promising cash flow potential yet trading below their fair value.

Amgen Investment Narrative Recap

To own Amgen, you need to believe that its established franchises can fund a transition toward newer growth areas like obesity, oncology and cardiovascular disease, while managing rising pricing and biosimilar pressures. The strong Q3 beat and higher 2025 guidance support that transition in the near term, but the biggest short term catalyst remains progress in MariTide and Imdelltra, and the key risk continues to be mounting pricing and competitive pressure on aging products.

In this context, the recent full FDA approval of Imdelltra for extensive stage small cell lung cancer and its Category 1 preferred status in NCCN guidelines looks especially important, reinforcing management’s focus on this drug as a future earnings driver at the same time investors are watching MariTide data as a potential swing factor for sentiment around Amgen’s longer term growth profile.

Yet, even with solid Q3 momentum, the risk that intensifying drug pricing pressures could weigh on margins over time is something investors should be aware of...

Read the full narrative on Amgen (it's free!)

Amgen's narrative projects $37.4 billion revenue and $8.2 billion earnings by 2028. This requires 2.3% yearly revenue growth and about a $1.6 billion earnings increase from $6.6 billion today.

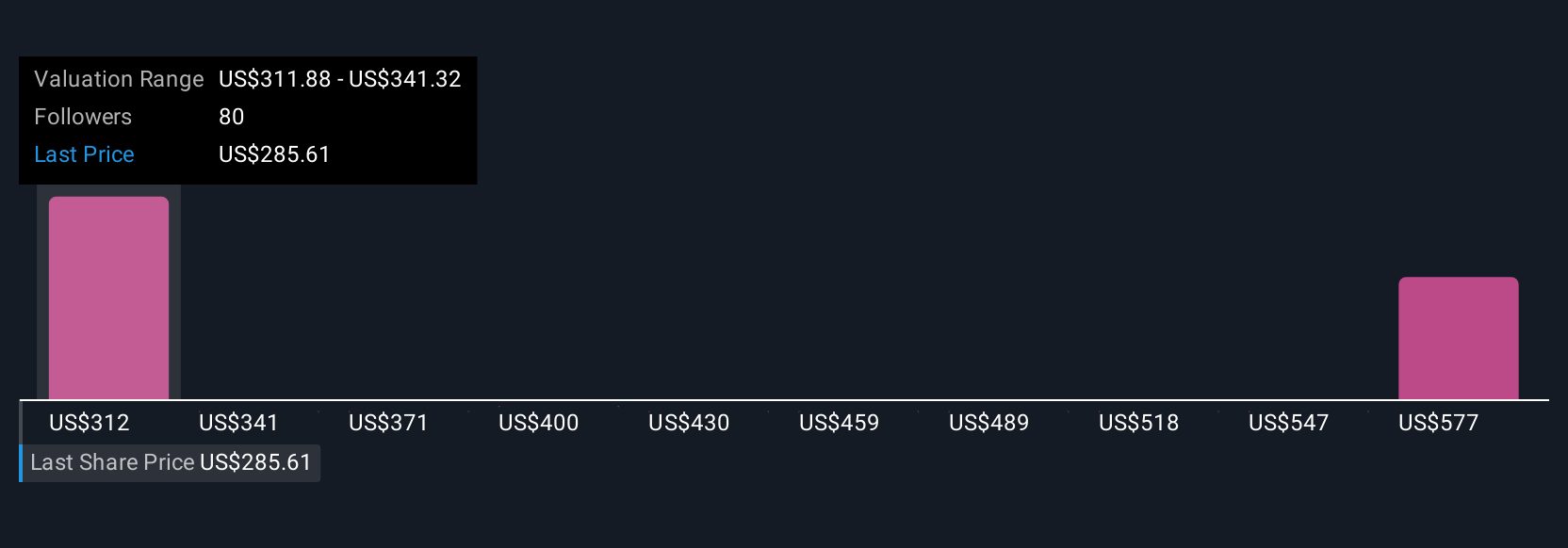

Uncover how Amgen's forecasts yield a $322.88 fair value, a 7% downside to its current price.

Exploring Other Perspectives

Some of the lowest estimate analysts were assuming Amgen’s revenue would shrink about 0.5% a year and earnings fall to roughly US$5.2 billion by 2028, so compared with the stronger Q3 update and pipeline progress, their view reflects a much more pessimistic take on pricing, patent and competition risks that you may want to weigh against more optimistic scenarios.

Explore 5 other fair value estimates on Amgen - why the stock might be worth as much as 62% more than the current price!

Build Your Own Amgen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amgen research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Amgen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amgen's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMGN

Amgen

Amgen Inc. discovers, develops, manufactures, and delivers human therapeutics worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026