- United States

- /

- Biotech

- /

- NasdaqGM:ALVO

Positive Sentiment Still Eludes Alvotech (NASDAQ:ALVO) Following 27% Share Price Slump

Alvotech (NASDAQ:ALVO) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. The recent drop has obliterated the annual return, with the share price now down 3.1% over that longer period.

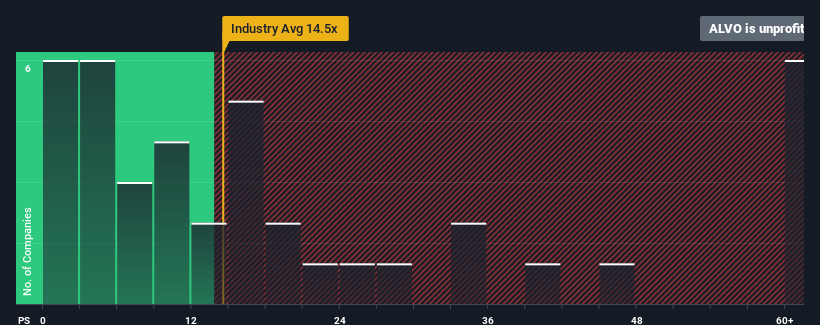

Even after such a large drop in price, Alvotech's price-to-earnings (or "P/E") ratio of -4.9x might still make it look like a strong buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 15x and even P/E's above 29x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

While the market has experienced earnings growth lately, Alvotech's earnings have gone into reverse gear, which is not great. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Alvotech

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Alvotech's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 183% decrease to the company's bottom line. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next year should generate growth of 66% as estimated by the five analysts watching the company. That's shaping up to be materially higher than the 5.0% growth forecast for the broader market.

With this information, we find it odd that Alvotech is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Having almost fallen off a cliff, Alvotech's share price has pulled its P/E way down as well. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Alvotech currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Alvotech that you need to be mindful of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:ALVO

Alvotech

Through its subsidiaries, develops and manufactures biosimilar medicines for patients worldwide.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives