- United States

- /

- Biotech

- /

- NasdaqGM:ALPN

Alpine Immune Sciences, Inc.'s (NASDAQ:ALPN) Shares Climb 41% But Its Business Is Yet to Catch Up

Despite an already strong run, Alpine Immune Sciences, Inc. (NASDAQ:ALPN) shares have been powering on, with a gain of 41% in the last thirty days. The annual gain comes to 241% following the latest surge, making investors sit up and take notice.

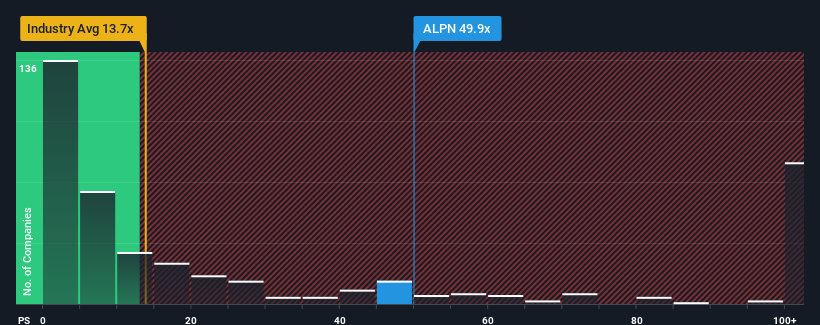

Since its price has surged higher, Alpine Immune Sciences may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 49.9x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios under 13.7x and even P/S lower than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Alpine Immune Sciences

What Does Alpine Immune Sciences' P/S Mean For Shareholders?

Alpine Immune Sciences hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Alpine Immune Sciences will help you uncover what's on the horizon.How Is Alpine Immune Sciences' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Alpine Immune Sciences' is when the company's growth is on track to outshine the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.2%. In spite of this, the company still managed to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

Looking ahead now, revenue is anticipated to slump, contracting by 7.9% each year during the coming three years according to the seven analysts following the company. That's not great when the rest of the industry is expected to grow by 225% each year.

With this information, we find it concerning that Alpine Immune Sciences is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

What We Can Learn From Alpine Immune Sciences' P/S?

Alpine Immune Sciences' P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

For a company with revenues that are set to decline in the context of a growing industry, Alpine Immune Sciences' P/S is much higher than we would've anticipated. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. Unless these conditions improve markedly, it'll be a challenging time for shareholders.

Before you settle on your opinion, we've discovered 3 warning signs for Alpine Immune Sciences (1 can't be ignored!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:ALPN

Alpine Immune Sciences

Operates as a clinical-stage biopharmaceutical company.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives