- United States

- /

- Biotech

- /

- NasdaqGS:ALNY

Alnylam Pharmaceuticals (NasdaqGS:ALNY) Sees 17% Weekly Gain As Vutrisiran Faces FDA Decision

Reviewed by Simply Wall St

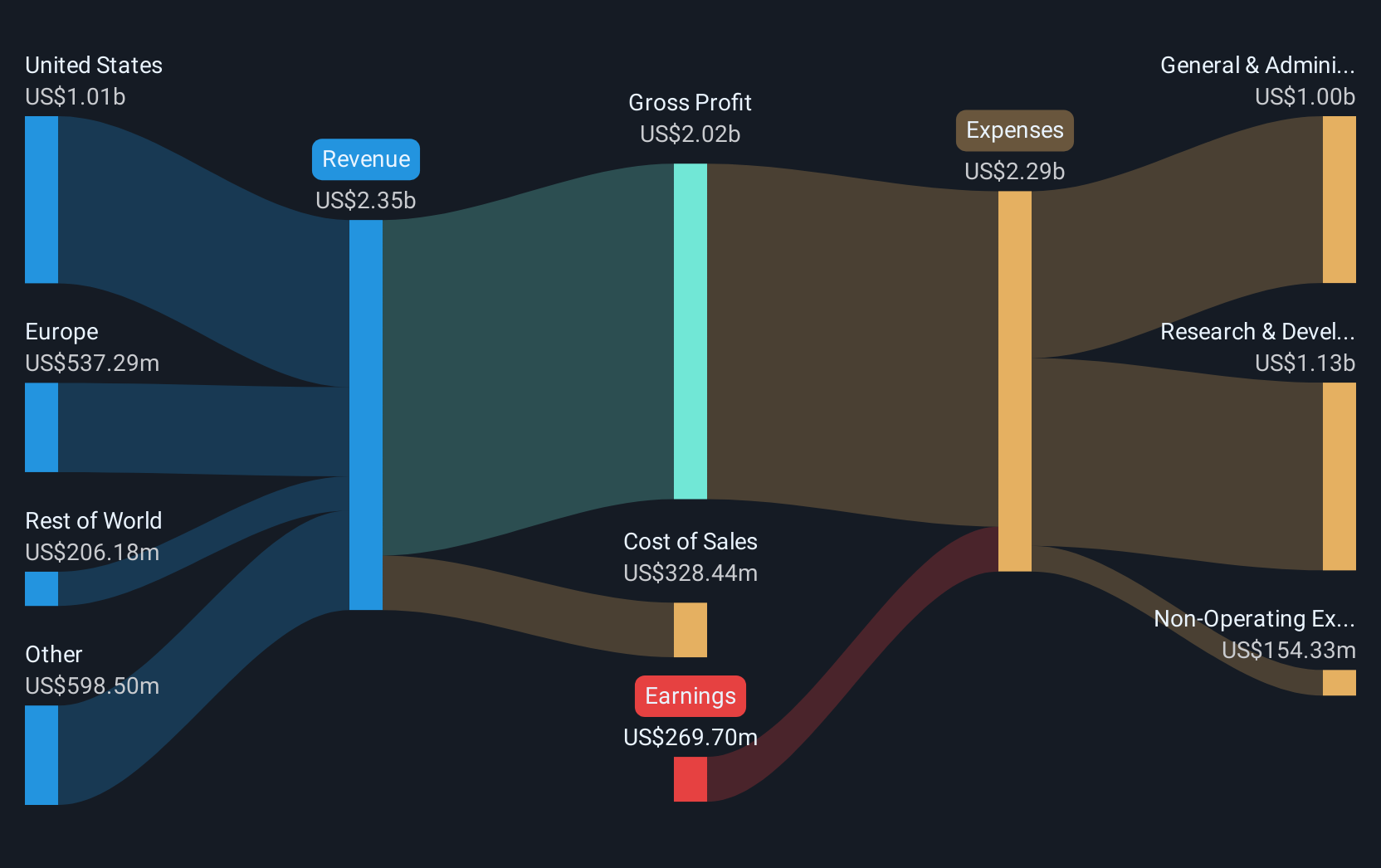

Alnylam Pharmaceuticals (NasdaqGS:ALNY) saw a 17% price increase over the past week, likely influenced by its recent announcements and market trends. The company's R&D progress showcase on February 25, featuring innovations like Nucresiran's high TTR knockdown capability and Vutrisiran's impending FDA decision, highlighted its strong pipeline, potentially boosting investor confidence. Additionally, the retirement announcement of co-founder Dr. Phillip A. Sharp on March 5 may have emphasized a shift in leadership while maintaining continuity in its advisory board. Meanwhile, an uptick in major indexes, like the Nasdaq's recent rise, may have also supported Alnylam's positive market performance.

```html

Since early 2020, Alnylam Pharmaceuticals has delivered a total return of 171.92%, reflecting a profound impact from its R&D progress and strategic endeavors. Notable achievements include the FDA approval of Vutrisiran for ATTR amyloidosis with cardiomyopathy and the anticipated approval of AMVUTTRA. These approvals are poised to transform the TTR franchise, significantly boosting anticipated revenue. With strategic partnerships, such as the collaboration with Roche for zilebesiran, Alnylam continues to enhance its therapeutic pipeline, underlining its potential for revenue growth despite pressure from competition and the intricacies of payer policy negotiations.

Alnylam's financial results show an increase in total revenues with 2025 expectations ranging between US$2.05 billion and US$2.25 billion. The collaboration with Medison Pharma has broadened the availability of its therapies in Central & Eastern Europe and Israel, reinforcing revenue streams. Additionally, expanded partnerships augur well for sustainable innovation. Despite recent losses due to development costs, surpassing both the US market and the Biotechs industry indicates resilient investor confidence in Alnylam's strategic direction.

```Learn about Alnylam Pharmaceuticals' future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALNY

Alnylam Pharmaceuticals

Alnylam Pharmaceuticals, Inc. discovers, develops, and commercializes therapeutics based on ribonucleic acid interference.

Exceptional growth potential with adequate balance sheet.