- United States

- /

- Biotech

- /

- NasdaqGS:ALNY

Alnylam Pharmaceuticals (NasdaqGS:ALNY) Celebrates FDA Approval of Qfitlia Despite 5% Share Price Dip

Reviewed by Simply Wall St

Alnylam Pharmaceuticals (NasdaqGS:ALNY) saw a 13% share price increase in the last quarter, propelled by the FDA approval of Qfitlia™ for hemophilia A or B, a significant milestone reflecting its leadership in RNAi therapeutics. Despite broader market declines due to renewed tariff concerns impacting sectors like auto, Alnylam's R&D advancements and robust earnings report, showing nearly 35% growth in revenue, likely contributed to the stock's positive performance. The company's strategic objectives, partnership with Sanofi, and clear future growth avenues further solidify its competitive positioning amidst global economic uncertainties.

Over the past five years, Alnylam Pharmaceuticals experienced a 153.69% total shareholder return, underscoring its ability to innovate in the biopharmaceutical sector. Notable milestones include the FDA approvals of key therapeutics such as Qfitlia™ for hemophilia and Vutrisiran's valuable expansion into treating ATTR amyloidosis. Collectively, these approvals signify Alnylam's strength in RNAi therapeutics and have been pivotal in elevating its market presence. The company’s robust R&D pipeline, which features promising advancements like the TRITON Phase 3 for nucresiran, indicates a commitment to sustainable innovation and potential revenue growth.

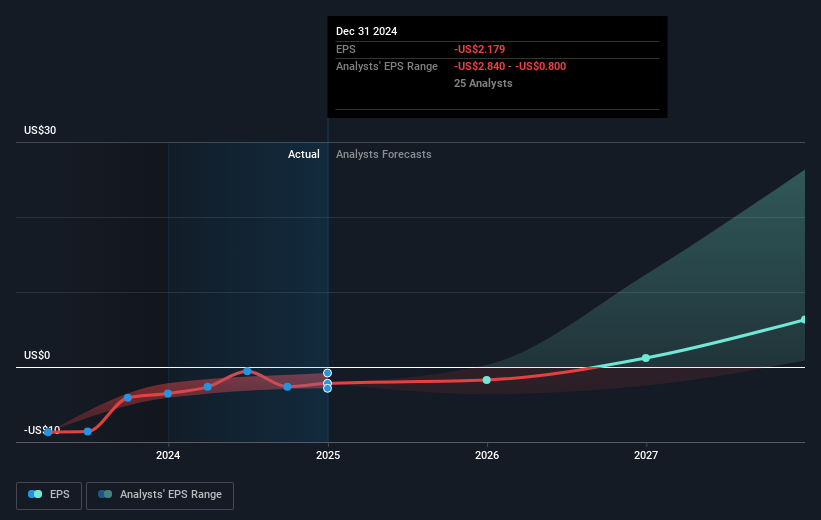

Financially, Alnylam's trajectory over recent years has been promising, with significant revenue increases—such as reaching US$593.17 million in Q4 2024—and minimizing net losses. These gains were bolstered by meaningful collaborations across multiple therapeutic areas and preparations for several new IND applications. Alnylam has outperformed both the US Market and US Biotechs industry over the past year, ensuring its relevance and competitive edge amid growing competition and expanding payer policies.

Review our growth performance report to gain insights into Alnylam Pharmaceuticals' future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Alnylam Pharmaceuticals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALNY

Alnylam Pharmaceuticals

Alnylam Pharmaceuticals, Inc. discovers, develops, and commercializes therapeutics based on ribonucleic acid interference.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives