- United States

- /

- Biotech

- /

- NasdaqGS:ALNY

Alnylam Pharmaceuticals (ALNY): Is the Stock’s Recent Surge Justified by Its Valuation?

Reviewed by Simply Wall St

Alnylam Pharmaceuticals (ALNY) has quietly extended its strong run, with the stock up about 12% over the past month and nearly doubling over the past year, inviting a closer look at what investors are pricing in.

See our latest analysis for Alnylam Pharmaceuticals.

That surge in the share price to about $473, alongside a roughly 12% 1 month share price return and a standout year to date share price return above 100%, points to investors rapidly re rating Alnylam as growth prospects and perceived pipeline risk both shift in its favor.

If Alnylam’s run has you rethinking your healthcare exposure, this could be a good moment to scan other innovative names with healthcare stocks and see what else fits your strategy.

With shares hovering just below Wall Street’s target yet still trading at a notable intrinsic discount, the key question now is simple: is Alnylam still mispriced, or are markets already baking in years of growth?

Most Popular Narrative: 3.2% Undervalued

With Alnylam’s shares closing at $473.29 against a narrative fair value near $489, the story leans modestly optimistic, hinging on powerful growth assumptions ahead.

The rapid and robust uptake of AMVUTTRA for ATTR-CM in its first full quarter post-approval, combined with near-universal first-line payer access and minimal patient out-of-pocket costs, indicates a much larger addressable market for Alnylam's RNAi therapies as diagnostics and disease awareness improve, supporting sustained double-digit revenue growth.

Curious how this momentum translates into that higher fair value? The narrative leans on aggressive revenue expansion, rising margins, and a rich future earnings multiple. Want the full blueprint?

Result: Fair Value of $489.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained pricing pressure on Amvuttra and ongoing heavy R&D spending could easily blunt that upbeat growth and margin story.

Find out about the key risks to this Alnylam Pharmaceuticals narrative.

Another View on Valuation

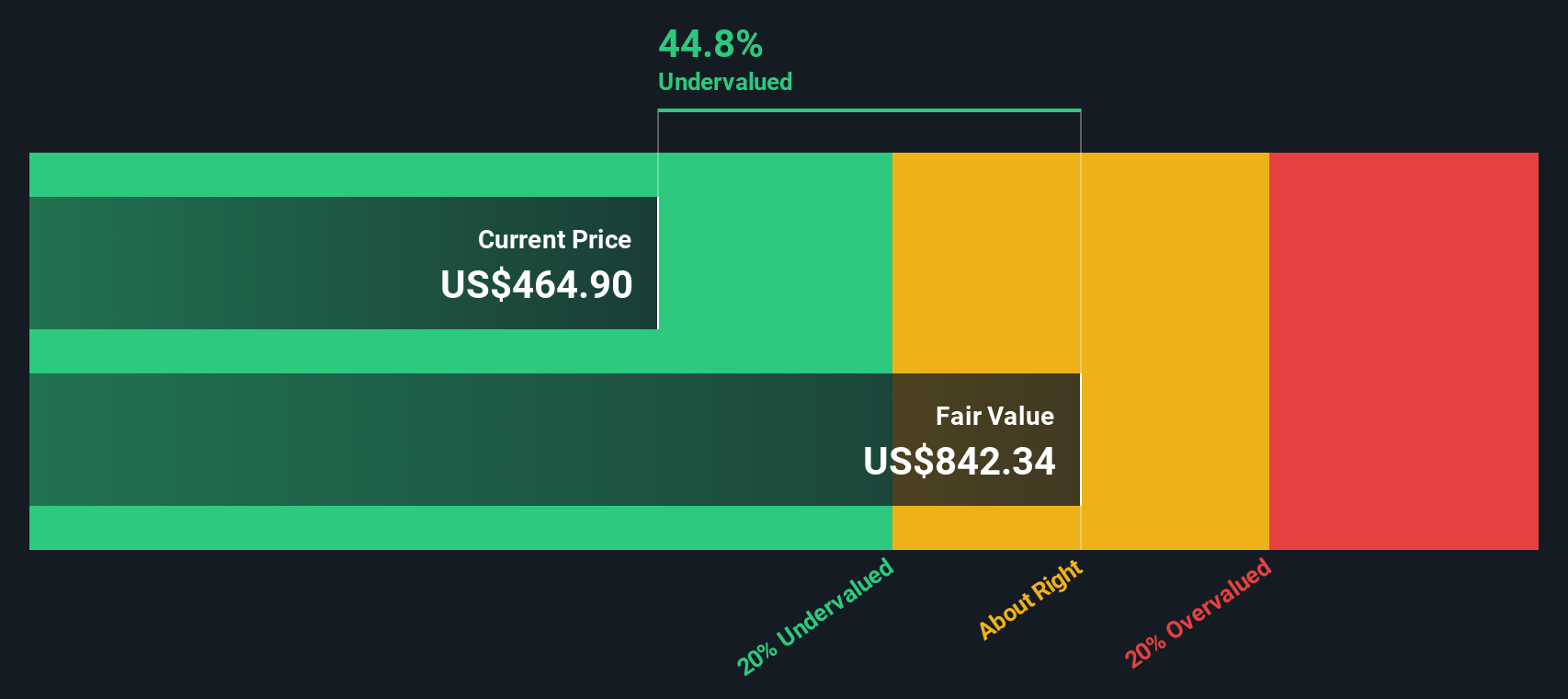

While the narrative fair value points to only a modest 3.2% upside, our DCF model is more generous, suggesting Alnylam is about 21% undervalued at $473 versus a fair value near $601. Is the cash flow math seeing something sentiment has not fully priced yet?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Alnylam Pharmaceuticals Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in minutes with Do it your way.

A great starting point for your Alnylam Pharmaceuticals research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next smart investing move?

Before markets move on without you, put your research momentum to work and line up your next opportunities using the Simply Wall Street Screener.

- Secure steadier portfolio income by hunting for reliable payers through these 14 dividend stocks with yields > 3% that can help anchor returns when growth names cool off.

- Capitalize on innovation tailwinds by targeting future leaders in automation, pattern recognition, and data analytics with these 25 AI penny stocks before the crowd catches on.

- Position yourself early in the next structural shift by scanning these 27 quantum computing stocks where breakthroughs in computing power could reshape entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALNY

Alnylam Pharmaceuticals

Alnylam Pharmaceuticals, Inc. discovers, develops, and commercializes therapeutics based on ribonucleic acid interference.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026