- United States

- /

- Biotech

- /

- NasdaqGS:ALKS

What Do Recent Gains Mean for Alkermes Stock Value in 2025?

Reviewed by Bailey Pemberton

Are you eyeing Alkermes and wondering what your next move should be? You are not alone. Investors have watched Alkermes quietly rack up impressive gains, with the stock closing recently at $31.51. Over just the last month, the price is up 10.8%, and the one-year return now stands at 18.5%. Those who have held on for the past five years have seen the stock rise a whopping 87.9%.

This isn’t just a lucky streak. Much of the momentum can be traced back to recent shifts in the broader pharmaceutical landscape, with investors rethinking risk and growth potential for specialty drugmakers. Alkermes has ridden this wave as its profile has grown, thanks to its steady pipeline and a market that seems to be reevaluating its prospects.

But growth is only half the picture. To really understand if Alkermes presents the right opportunity, we have to dig into its valuation. Here is where things get interesting: Alkermes recently scored a 5 out of 6 on key valuation checks, signaling that by most measures, this stock appears undervalued.

Of course, no single metric tells the whole story. Up next, we are going to walk through how valuation is actually measured and hint at a smarter, more nuanced way to read between the numbers that comes at the end of the article.

Approach 1: Alkermes Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's worth by projecting its future cash flows and discounting them back to their present value. In essence, it tries to answer how much future profits are worth in today's dollars.

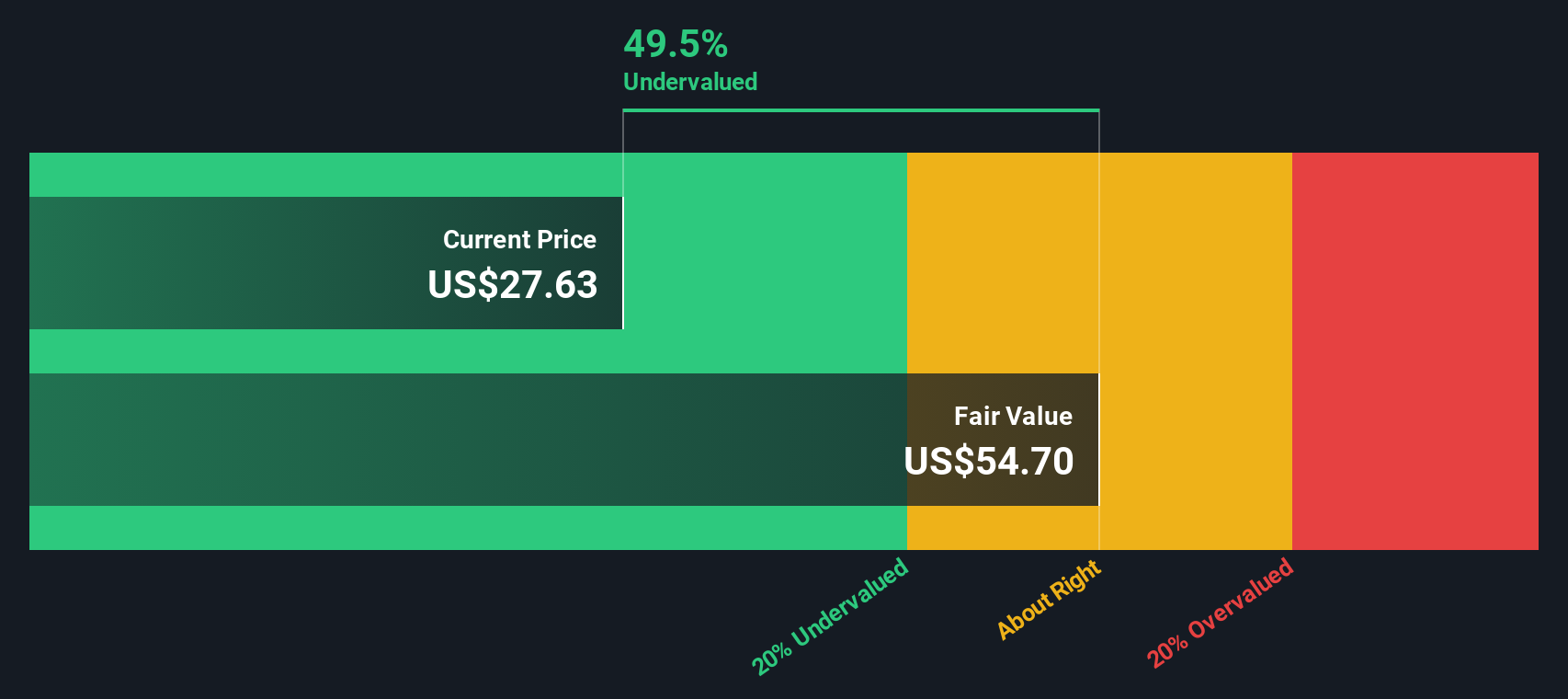

For Alkermes, the latest reported Free Cash Flow stands at $478.9 million. Analyst estimates predict free cash flow to grow over the next five years, with projections stretching to $375.5 million in 2029. After that, Simply Wall St applies extrapolation techniques to extend these forecasts out to a total of ten years, drawing on historical growth rates and industry trends.

Based on this two-stage DCF approach, Alkermes's intrinsic value comes to $54.49 per share. When compared to the current market price of $31.51, this points to a 42.2% discount. In other words, the shares are trading well below what the model considers their fair value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Alkermes is undervalued by 42.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Alkermes Price vs Earnings

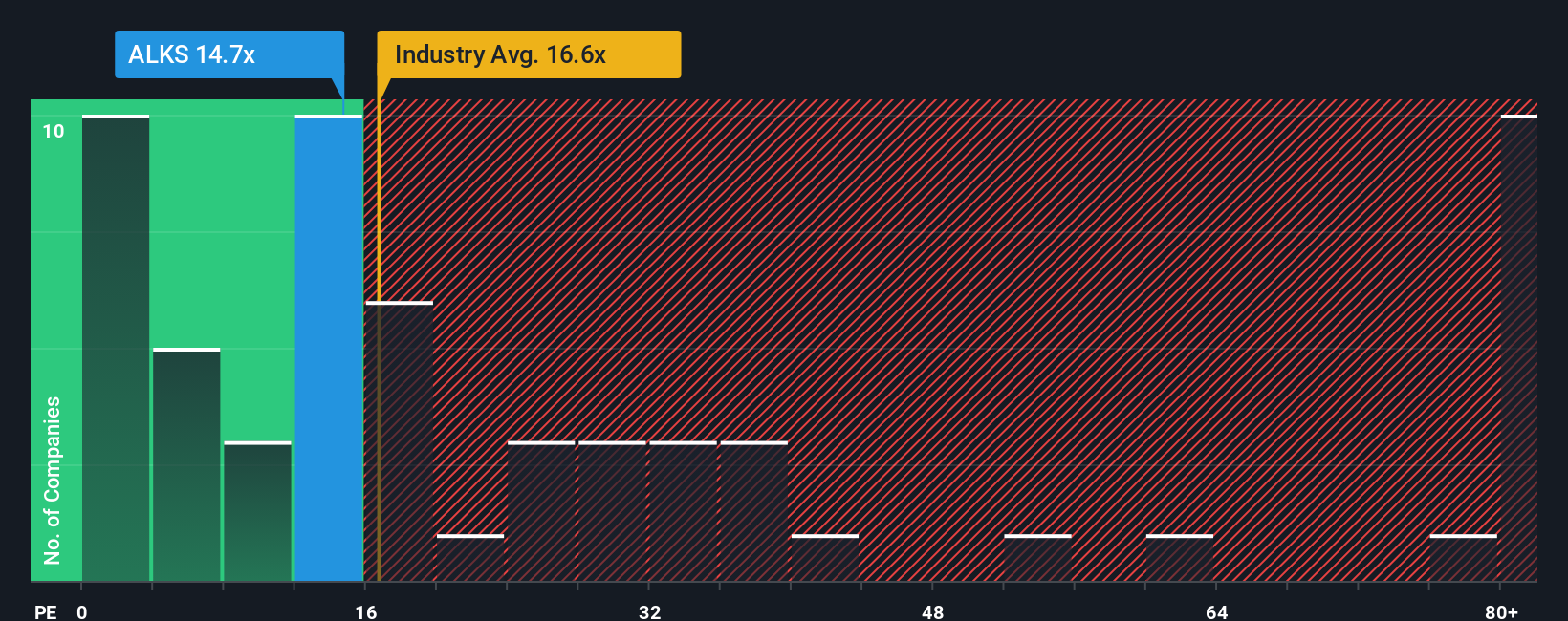

The price-to-earnings (PE) ratio is a popular way to value profitable companies like Alkermes because it relates what the market is willing to pay for each dollar of current earnings. When a company consistently delivers profits, the PE ratio helps investors assess whether they are paying a fair price relative to its historical earnings and future outlook.

What counts as a “fair” PE ratio depends a lot on growth expectations and risk. Companies with higher expected earnings growth typically deserve a higher PE ratio, while more stable, lower-growth or riskier companies might trade at a discount. Industry norms and peer valuations also provide context, but they do not account for all company-specific factors.

Alkermes is currently trading at a PE ratio of 14.94x. For comparison, the average PE for other Biotech stocks is 16.70x, and the peer group sits significantly higher at 35.72x. These numbers might suggest Alkermes is undervalued, but raw comparisons can miss important pieces of the puzzle.

This is where Simply Wall St’s “Fair Ratio” comes in. For Alkermes, the proprietary Fair PE is 14.23x. Unlike industry or peer averages, this tailored metric factors in Alkermes’s unique earnings growth outlook, profit margins, risk profile, market cap, and the nuances of its sector. As a result, it provides a far more informed benchmark.

Comparing Alkermes’s actual PE of 14.94x to its Fair Ratio of 14.23x shows the share price is almost perfectly in line with what would be expected given the current fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Alkermes Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal take on a company’s future; it’s the story you see playing out, expressed through your own assumptions for things like Alkermes’s revenue, profit margins, and what you believe the stock is really worth.

Unlike traditional models where numbers stand alone, Narratives connect the dots from the company's unique story to a personalized financial forecast and ultimately to a tailored fair value. On Simply Wall St’s Community page, you can explore or create your own Narrative in just a few clicks, a tool millions of investors already use to make sense of the numbers.

Narratives empower you to test your own ideas about when Alkermes is under- or overvalued by directly comparing your Fair Value with the latest market Price. They dynamically update when new information, such as news or earnings announcements, hits the market so your investment story always stays relevant and actionable.

For instance, in the Alkermes Community, some investors see a fair value as high as $54.00 by focusing on expanding neuroscience demand and new product pipelines, while others are more cautious with a fair value of $30.00, highlighting concerns around pipeline risk and regulatory headwinds.

Do you think there's more to the story for Alkermes? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALKS

Alkermes

A biopharmaceutical company, researches, develops, and commercializes pharmaceutical products to address unmet medical needs of patients in therapeutic areas in the United States, Ireland, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives