- United States

- /

- Biotech

- /

- NasdaqGS:ALEC

3 Promising Penny Stocks With Market Caps Under $400M

Reviewed by Simply Wall St

As of October 7, 2025, major U.S. stock indexes have seen a mix of record highs and subsequent declines, reflecting the market's volatility amidst significant economic shifts such as gold reaching an unprecedented $4,000 per ounce. For investors looking to explore beyond well-known large-cap stocks, penny stocks offer intriguing opportunities by potentially combining affordability with growth potential. Although the term "penny stocks" may seem outdated, these smaller or newer companies can still represent promising investment avenues when backed by solid financials and strategic positioning within their industries.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.96 | $437.18M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.93 | $712.48M | ✅ 4 ⚠️ 0 View Analysis > |

| Global Self Storage (SELF) | $4.993 | $57.14M | ✅ 5 ⚠️ 1 View Analysis > |

| Performance Shipping (PSHG) | $1.89 | $23.62M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.58 | $654.03M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.96 | $7.05M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.82 | $86.32M | ✅ 3 ⚠️ 2 View Analysis > |

| Universal Safety Products (UUU) | $4.40 | $11.54M | ✅ 2 ⚠️ 3 View Analysis > |

| Resources Connection (RGP) | $4.85 | $164.18M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 365 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Lantronix (LTRX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Lantronix, Inc. is engaged in the development, marketing, and sale of industrial and enterprise IoT products and services across various regions including the Americas, Europe, the Middle East, Africa, and Asia Pacific Japan with a market cap of approximately $201.85 million.

Operations: The company's revenue is primarily derived from its Computer Networks segment, which generated $122.92 million.

Market Cap: $201.85M

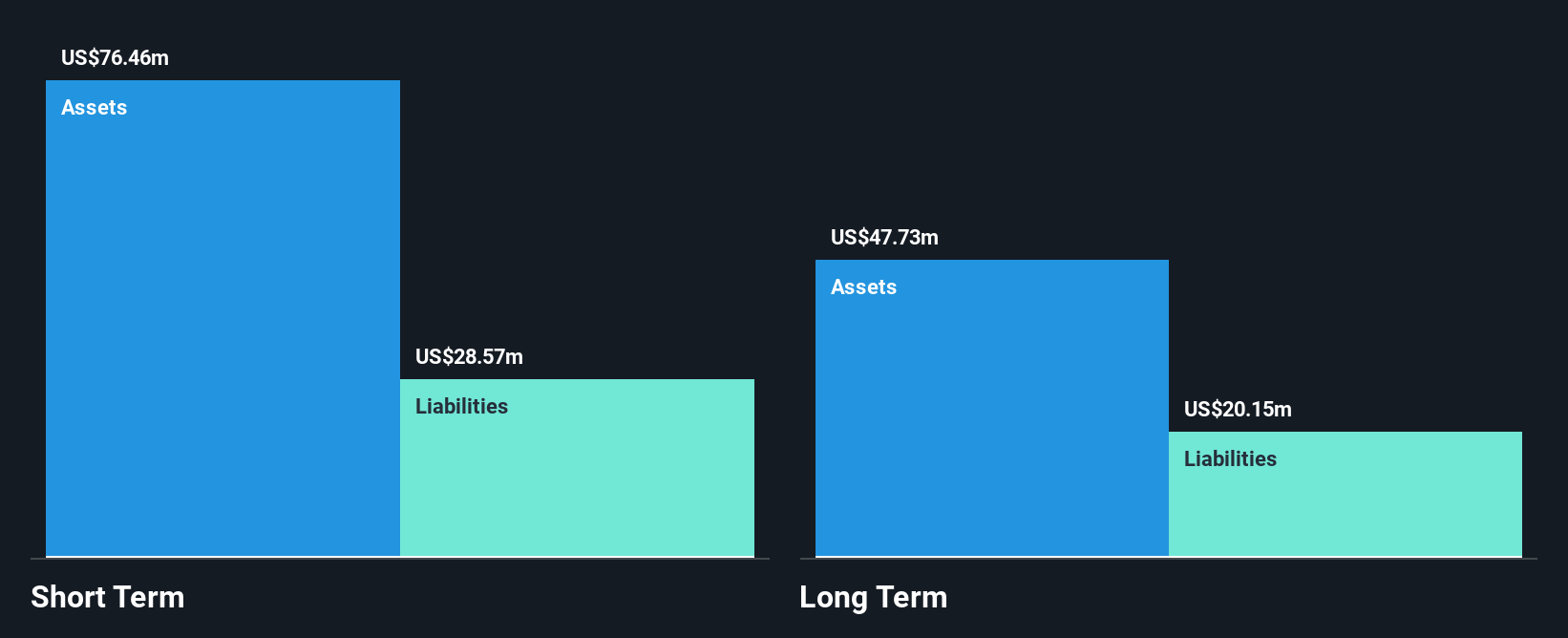

Lantronix, Inc., with a market cap of approximately US$201.85 million, is navigating the challenging landscape of penny stocks by leveraging its technological innovations and strategic partnerships. Despite reporting a net loss of US$11.37 million for the fiscal year ending June 2025, Lantronix's launch of EdgeFabric.ai and its collaboration with Teal Drones under the U.S. Army's SRR Program highlight its potential in high-growth markets like AI and defense. While unprofitable, Lantronix maintains a strong cash position exceeding debt levels and has secured a revolving credit facility to support ongoing operations and growth initiatives until 2028.

- Get an in-depth perspective on Lantronix's performance by reading our balance sheet health report here.

- Evaluate Lantronix's prospects by accessing our earnings growth report.

Metalpha Technology Holding (MATH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Metalpha Technology Holding Limited, with a market cap of $151.67 million, offers wealth management services through its subsidiaries in Hong Kong.

Operations: The company generates revenue of $44.57 million from trading proprietary digital assets and derivative contracts.

Market Cap: $151.67M

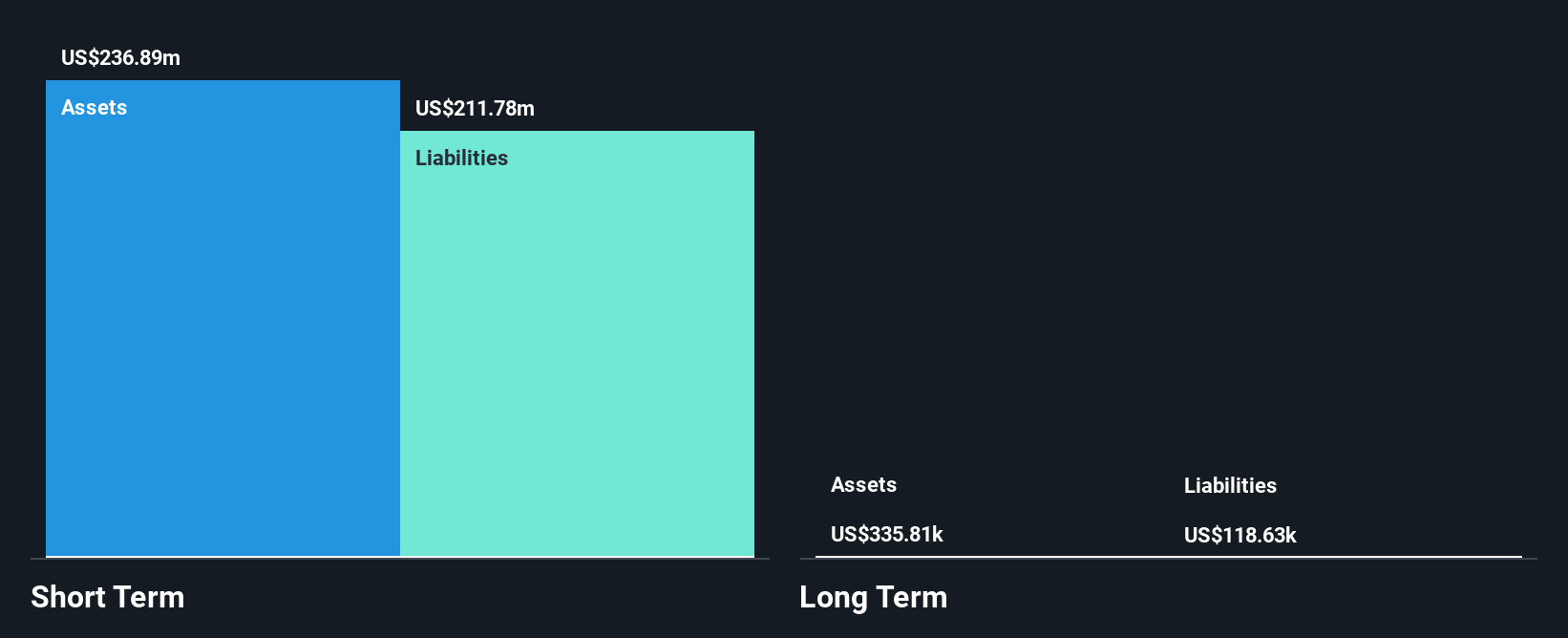

Metalpha Technology Holding, with a market cap of US$151.67 million, is navigating the penny stock landscape by focusing on digital asset solutions and strategic partnerships. The company's collaboration with AMINA Bank AG to distribute Principal Fund I highlights its efforts to capture institutional demand for crypto exposure. Metalpha's recent profitability, with net income reaching US$15.89 million from sales of US$44.57 million, underscores its financial turnaround and solidifies its position in the market despite high share price volatility. The appointment of experienced executives strengthens its investor relations and compliance strategies as it expands globally.

- Unlock comprehensive insights into our analysis of Metalpha Technology Holding stock in this financial health report.

- Explore historical data to track Metalpha Technology Holding's performance over time in our past results report.

Alector (ALEC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Alector, Inc. is a late-stage clinical biotechnology company that develops therapies targeting neurodegenerative diseases, with a market cap of $321.86 million.

Operations: The company generates revenue from its Biotechnology segment, totaling $81.13 million.

Market Cap: $321.86M

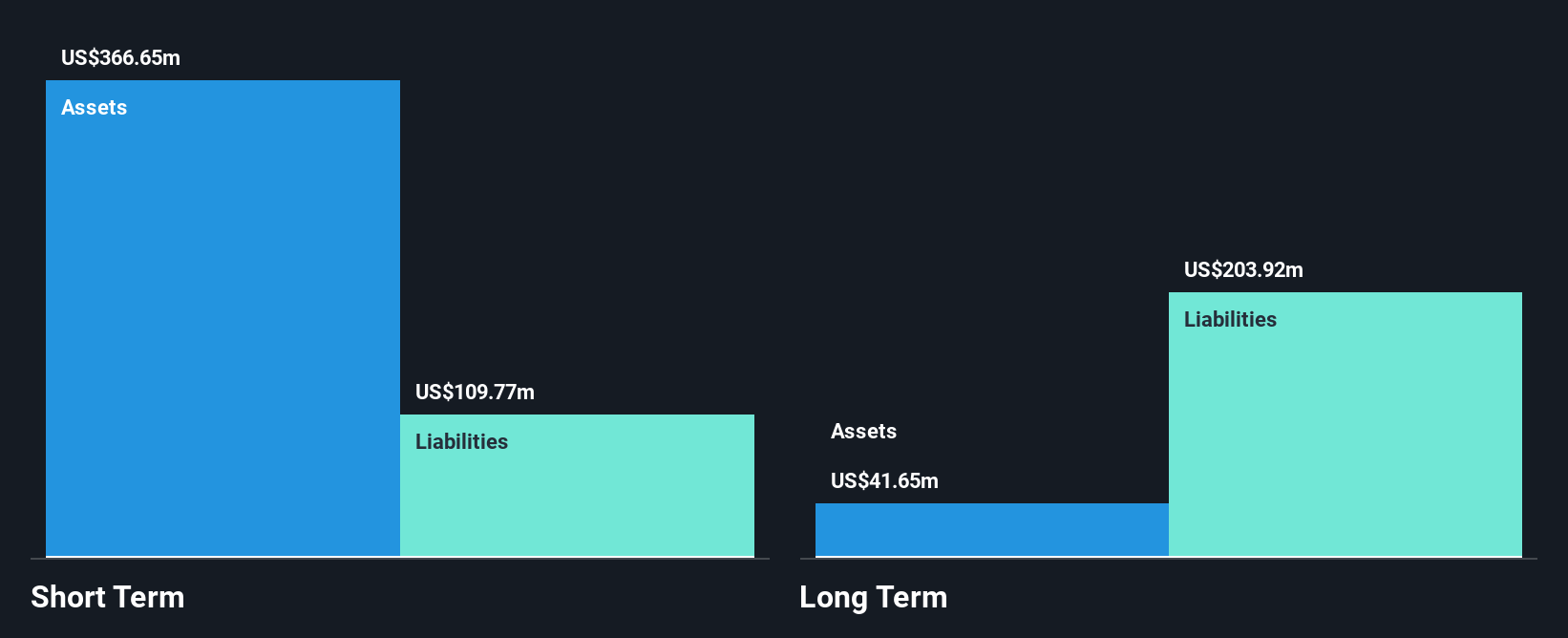

Alector, Inc., with a market cap of US$321.86 million, operates in the biotechnology sector focusing on neurodegenerative diseases. Despite being unprofitable, it has shown progress by reducing losses over five years and maintaining a stable cash runway for 2.6 years if cash flow trends continue. The company recently hosted an event to discuss its progranulin franchise and Alector Brain Carrier-enabled programs, indicating active development in pivotal trials for Alzheimer's and Parkinson's therapies. While earnings are forecasted to grow significantly annually, high share price volatility and insider selling may concern potential investors in this penny stock space.

- Dive into the specifics of Alector here with our thorough balance sheet health report.

- Understand Alector's earnings outlook by examining our growth report.

Seize The Opportunity

- Reveal the 365 hidden gems among our US Penny Stocks screener with a single click here.

- Ready For A Different Approach? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALEC

Alector

A late-stage clinical biotechnology company, develops therapies that is focused on counteracting the devastating progression of neurodegenerative diseases.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives