- United States

- /

- Biotech

- /

- NasdaqCM:AKBA

Akebia Therapeutics, Inc.'s (NASDAQ:AKBA) Share Price Boosted 31% But Its Business Prospects Need A Lift Too

Despite an already strong run, Akebia Therapeutics, Inc. (NASDAQ:AKBA) shares have been powering on, with a gain of 31% in the last thirty days. The last month tops off a massive increase of 137% in the last year.

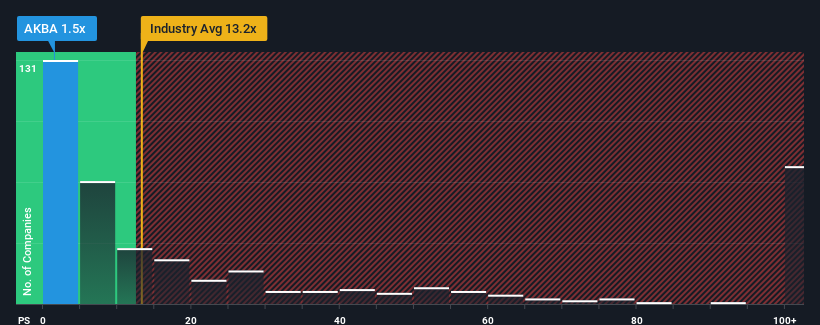

Although its price has surged higher, Akebia Therapeutics' price-to-sales (or "P/S") ratio of 1.5x might still make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 13.2x and even P/S above 55x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Akebia Therapeutics

How Has Akebia Therapeutics Performed Recently?

Akebia Therapeutics hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Akebia Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Akebia Therapeutics?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Akebia Therapeutics' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 34%. This means it has also seen a slide in revenue over the longer-term as revenue is down 37% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 4.7% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 242% per year, which is noticeably more attractive.

With this information, we can see why Akebia Therapeutics is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Akebia Therapeutics' P/S?

Shares in Akebia Therapeutics have risen appreciably however, its P/S is still subdued. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As expected, our analysis of Akebia Therapeutics' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about these 3 warning signs we've spotted with Akebia Therapeutics (including 2 which are a bit unpleasant).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:AKBA

Akebia Therapeutics

A biopharmaceutical company, focuses on the development and commercialization of therapeutics for patients with kidney diseases.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives