- United States

- /

- Biotech

- /

- NasdaqGM:ADMA

How Analyst Upgrades and Rising EPS Expectations at ADMA Biologics (ADMA) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Adma Biologics is preparing to release its latest earnings results, with analysts expecting earnings per share of $0.16, an improvement from the same period last year.

- Recent upward revisions in analyst forecasts signal growing confidence in Adma Biologics' operational performance and prospects for higher profitability.

- We’ll assess how analyst optimism ahead of the upcoming earnings announcement may influence Adma Biologics' long-term investment outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

ADMA Biologics Investment Narrative Recap

Owning shares in ADMA Biologics means believing in the company's ability to maintain rapid revenue growth, expand margins through efficiency gains, and sustain operational resilience in a highly competitive plasma therapeutics market. While analyst optimism reflected in recent EPS forecast revisions highlights positive sentiment around ADMA's profitability, this in itself is unlikely to materially alter the most immediate catalyst, continued commercial scaling of its yield enhancement process, or address the ongoing risk tied to heavy reliance on its core products.

Of the recent company announcements, the FDA approval of ADMA’s yield enhancement production process stands out as especially relevant for near-term profitability and cost structure. By increasing immunoglobulin output by over 20%, this catalyst directly relates to stronger earnings performance and supports analyst confidence, even as broader risks from product concentration and operational challenges remain.

Yet, against the optimism, investors should not lose sight of the operational risks at the Boca Raton facility, as disruptions here could...

Read the full narrative on ADMA Biologics (it's free!)

ADMA Biologics' narrative projects $904.6 million revenue and $350.9 million earnings by 2028. This requires 24.0% yearly revenue growth and a $142.0 million earnings increase from $208.9 million.

Uncover how ADMA Biologics' forecasts yield a $29.06 fair value, a 107% upside to its current price.

Exploring Other Perspectives

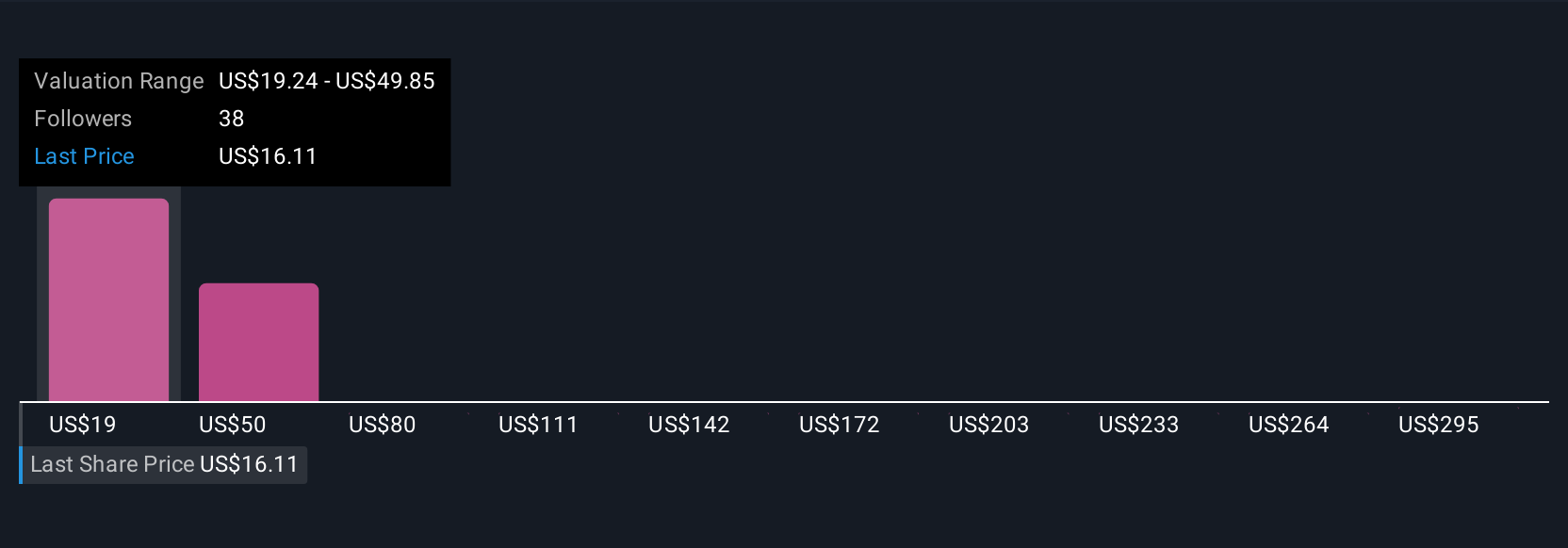

Eight private investors in the Simply Wall St Community have assigned fair values for ADMA Biologics ranging from US$19.24 to US$325.32 per share. Alongside this wide divergence in opinion, margin expansion from yield enhancement remains a central focus as you consider these varied outlooks.

Explore 8 other fair value estimates on ADMA Biologics - why the stock might be worth just $19.24!

Build Your Own ADMA Biologics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ADMA Biologics research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ADMA Biologics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ADMA Biologics' overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ADMA

ADMA Biologics

A biopharmaceutical company, develops, manufactures, and markets specialty plasma-derived biologics for the treatment of immune deficiencies and infectious diseases in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives