- United States

- /

- Biotech

- /

- NasdaqGS:ADAP

Investors Don't See Light At End Of Adaptimmune Therapeutics plc's (NASDAQ:ADAP) Tunnel And Push Stock Down 26%

To the annoyance of some shareholders, Adaptimmune Therapeutics plc (NASDAQ:ADAP) shares are down a considerable 26% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 25% share price drop.

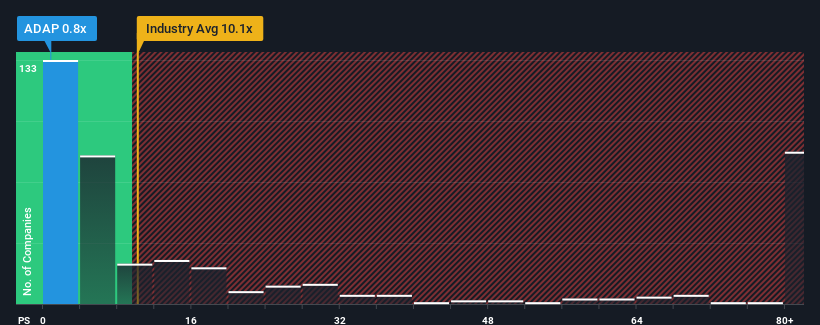

After such a large drop in price, Adaptimmune Therapeutics' price-to-sales (or "P/S") ratio of 0.8x might make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 10x and even P/S above 66x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Adaptimmune Therapeutics

What Does Adaptimmune Therapeutics' Recent Performance Look Like?

Recent times haven't been great for Adaptimmune Therapeutics as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Adaptimmune Therapeutics will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Adaptimmune Therapeutics' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 146% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue growth is heading into negative territory, declining 10% each year over the next three years. With the industry predicted to deliver 114% growth each year, that's a disappointing outcome.

With this in consideration, we find it intriguing that Adaptimmune Therapeutics' P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Adaptimmune Therapeutics' P/S

Adaptimmune Therapeutics' P/S looks about as weak as its stock price lately. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Adaptimmune Therapeutics' analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for Adaptimmune Therapeutics that you should be aware of.

If you're unsure about the strength of Adaptimmune Therapeutics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ADAP

Adaptimmune Therapeutics

A clinical-stage biopharmaceutical company, provides novel cell therapies primarily to cancer patients in the United States and the United Kingdom.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives