- United States

- /

- Biotech

- /

- NasdaqCM:ADAP

Adaptimmune Therapeutics plc (NASDAQ:ADAP) Stock Catapults 107% Though Its Price And Business Still Lag The Industry

Adaptimmune Therapeutics plc (NASDAQ:ADAP) shares have continued their recent momentum with a 107% gain in the last month alone. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 7.4% over the last year.

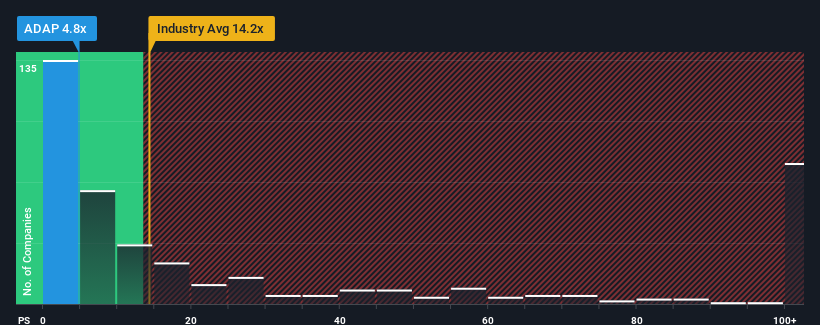

In spite of the firm bounce in price, Adaptimmune Therapeutics' price-to-sales (or "P/S") ratio of 4.8x might still make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 14.2x and even P/S above 65x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Adaptimmune Therapeutics

What Does Adaptimmune Therapeutics' Recent Performance Look Like?

Adaptimmune Therapeutics certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Adaptimmune Therapeutics will help you uncover what's on the horizon.How Is Adaptimmune Therapeutics' Revenue Growth Trending?

In order to justify its P/S ratio, Adaptimmune Therapeutics would need to produce anemic growth that's substantially trailing the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. Spectacularly, three year revenue growth has also set the world alight, thanks to the last 12 months of incredible growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 8.0% each year as estimated by the five analysts watching the company. That's not great when the rest of the industry is expected to grow by 269% per annum.

In light of this, it's understandable that Adaptimmune Therapeutics' P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From Adaptimmune Therapeutics' P/S?

Adaptimmune Therapeutics' recent share price jump still sees fails to bring its P/S alongside the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's clear to see that Adaptimmune Therapeutics maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 5 warning signs for Adaptimmune Therapeutics (1 is a bit unpleasant!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Adaptimmune Therapeutics, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ADAP

Adaptimmune Therapeutics

A commercial-stage biopharmaceutical company, provides novel cell therapies primarily to cancer patients in the United States and the United Kingdom.

Undervalued moderate.

Similar Companies

Market Insights

Community Narratives