- United States

- /

- Biotech

- /

- NasdaqGS:ACLX

Has Arcellx’s Recent Price Surge Left Room for Further Growth in 2025?

Reviewed by Bailey Pemberton

If you’re debating what to do with shares of Arcellx, you’re definitely not alone. It’s the kind of stock that makes investors pause and reconsider, especially after such a striking run. Let’s look at the numbers: Arcellx’s price gained 16.2% over the last month, climbed 6.7% in just seven days, and has rocketed an eye-watering 346.5% over three years. It’s not every day you see those kinds of returns, and the buzz in biotech circles hasn’t hurt either, as recent market developments have helped shine a spotlight on cell therapy innovators like Arcellx.

That sharp momentum says something about both investor confidence and shifting attitudes toward risk in this sector. However, it naturally raises a question: Has the market already built high expectations into the price, or is there more room to grow? That’s where our valuation checks come in. For Arcellx, the company currently gets a valuation score of 3, meaning it looks undervalued on three out of six major metrics, which is a solid indication that the stock could offer real value, while still leaving room for debate.

Next, I’ll walk through the valuation approaches I use to break down opportunities like this, step by step. Stay tuned until the end for a perspective that goes beyond the numbers, to see if there's a smarter way to judge what Arcellx is really worth.

Approach 1: Arcellx Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting future cash flows and then discounting those values back to the present day. This approach helps investors assess what the business could be worth based on its actual cash generation, instead of focusing only on reported profits or market hype.

For Arcellx, current free cash flow sits at -$127.4 million, reflecting the company's ongoing investments in growth. Looking ahead, analysts expect rapid improvement. By 2029, free cash flow is projected to reach $364.7 million, and the internal extrapolation increases this figure in subsequent years, up to $1.86 billion (discounted to $962.3 million) by 2035. These forecasts, based on analyst estimates and internal modeling, highlight a transition from negative to positive cash generation within the decade.

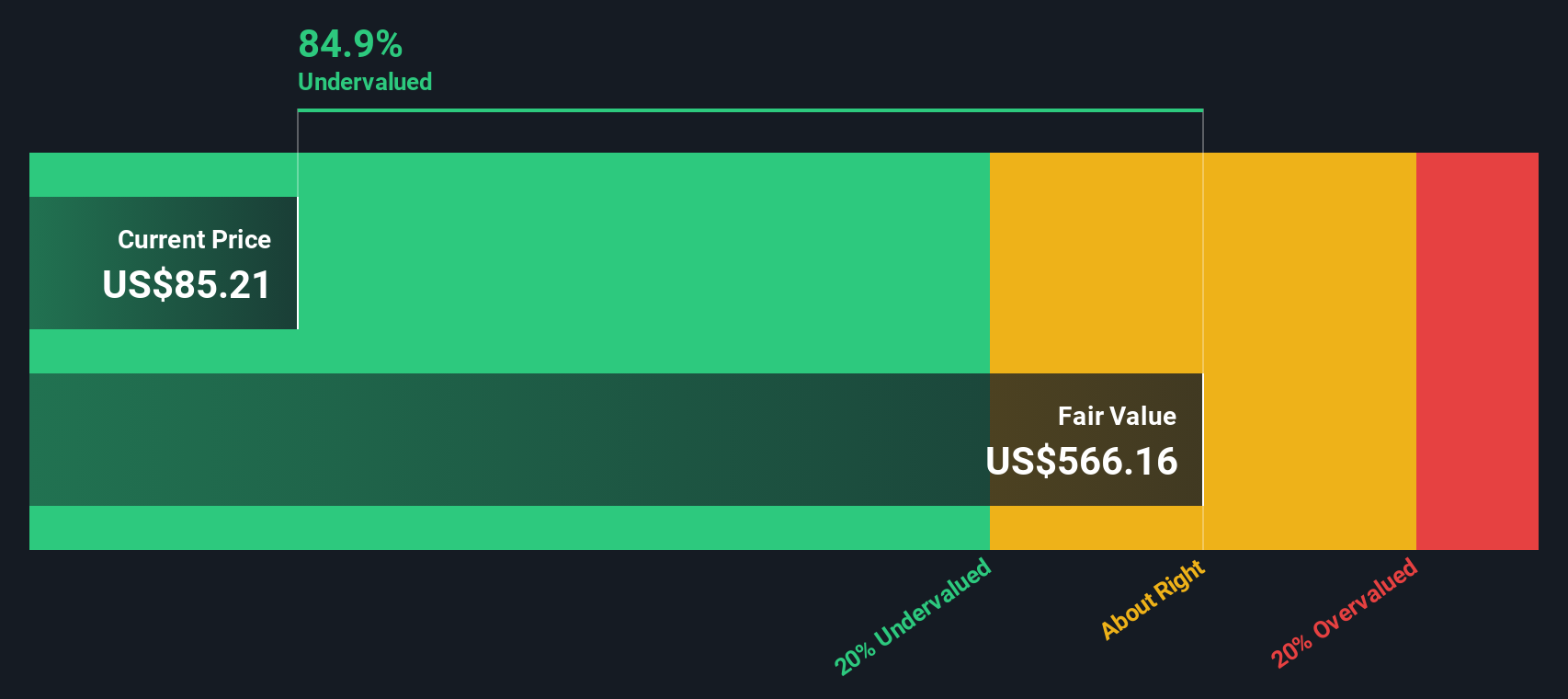

The DCF analysis results in an estimated intrinsic value of $566.76 per share. Compared to today's price, this implies the stock is trading at an 85.1% discount to its calculated fair value, indicating a significant undervaluation based on long-term cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Arcellx is undervalued by 85.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Arcellx Price vs Book

The Price-to-Book (P/B) ratio is a useful valuation multiple, especially for biotech firms like Arcellx, which are still working toward consistent profitability. This metric shows investors how much they are paying for each dollar of net assets, making it a helpful check for companies where earnings can be volatile due to heavy investment in research or product development.

Growth expectations and risk play a big part in determining what a “normal” or “fair” P/B ratio should be. Higher growth prospects or lower risk typically justify a higher multiple, while more mature or riskier businesses should naturally trade at a discount. For Arcellx, the current P/B ratio is 11.93x. That is well above the biotech industry average of 2.50x, and modestly higher than the peer average of 11.38x, signaling that investors are clearly factoring in optimistic growth expectations for the business.

At this point, it’s important to look closer than simple comparisons with peers or the industry. This is where Simply Wall St’s “Fair Ratio” comes in, a proprietary measure that accounts for a blend of factors, such as expected earnings growth, company size, risk profile, profit margins, and industry conditions. Unlike plain-vanilla averages, the Fair Ratio gives a nuanced view that truly reflects what Arcellx’s valuation multiple should be, given its specific situation rather than generic benchmarks.

Comparing Arcellx’s actual P/B ratio to the Fair Ratio yields a minimal difference, suggesting the market price closely aligns with company-specific fundamentals after considering all the moving parts investors care about.

Result: ABOUT RIGHT

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Arcellx Narrative

Earlier, we mentioned that there’s an even better way to understand valuation, so let’s introduce you to Narratives. Narratives make investing more intuitive by letting you build a story around a company like Arcellx. This approach connects your personal view on its future with your assumptions about fair value, revenue, and earnings growth. Instead of relying solely on models or ratios, a Narrative links the company’s journey to a financial forecast and then connects it directly to a fair value estimate, making your decision process much clearer.

On Simply Wall St’s popular Community page, Narratives are an incredibly accessible tool, used by millions to share and update their perspectives in real time. This feature helps you gauge when to buy or sell, as it directly compares your calculated Fair Value with the current share price and updates dynamically whenever new news, earnings, or other critical events are released. For Arcellx, you’ll find that some investors are optimistic, projecting substantial upside to fair value, while others expect more cautious outcomes. This gives you a full spectrum of viewpoints to inform your next move.

Do you think there's more to the story for Arcellx? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACLX

Arcellx

Together with its subsidiary, engages in the development of various immunotherapies for patients with cancer and other incurable diseases in the United States.

Excellent balance sheet and fair value.

Market Insights

Community Narratives