- United States

- /

- Biotech

- /

- NasdaqGS:ACAD

Should ACADIA’s Earnings Beat and Conference Highlights Require Action From ACADIA Pharmaceuticals (ACAD) Investors?

Reviewed by Sasha Jovanovic

- ACADIA Pharmaceuticals recently presented at Citi’s Annual Global Healthcare Conference 2025 in Miami, highlighting its progress in central nervous system and rare disease therapies.

- Stronger-than-expected third-quarter earnings and analyst commentary on Nuplazid and Daybue’s commercial traction have sharpened investor focus on ACADIA’s growth profile.

- Now we’ll examine how ACADIA’s earnings beat and evolving analyst views may shape the company’s broader investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

ACADIA Pharmaceuticals Investment Narrative Recap

To own ACADIA Pharmaceuticals, you need to believe its focus on CNS and rare diseases can translate Nuplazid and Daybue into durable, cash‑generating franchises while the pipeline gradually reduces single‑product dependence. The recent earnings beat and conference appearance reinforce near term confidence in commercial execution but do not materially change the key catalyst of sustained Nuplazid and Daybue uptake, nor the core risk around pricing pressure and eventual generic or reimbursement headwinds.

Mizuho’s move to lift its price target to US$29 after ACADIA’s strong third quarter, while keeping a Neutral rating, is most relevant here because it ties directly to Nuplazid and Daybue sales momentum. That balance between higher sales expectations and caution on valuation reflects how investors are weighing the current product strength against concentration risk and the need for pipeline success to support the next leg of the story.

Yet even with solid recent results, the concentration risk around Nuplazid is something investors should be aware of if...

Read the full narrative on ACADIA Pharmaceuticals (it's free!)

ACADIA Pharmaceuticals' narrative projects $1.4 billion revenue and $306.0 million earnings by 2028.

Uncover how ACADIA Pharmaceuticals' forecasts yield a $29.32 fair value, a 13% upside to its current price.

Exploring Other Perspectives

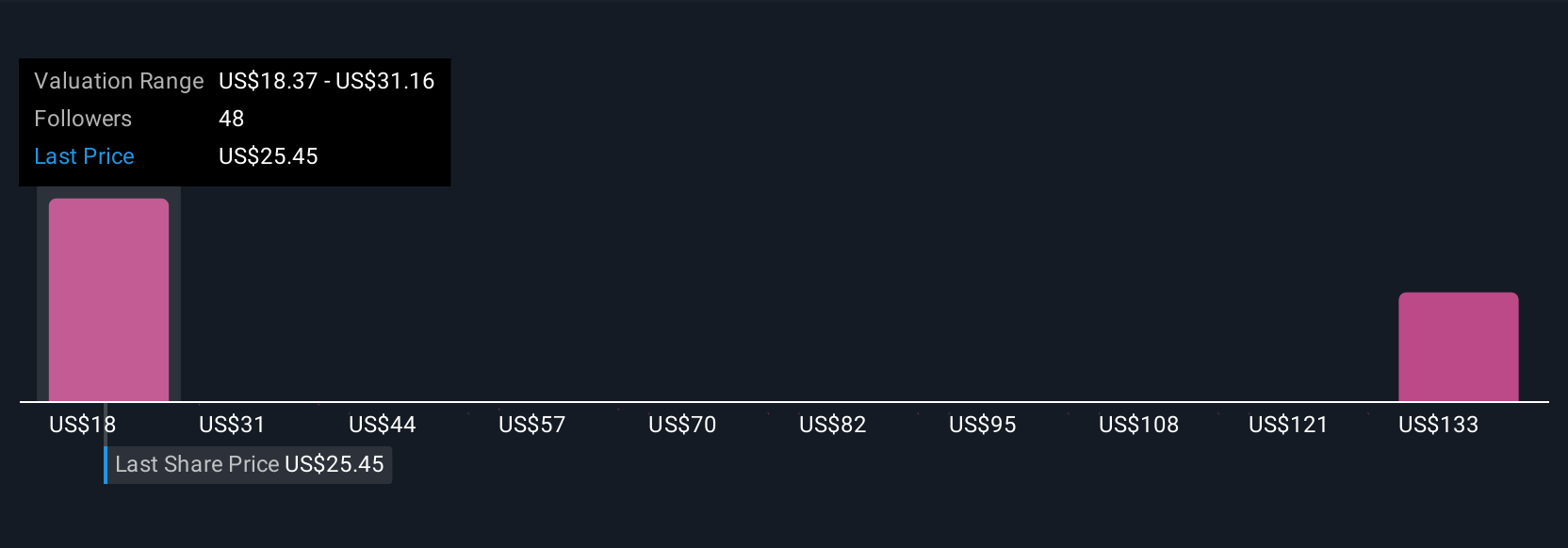

Six fair value estimates from the Simply Wall St Community span roughly US$18 to over US$215 per share, showing how far apart individual views can be. Against that backdrop, the reliance on Nuplazid for a large share of current revenue may shape how you think about the company’s resilience if pricing or generic pressures eventually emerge, so it can be useful to compare several of these perspectives before deciding how that risk fits your own expectations.

Explore 6 other fair value estimates on ACADIA Pharmaceuticals - why the stock might be worth over 8x more than the current price!

Build Your Own ACADIA Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ACADIA Pharmaceuticals research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free ACADIA Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ACADIA Pharmaceuticals' overall financial health at a glance.

No Opportunity In ACADIA Pharmaceuticals?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACAD

ACADIA Pharmaceuticals

A biopharmaceutical company, focuses on the development and commercialization of medicines for central nervous system (CNS) disorders and rare diseases in the United States.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026