- United States

- /

- Biotech

- /

- NasdaqGS:ACAD

High Growth Tech Stocks to Watch in November 2024

Reviewed by Simply Wall St

The United States market has shown robust performance recently, with a 3.9% increase over the last week and a remarkable 33% rise over the past year, while earnings are projected to grow by 16% annually. In this thriving environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation potential and adaptability to capitalize on these favorable market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| AsiaFIN Holdings | 51.75% | 58.17% | ★★★★★★ |

| Invivyd | 47.87% | 67.72% | ★★★★★★ |

| Sarepta Therapeutics | 23.89% | 42.65% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.45% | 70.66% | ★★★★★★ |

| Blueprint Medicines | 25.26% | 68.92% | ★★★★★★ |

| Travere Therapeutics | 31.19% | 72.58% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 240 stocks from our US High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Bitdeer Technologies Group (NasdaqCM:BTDR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bitdeer Technologies Group is a technology company focused on blockchain and computing, with a market cap of $1.67 billion.

Operations: Bitdeer Technologies Group generates revenue primarily through its data processing operations, amounting to $420.89 million.

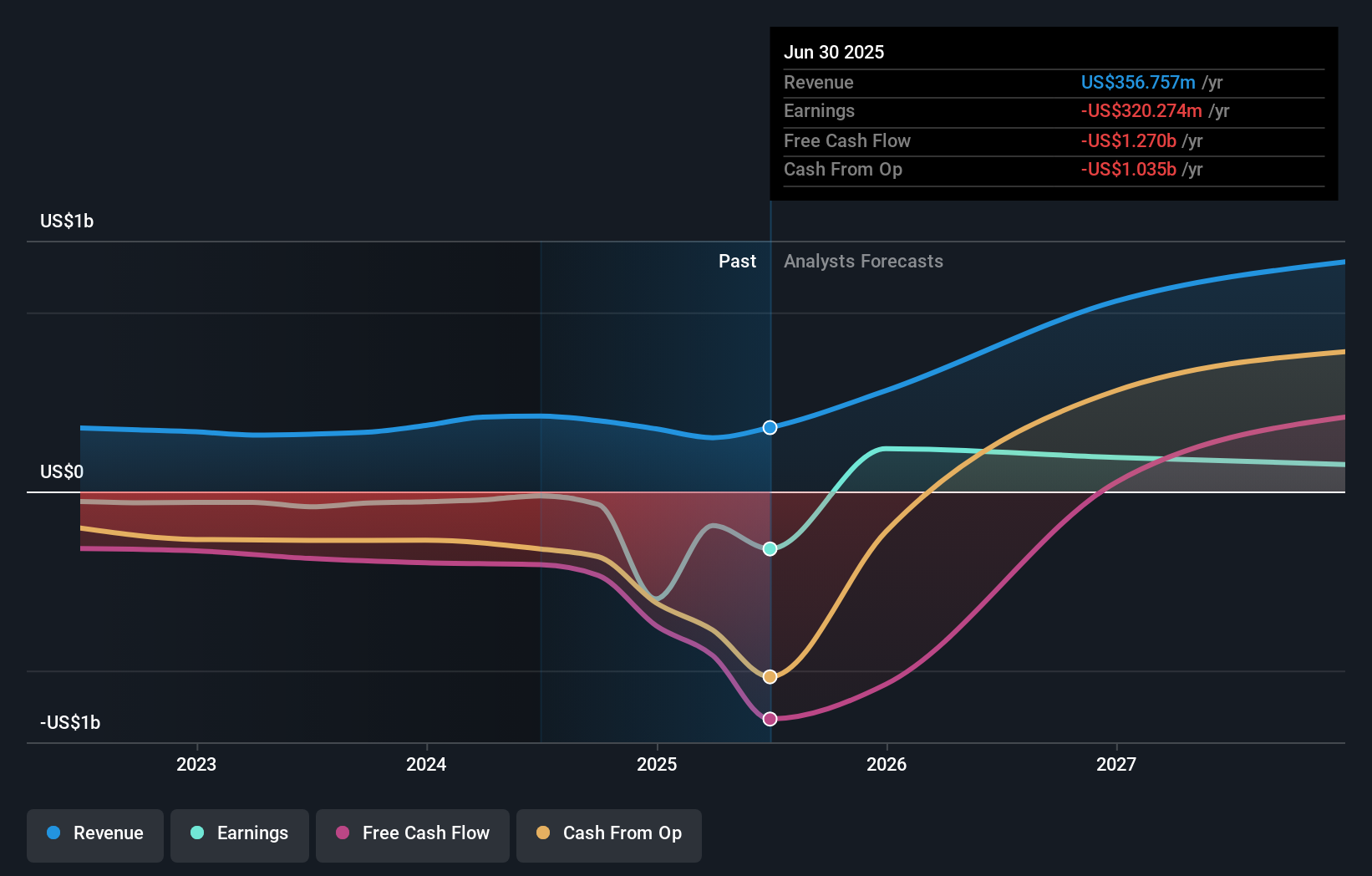

Bitdeer Technologies Group, recently added to the S&P Global BMI Index, is navigating a transformative phase with significant investments in innovation and market expansion. Despite a decrease in Bitcoin mined—from 482 units last September to 164 this year—the company is optimistic about its growth trajectory with a forecasted revenue increase of 24.8% annually, outpacing the US market's average of 8.9%. The firm has also initiated a share repurchase program valued at $10 million, underscoring its commitment to shareholder value amidst financial challenges including less than one year of cash runway and current unprofitability. Moreover, Bitdeer's AI division launched an advanced AI Training Platform, enhancing its competitive edge by offering scalable solutions through serverless GPU infrastructure which simplifies complex setups and optimizes development costs—a strategic move expected to fuel an earnings growth of 97.54% per year as it strides towards profitability within three years.

ACADIA Pharmaceuticals (NasdaqGS:ACAD)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ACADIA Pharmaceuticals Inc. is a biopharmaceutical company dedicated to developing and commercializing innovative medicines for unmet medical needs in central nervous system disorders and rare diseases in the United States, with a market capitalization of approximately $3.04 billion.

Operations: ACADIA focuses on developing and commercializing medicines for CNS disorders and rare diseases, generating revenue of $929.24 million from these activities.

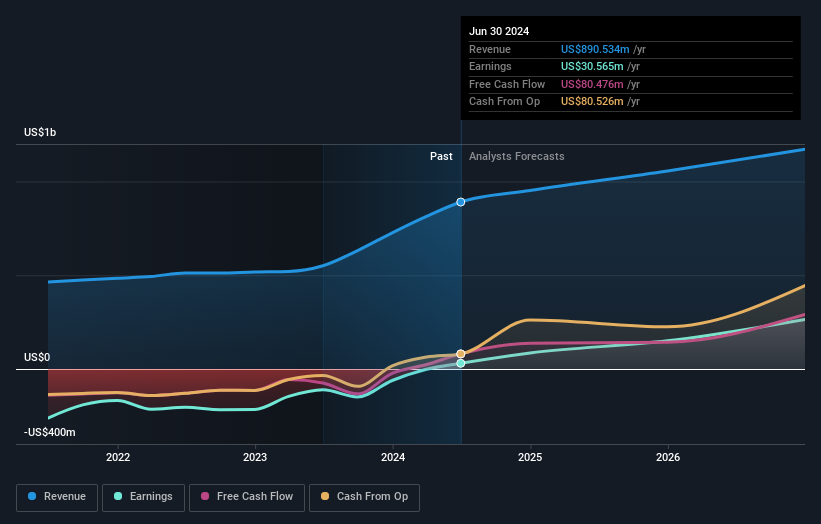

ACADIA Pharmaceuticals has demonstrated a robust turnaround, evidenced by its recent surge in revenue to $250.4 million in Q3 2024, up from $211.7 million the previous year, and a swing to a net income of $32.77 million from a loss of $65.18 million. This financial rebound is supported by significant R&D investments and the strategic approval of DAYBUE™ in Canada for Rett syndrome treatment, marking it as the first drug approved for this condition. The company's growth trajectory is further underscored by an earnings forecast growth rate of 29.8% per year, outpacing both its past performance and broader market projections, with revenue expected to grow at 9.9% annually—above the US market average of 8.9%.

- Click here and access our complete health analysis report to understand the dynamics of ACADIA Pharmaceuticals.

Explore historical data to track ACADIA Pharmaceuticals' performance over time in our Past section.

CarGurus (NasdaqGS:CARG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CarGurus, Inc. operates an online automotive platform facilitating vehicle transactions both in the United States and internationally, with a market capitalization of approximately $3.89 billion.

Operations: The company generates revenue primarily from its U.S. Marketplace segment, which accounts for $709.19 million, and its Digital Wholesale segment, contributing $120.31 million.

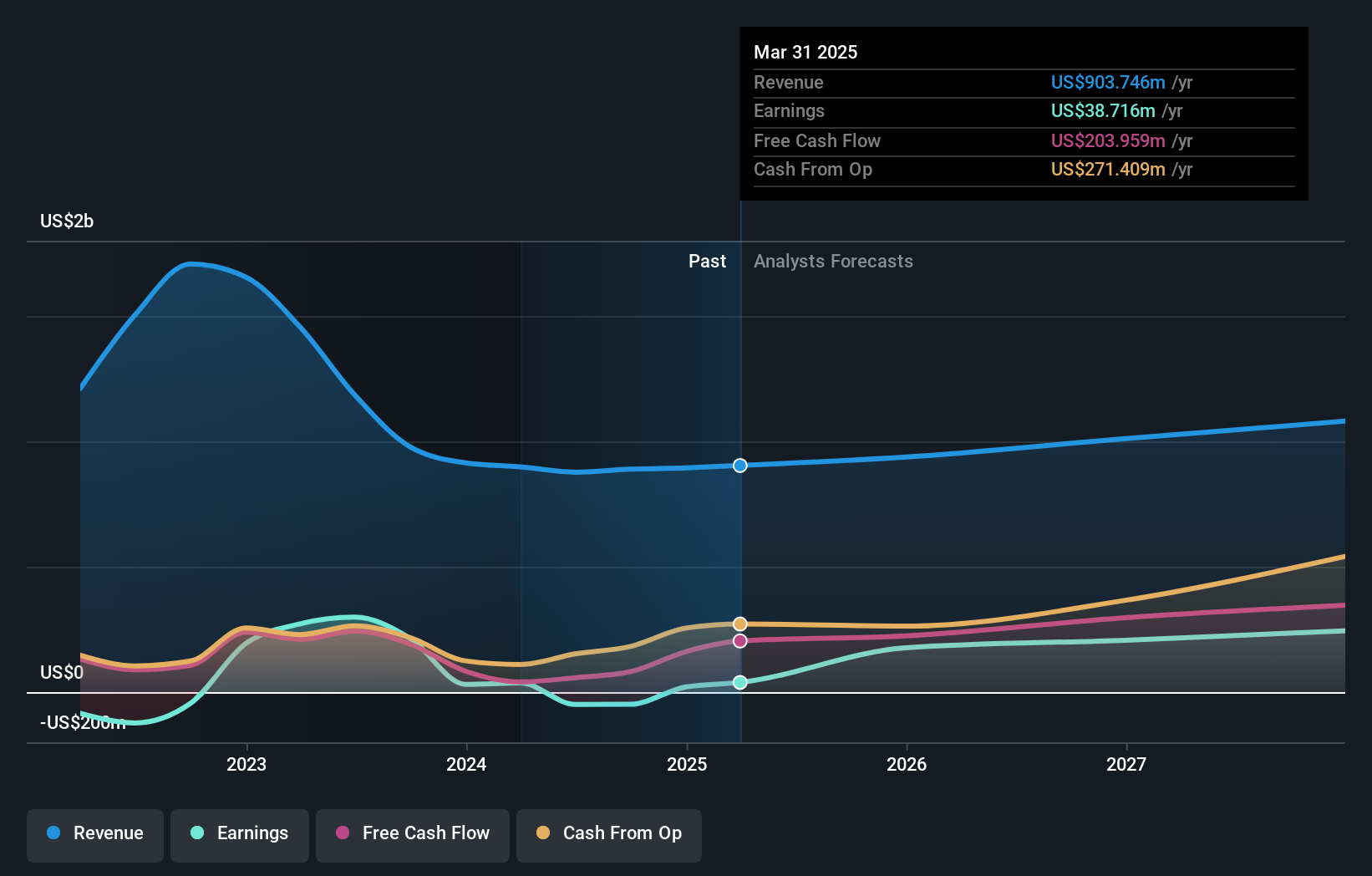

CarGurus has demonstrated resilience and adaptability in a competitive market, with a third-quarter revenue increase to $231.36 million from $219.42 million year-over-year, showcasing a growth rate of 13.5%. This performance is underpinned by strategic initiatives such as the launch of CarGurus Digital Deal in Canada, enhancing dealer-customer interactions through digital solutions. Furthermore, the company's commitment to innovation is evident from its R&D investments which have supported developments like this new platform, aligning with industry shifts towards more integrated online commerce solutions. Looking ahead, CarGurus projects annual revenue growth at an optimistic 52.56%, signaling robust future prospects despite current challenges marked by a net loss this year compared to net income previously. The recent authorization of a $200 million share repurchase program reflects confidence in long-term value creation, backed by strong operational cash flow.

- Take a closer look at CarGurus' potential here in our health report.

Assess CarGurus' past performance with our detailed historical performance reports.

Key Takeaways

- Click this link to deep-dive into the 240 companies within our US High Growth Tech and AI Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACAD

ACADIA Pharmaceuticals

A biopharmaceutical company, focuses on the development and commercialization innovative medicines that address unmet medical needs in central nervous system (CNS) disorders and rare diseases in the United States.

Flawless balance sheet with proven track record.