- United States

- /

- Biotech

- /

- NasdaqCM:ABEO

How Much Did Abeona Therapeutics'(NASDAQ:ABEO) Shareholders Earn From Share Price Movements Over The Last Three Years?

It is doubtless a positive to see that the Abeona Therapeutics Inc. (NASDAQ:ABEO) share price has gained some 45% in the last three months. But that is meagre solace in the face of the shocking decline over three years. Indeed, the share price is down a whopping 87% in the last three years. So we're relieved for long term holders to see a bit of uplift. Of course the real question is whether the business can sustain a turnaround.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Check out our latest analysis for Abeona Therapeutics

Because Abeona Therapeutics made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, Abeona Therapeutics grew revenue at 70% per year. That's well above most other pre-profit companies. So on the face of it we're really surprised to see the share price down 23% a year in the same time period. The share price makes us wonder if there is an issue with profitability. Ultimately, revenue growth doesn't amount to much if the business can't scale well. Unless the balance sheet is strong, the company might have to raise capital.

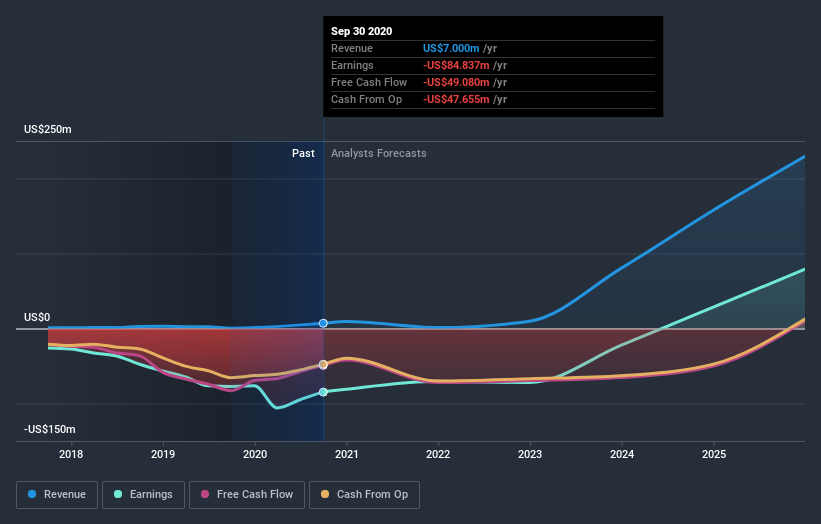

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Abeona Therapeutics' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Abeona Therapeutics shareholders are down 25% for the year, but the market itself is up 22%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 5% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for Abeona Therapeutics that you should be aware of before investing here.

Of course Abeona Therapeutics may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade Abeona Therapeutics, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:ABEO

Abeona Therapeutics

A clinical-stage biopharmaceutical company, develops gene and cell therapies for life-threatening diseases.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives