- United States

- /

- Life Sciences

- /

- NasdaqGS:ABCL

A Look at AbCellera Biologics (NasdaqGS:ABCL) Valuation Following New Phase 1 Trial and Leadership Update

Reviewed by Simply Wall St

AbCellera Biologics (NasdaqGS:ABCL) is back in the spotlight as the company kicked off its Phase 1 clinical trial for ABCL575, a next-generation antibody therapy aimed at moderate-to-severe atopic dermatitis and other immune conditions. The buzz around this event is more than typical pipeline progress, as it signals a hands-on strategy to speed up clinical development and boost credibility. With the appointment of Sarah Noonberg, M.D., Ph.D., as Chief Medical Officer, it is clear that AbCellera is fully leaning into its ambition to grow from a platform technology story into a drug development powerhouse.

This sequence of milestones is certainly catching investor attention. AbCellera’s share price has climbed a striking 75% over the past year, including nearly 37% in just the past 3 months, suggesting a shift in sentiment that aligns with these latest announcements. While the pace has picked up recently, long-term holders may remember a less spectacular track record, as the 3-year return still sits deep in negative territory. This underscores just how volatile and changeable biotech narratives can be.

With the excitement around new leadership and a fresh clinical trial underway, is AbCellera finally trading at a discount, or has the market already factored in its future growth story?

Most Popular Narrative: 48.9% Undervalued

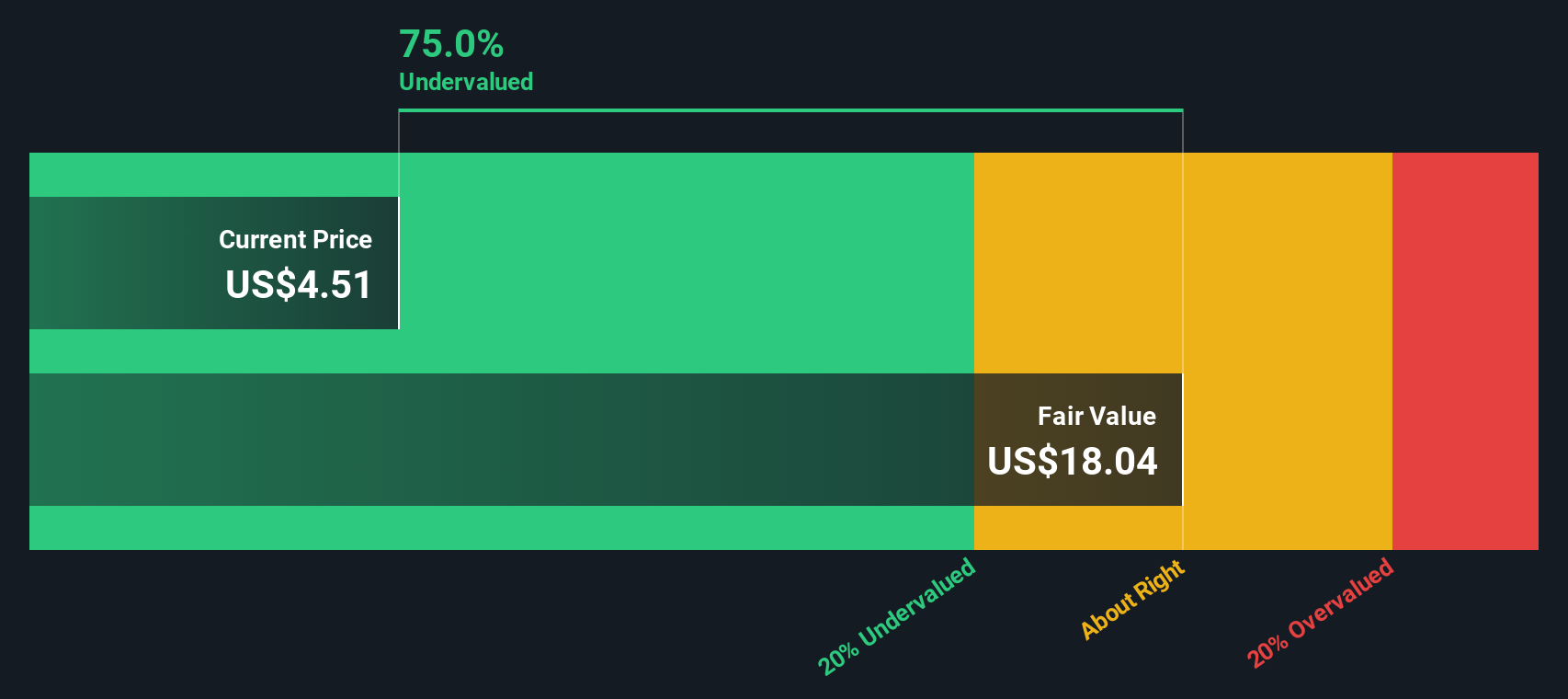

According to the most widely followed narrative, AbCellera Biologics shares are significantly undervalued. Analysts see the stock trading well below what they estimate as its true fair value.

The initiation of Phase I clinical trials for ABCL635 and ABCL575, with promising differentiation factors such as a unique dosing regimen and improved safety profile for ABCL635, is expected to position the company to capture a significant market opportunity in an underserved area. This could potentially boost future revenue.

Want to know why analysts believe this biotech could be worth almost double its current share price? There is a specific combination of bold growth assumptions, profit margin jumps, and a sky-high valuation multiple driving this target. Curious which ambitious projections turn a loss-making company into an investor darling? Dig into the full narrative to see the surprising numbers underpinning this undervalued call.

Result: Fair Value of $9.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, setbacks in key clinical trials or persistent high research costs could quickly undermine the bullish outlook surrounding AbCellera’s future growth story.

Find out about the key risks to this AbCellera Biologics narrative.Another View: Looking at Valuation from a Different Angle

While analysts see upside based on future growth, our DCF model takes a different approach: it projects future cash flows to estimate value. This method also suggests shares could be worth more, but will the market agree?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own AbCellera Biologics Narrative

If this outlook does not match your view or you would rather rely on your own research, you can craft your own take in under three minutes with Do it your way.

A great starting point for your AbCellera Biologics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Investment Angles?

Ready to supercharge your portfolio? Don't miss out on some of the most exciting opportunities Simply Wall Street’s Screener has uncovered, all tailored to different strategies and market trends.

- Access fresh growth potential by checking out penny stocks with robust financial health through penny stocks with strong financials.

- Tap into the future of medicine by finding healthcare pioneers leveraging artificial intelligence using healthcare AI stocks.

- Secure reliable income streams by targeting standout companies offering high-yield dividends with dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ABCL

AbCellera Biologics

Engages in discovering and developing antibody-based medicines for indications with unmet medical need in the United States.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives