- United States

- /

- Media

- /

- NYSE:WLY

Wiley (WLY) Q1 EPS Slowdown Tests Bullish Margin-Improvement Narrative

Reviewed by Simply Wall St

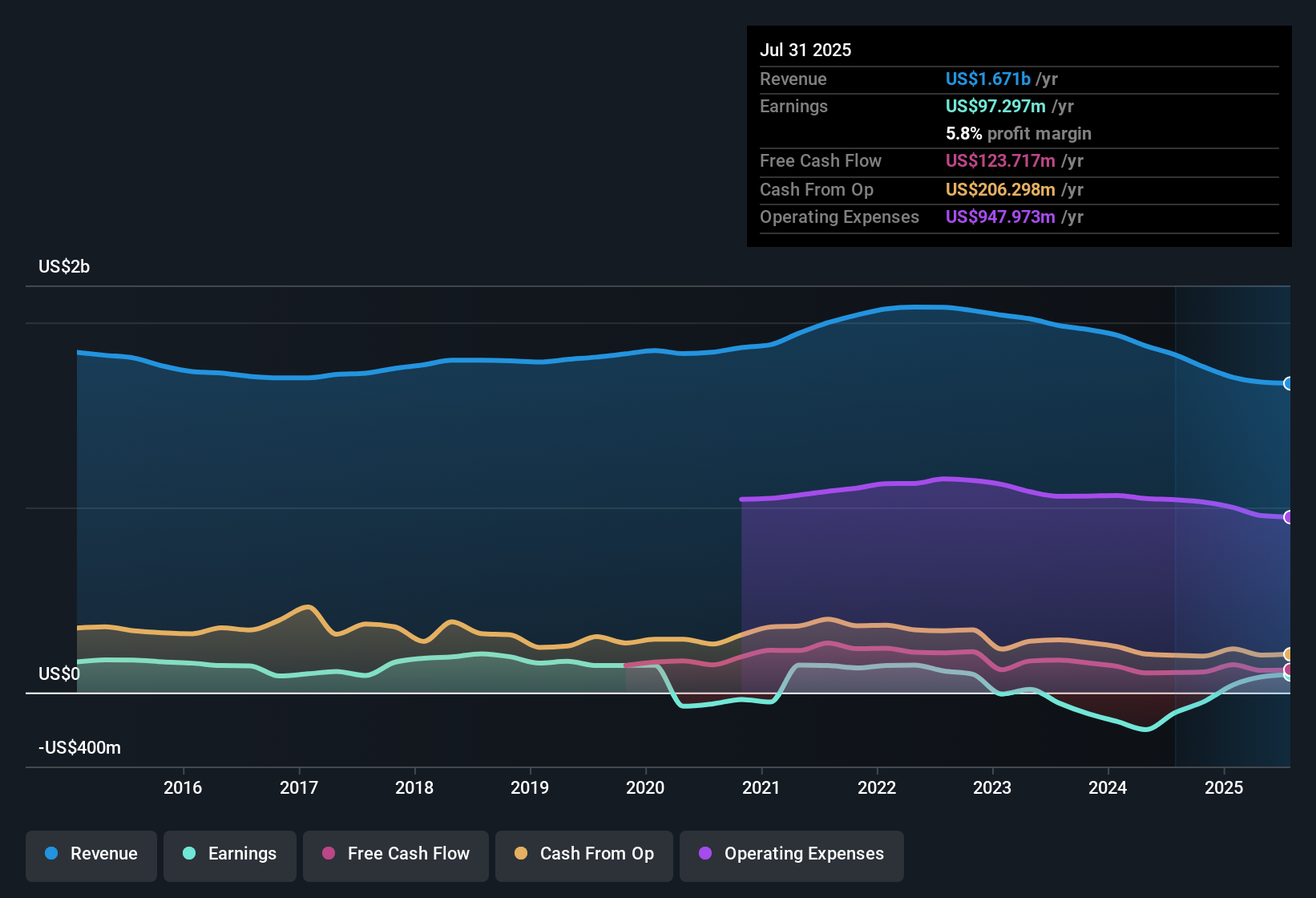

John Wiley & Sons (WLY) has opened fiscal 2026 with Q1 revenue of $396.8 million and basic EPS of $0.22, alongside trailing 12 month EPS of $1.81 on $1.7 billion of revenue. This sets the stage for a cleaner, more profitable run rate than investors saw a year ago. The company has seen revenue move from $468.5 million in Q4 2024 to $396.8 million in the latest quarter, while quarterly EPS has shifted from $0.46 to $0.22. This trajectory sits against a trailing recovery from deep losses to almost $100 million of net income and hints at gradually firmer margins beneath the noise.

See our full analysis for John Wiley & Sons.With the headline numbers on the table, the next step is to compare them with the dominant narratives around Wiley to see how the growth story, the risks, and the evolving profitability picture really align.

See what the community is saying about John Wiley & Sons

Profit Swings After $55 Million One Off

- Over the last 12 months, Wiley moved from a net loss of $200.3 million to net income of $97.3 million, even though that period still includes a $55.0 million one off loss.

- Consensus narrative points to margin improvement from restructuring and digital mix, which lines up with the shift from a $109.5 million loss in early 2025 to $97.3 million in trailing net income, yet

- the presence of a $55.0 million one off loss in those same 12 months shows that part of the margin story is still distorted by cleanup items rather than only steady operations.

- net income also dipped from $68.1 million in Q4 2025 to $11.7 million in Q1 2026, reminding investors that quarterly profitability can still be choppy while the longer term margin thesis plays out.

Slow 1.7 Percent Revenue Growth vs Faster Earnings

- Revenue over the trailing 12 months slipped from $1.9 billion in 2024 to $1.7 billion in 2026, while forward looking estimates call for only 1.7 percent annual revenue growth compared with forecast earnings growth of 34.7 percent per year.

- Consensus narrative emphasises high margin digital publishing and AI licensing as drivers of scalable growth, but

- the modest 1.7 percent revenue growth forecast contrasts with the 34.7 percent earnings growth outlook, suggesting a bigger role for cost discipline and mix shift than for top line acceleration.

- reported revenue has already declined from $468.5 million in Q4 2024 to $396.8 million in Q1 2026, so investors need that higher margin digital revenue to offset pressure on more traditional lines.

Mixed Valuation With 4.1 Percent Yield

- At a share price of $34.66, Wiley trades on a 19 times trailing P E, above the US Media industry at 15.5 times but below peers at 26 times, and slightly above a DCF fair value of $33.14, while offering a 4.1 percent dividend yield.

- Consensus narrative frames Wiley as building resilient, recurring cash flows through digital platforms, which helps explain why

- investors are paying a premium to the broader media industry despite only 1.7 percent expected revenue growth, likely leaning on the 34.7 percent forecast earnings growth and the 4.1 percent yield for total return.

- the DCF fair value of $33.14 sitting just below the market price of $34.66 suggests expectations are not extreme, leaving some room for upside if margins approach the long term targets analysts are baking in.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for John Wiley & Sons on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? In just a few minutes you can test your own thesis, shape the Wiley story, and share it with the community: Do it your way.

A great starting point for your John Wiley & Sons research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Wiley’s modest 1.7 percent revenue outlook, recent top line decline, and choppy quarterly earnings leave its long term growth story looking uncertain.

If you prefer clearer, more reliable momentum, use our stable growth stocks screener (2081 results) to quickly focus on businesses already demonstrating consistent revenue and earnings progress rather than waiting for Wiley’s turnaround.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WLY

John Wiley & Sons

A publisher, provides authoritative content, data-driven insights, and knowledge services for the advancement of science, innovation, and learning in the United States, China, the United Kingdom, Japan, Australia, and internationally.

Established dividend payer with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026