- United States

- /

- Interactive Media and Services

- /

- NYSE:TWTR

Although Twitter, Inc. (NYSE:TWTR) Declined, Institutions Boosted Their Stakes

After relatively smooth and profitable sailing through 2021, Twitter, Inc. (NYSE: TWTR) turned around, giving away 2 years of gains.

While missing 2 earnings in the row isn't necessarily disastrous, a loss of confidence from prominent institutional investors comes with more serious implications.

View our latest analysis for Twitter

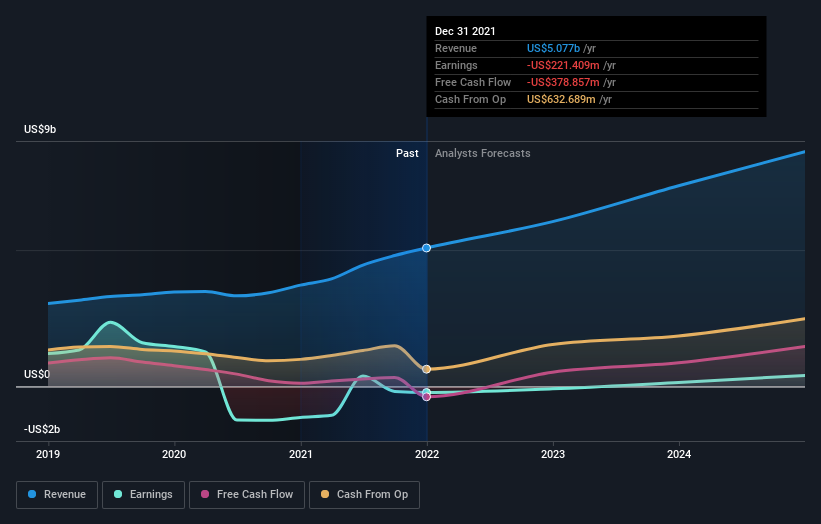

Full-year 2021 results

- US$0.28 loss per share (up from US$1.44 loss in FY 2020).

- Revenue: US$5.08b (up 37% from FY 2020).

- Net loss: US$221.4m (loss narrowed 81% from FY 2020).

Revenue was in line with analyst estimates. Earnings per share (EPS) missed analyst estimates by 21%.

Over the next year, revenue is forecast to grow 19%, compared to a 17% growth forecast for the industry in the US. Over the last 3 years, on average, the company's share price growth rate has exceeded its earnings growth rate by 83 percentage points per year, which is a significant difference in performance.

Reacting to the earnings, Morgan Stanley boosted the price target to US$59, maintaining the Equal Weight rating. While a hefty 65% upside from the current levels, the investment bank believes achieving an ambitious growth of the direct response is a challenge.

Cathie Wood Makes an Exit

Looking back at ARK holdings in December, between 3 of their ETFs, the position in Twitter was around 16 million shares – worth US$700m at the time. Since then, Cathie Wood has been selling Twitter every week, dumping as much as 3.9 million shares days before the latest earnings. At the same time, ARK boosted positions in Tesla and Roblox.

However, other institutional investors seem to be on the same page as David Tepper of Appaloosa Management eliminated his 1.24m strong position.

Who Currently Owns Twitter?

Twitter has a market capitalization of US$28b, so it's too big to fly under the radar. We'd expect to see both institutions and retail investors owning a portion of the company. Our analysis of the company's ownership below shows that institutions are noticeable on the share registry. We can zoom in on the different ownership groups to learn more about Twitter.

Here is the current ownership breakdown

What Does The Institutional Ownership Tell Us About Twitter?

Institutions typically measure themselves against a benchmark when reporting to their investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

As you can see, institutional investors have a fair amount of stake in Twitter. This implies the analysts working for those institutions have looked at the stock, and they like it. But just like anyone else, they could be wrong. If multiple institutions change their view on a stock simultaneously, you could see the share price drop fast - which looks to be the culprit of the last 2 months.

It's, therefore, worth looking at Twitter's earnings history below.

Institutional investors own over 50% of the company, so together, they can probably strongly influence board decisions. Hedge funds do not own twitter. The Vanguard Group, Inc. is currently the largest shareholder, with 8.8% of shares outstanding. Morgan Stanley Investment Management Inc. is the second-largest shareholder owning 8.6% of common stock, and BlackRock, Inc. holds about 6.5% of the company stock.

The shareholder registry shows that the top 16 shareholders control 50% of the ownership, meaning that no single shareholder has a majority interest in the ownership.

Insider Ownership Of Twitter

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially a founder or CEO.

We can see that insiders own shares in Twitter, Inc. The insiders have a meaningful stake worth US$717m. We sometimes take an interest in whether they have been buying or selling.

General Public Ownership

The general public, usually individual investors, holds a 17% stake in Twitter. While this size of ownership may not be enough to sway a policy decision in their favor, they can still make a collective impact on company policies.

Conclusion

Although some prominent institutional investors keep selling shares, it seems like other institutions are picking them up. Looking back into our register, it looks like the general public trimmed the stake while institutions bought it, bringing the ownership up to 80%.

Looking at the current situation, the new CEO has a lot of work to turn the ship around. First, he needs to address the rampaging expenses that he inherited.

Consider the following from Q4

- Sales and marketing expenses: up 39%

- R&D expenses: up 50%

- Administrative expenses: up 55%!

Meanwhile, total ad engagements decreased by 12%.

Tracking the changes in ownership is valuable, but to truly gain insight, we need to consider other information. For example, we've discovered 2 warning signs for Twitter that you should be aware of before investing here.

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full-year annual report figures.

Valuation is complex, but we're here to simplify it.

Discover if Twitter might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:TWTR

Twitter, Inc. operates as a platform for public self-expression and conversation in real-time.

Mediocre balance sheet and slightly overvalued.