- United States

- /

- Entertainment

- /

- NYSE:TME

Tencent Music Entertainment Group (NYSE:TME) Jumps 19% This Quarter After Strong Financial Results

Reviewed by Simply Wall St

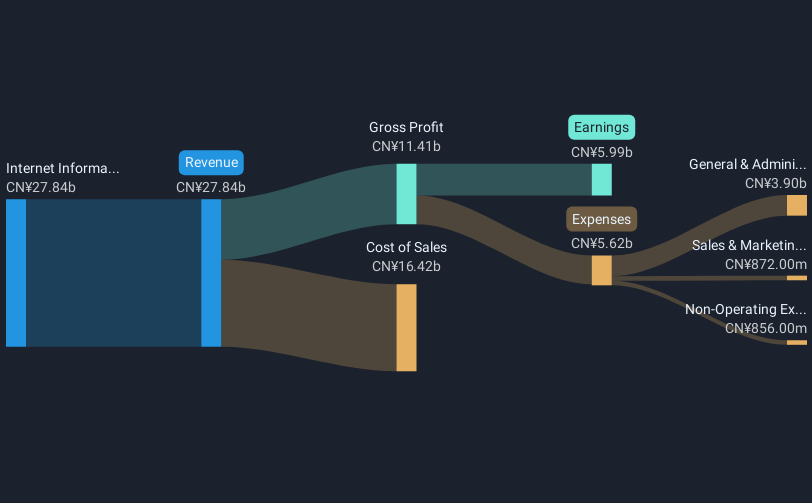

Tencent Music Entertainment Group (NYSE:TME) recently announced a robust financial performance with annual revenue growing to CNY 28,401 million and net income reaching CNY 6,644 million. These results, coupled with the approval of a new $1,000 million share buyback program, likely bolstered investor confidence, contributing to a 19% price rise over the last quarter. The tech sector's rally, supported by broader market gains after four-week declines, also played a role. Governance changes, including Mr. Wai Yip Tsang joining the board, might have influenced investor sentiment, steering TME stock higher amidst market recovery.

Over the past three years, Tencent Music Entertainment Group has achieved a total shareholder return of 184.75%, a performance that underscores its significant achievements during this period. This period included transformative steps such as the adoption of a dual-engine strategy focused on content and platform innovation, resulting in enhanced user engagement through partnerships and AI technology integration. These initiatives have potentially driven financial growth by increasing subscriber conversions and improving net margins.

The company's aggressive share repurchase programs, including the recent authorization of a US$1 billion buyback, and consistent dividend distributions, have effectively returned capital to shareholders. These financial maneuvers reflect confidence in Tencent Music's future prospects. Despite an underperformance compared to the US Entertainment industry over the past year, Tencent Music's actions like the GMM Music partnership and concerted buyback efforts have likely contributed to their robust long-term returns, amidst challenges like rising competition and exchange rate fluctuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tencent Music Entertainment Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TME

Tencent Music Entertainment Group

Operates online music entertainment platforms to provide music streaming, online karaoke, and live streaming services in the People’s Republic of China.

Solid track record with excellent balance sheet.