- United States

- /

- Entertainment

- /

- NYSE:TME

Is Tencent Music a Good Value After Strong 2024 Performance and Revenue Growth?

Reviewed by Bailey Pemberton

If you are wondering what your next move should be with Tencent Music Entertainment Group, you are not alone. The stock has been on quite a ride recently, capturing the attention of both cautious investors and opportunity-seekers. Over the past week, shares dipped by 3.5%, extending a 30-day slide of 6.5%. But do not mistake these short-term declines as the whole story. Year-to-date, Tencent Music is up an impressive 102.3%, and if you take a longer view, the stock has delivered a massive 478.8% return to holders over the past three years. Even on a five-year basis, the gain stands at 63.4%, which is not too shabby at all.

Much of this upward momentum can be traced back to strong demand for digital music services, strategic partnerships, and a willingness among investors to take on more risk as market conditions shifted. With buzz around the evolving Chinese entertainment landscape and renewed interest in tech-related stocks, Tencent Music has clearly benefited from market optimism at different times, despite short-term volatility.

So, does Tencent Music still offer value after such a run, or are the best days behind it? To answer this, we lean on a valuation score that tallies six different checks for whether the stock is undervalued. Tencent Music scores a 4, meaning it comes out as undervalued on four of those six measures. That is an encouraging sign, but let us break down exactly how these checks work and why even this system might not be the last word in truly understanding what Tencent Music is worth. Stay tuned for an even better way to think about valuation at the end of the article.

Approach 1: Tencent Music Entertainment Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is really worth by projecting its future cash flows and then discounting them back to today's value. This approach focuses on how much cash the company is likely to produce over the coming years, taking into account both analyst estimates and longer-term trends.

For Tencent Music Entertainment Group, the latest reported Free Cash Flow stands at CN¥7.67 Billion. Analyst forecasts expect steady growth, with projections reaching CN¥17.15 Billion by 2029. Simply Wall St extends these projections up to 2035, based on estimated growth rates once analyst data ends.

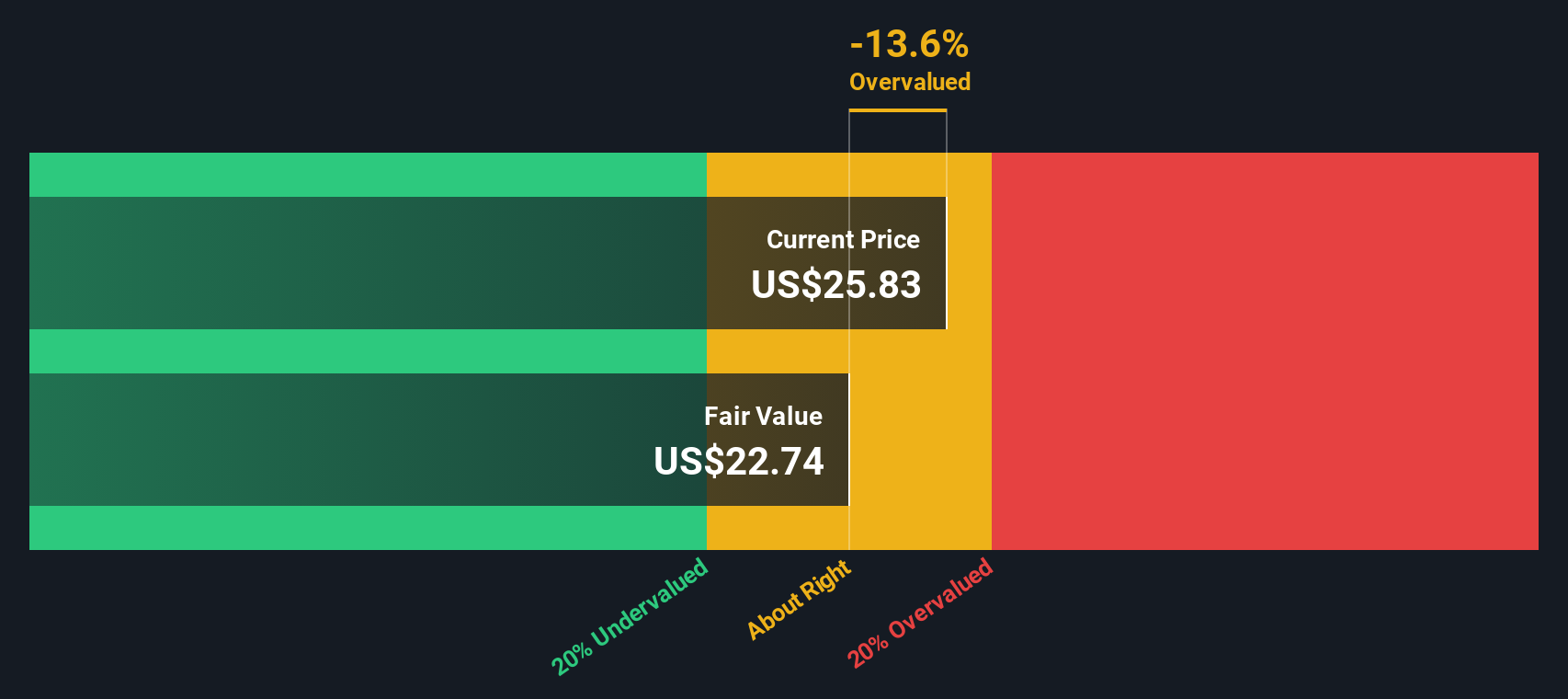

Using the 2 Stage Free Cash Flow to Equity model, the DCF analysis arrives at an intrinsic value of $23.56 per share. Based on the current share price, this represents a discount of 2.8%, indicating the stock is trading just below its estimated fair value.

In simple terms, the DCF model suggests Tencent Music shares are priced almost exactly in line with their projected future cash generation. This means the shares are neither a bargain nor overpriced at this level.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Tencent Music Entertainment Group's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Tencent Music Entertainment Group Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Tencent Music Entertainment Group because it directly relates a company’s current share price to its earnings. For established businesses with consistent profits, the PE ratio provides investors with a quick comparison tool to assess if a stock is expensive or reasonable relative to its earnings power.

However, it is important to remember that a “normal” or “fair” PE ratio is not universal. Companies with higher expected growth typically command higher PE ratios, reflecting optimism about future profits. Conversely, firms with greater risks or slower growth tend to trade at lower PE ratios. Other aspects, such as profit margins, industry trends, and company size, further influence what is considered a fair multiple.

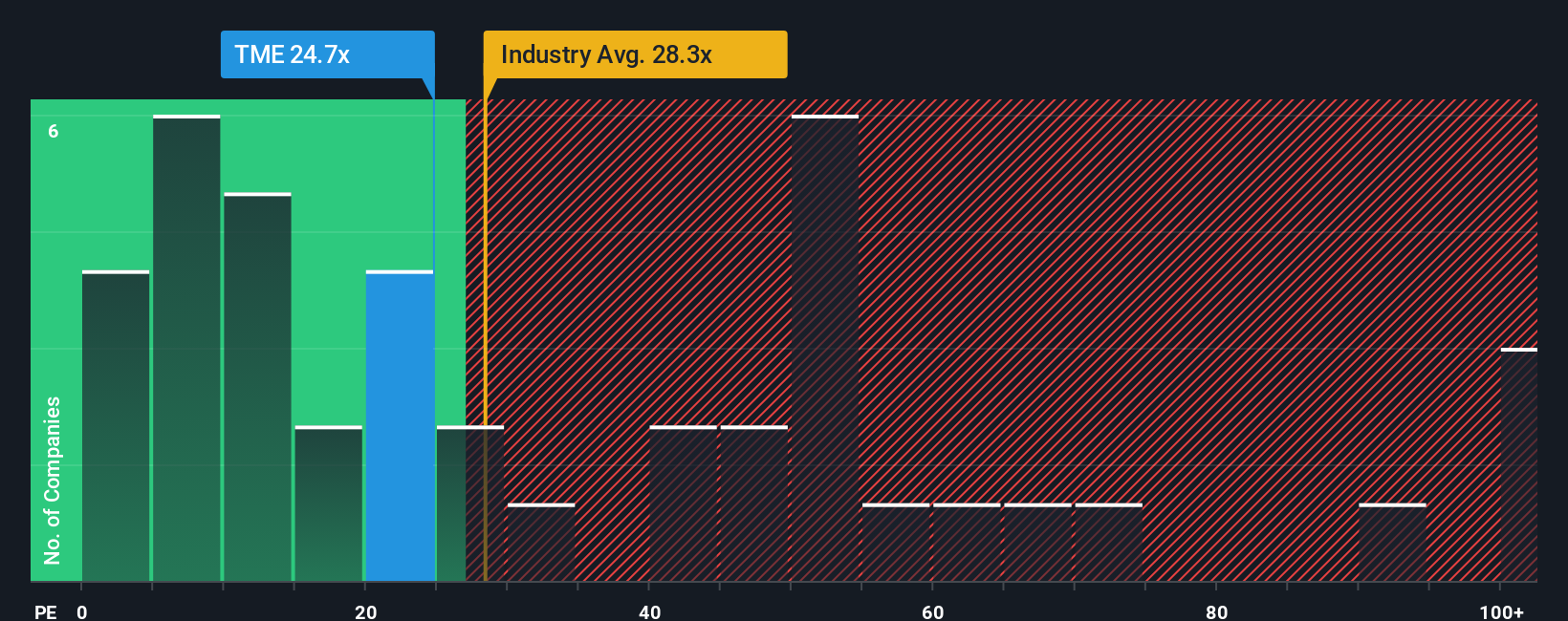

Tencent Music currently trades at a PE ratio of 25.2x. This sits below the industry average of 29.4x and far below the average of its peer group at 75.9x. While these metrics offer useful context, Simply Wall St’s proprietary Fair Ratio comes in at 24.8x. This Fair Ratio is designed to account for Tencent Music’s specific strengths and risks, such as its earnings growth, profitability, industry positioning, and market capitalization, rather than making broad-brush comparisons. Because the company’s PE ratio and Fair Ratio are nearly identical (both around 25x), it suggests the stock’s current market value is closely aligned with its intrinsic earning power.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Tencent Music Entertainment Group Narrative

Earlier, we mentioned there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is simply your story or perspective on a company like Tencent Music Entertainment Group. It is how you tie together the numbers, your assumptions on future revenue, earnings, margins, and what you believe the company’s real potential is. Narratives link your view of the business with a specific financial forecast and ultimately a fair value, bridging the gap between facts and your investment thesis.

Millions of investors on Simply Wall St use the Community page to easily create, compare, and update Narratives. You can see investment stories from different angles or create your own, all with just a few taps. Narratives help you decide when to buy or sell by showing if your assumed Fair Value is higher or lower than today’s price, and are automatically updated as soon as news or earnings are released.

For example, one investor might see rising smartphone usage and fan economy transforming entertainment and project a Fair Value as high as $32.95. Another, wary of regulatory risks and competition, may arrive at a much lower estimate like $17.00. Narratives make it simple for you to sense-check your assumptions and keep your investment decisions grounded and up-to-date.

Do you think there's more to the story for Tencent Music Entertainment Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tencent Music Entertainment Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TME

Tencent Music Entertainment Group

Operates online music entertainment platforms that provides music streaming, online karaoke, and live streaming services in the People’s Republic of China.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives