- United States

- /

- Entertainment

- /

- NYSE:SPOT

Spotify (SPOT) Valuation Check as It Expands Into Music Videos, New Licensing Deals, and Netflix Integration

Reviewed by Simply Wall St

Spotify Technology (SPOT) just signaled its next act, rolling out music video capabilities, fresh licensing deals, and a Netflix integration that pushes the platform firmly beyond audio into broader multimedia territory.

See our latest analysis for Spotify Technology.

Despite all these launches and Wrapped driven buzz, Spotify’s recent 30 day share price return of minus 8.88 percent and 90 day share price return of minus 20.12 percent show fading near term momentum, even as the year to date share price return of 23.40 percent and three year total shareholder return of 622.69 percent still point to a powerful longer term value creation story.

If Spotify’s latest move has you thinking more broadly about digital media, this can be a good moment to explore high growth tech and AI stocks as potential next wave beneficiaries.

With revenue and profits now compounding, a below target share price, and Spotify stretching from audio into video, is the recent pullback a rare entry point or simply markets calibrating to already priced in future growth?

Most Popular Narrative: 19.7% Undervalued

According to MichaelP’s narrative, Spotify’s long term value sits well above the recent 564.93 dollars close, implying meaningful upside if the cash flow story holds.

As the business ramps up monetization of content, achieves better deals with the labels, reduces growth expenditure and relies less on music, I expect its gross and net margins will improve considerably, which will also change the way investors value the stock.

Curious how a maturing streamer still earns a growth style valuation? The case presented here rests on significant margin expansion and stronger cash generation. Want to see exactly how those levers could reshape Spotify’s earnings power and help support a higher share price? Read on to review the full set of projections behind this fair value estimate.

Result: Fair Value of $703.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, several things could still derail this upside case, including tougher streaming competition and slower ad monetization, which would pressure both user growth and margins.

Find out about the key risks to this Spotify Technology narrative.

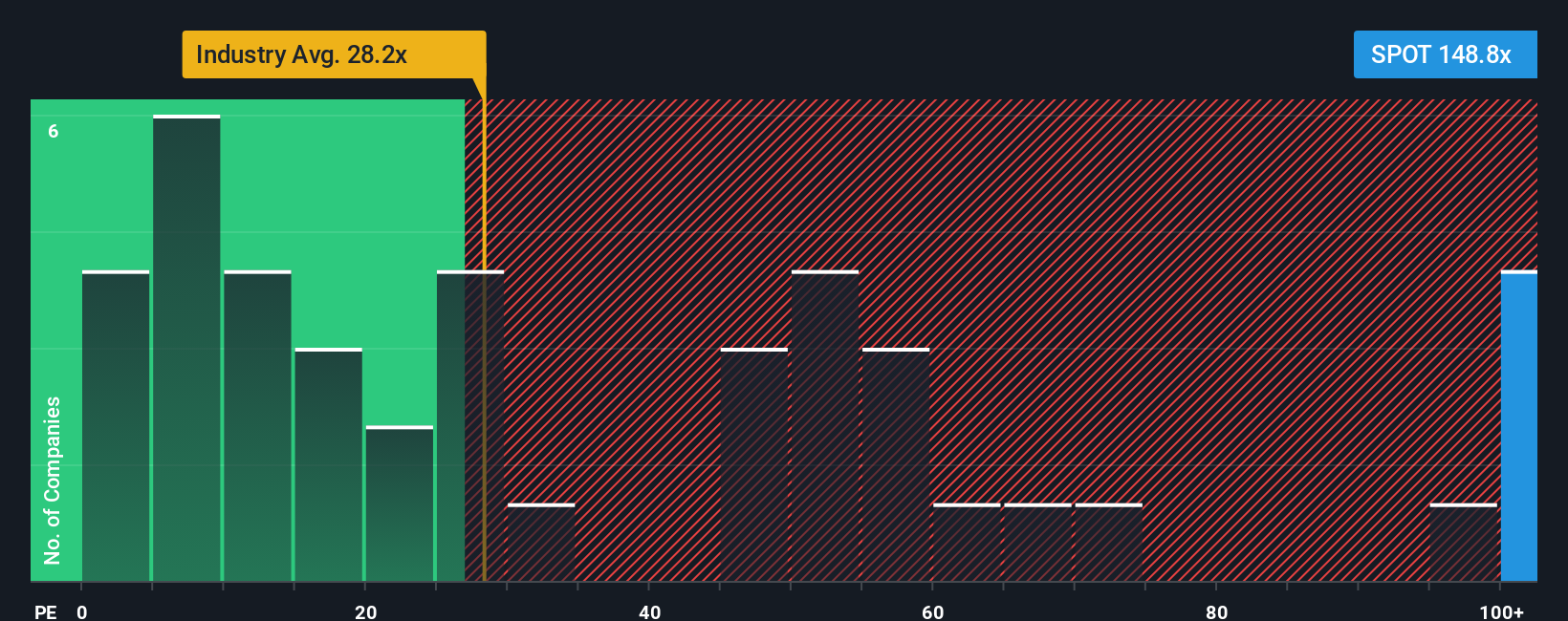

Another View: Multiples Flash a Caution Light

Step away from narratives and our DCF, and the earnings multiple paints a sharper picture. Spotify trades on a 71.2 times price to earnings ratio, roughly triple the US Entertainment average of 23.2 times and well above a 34.7 times fair ratio. This suggests limited room for further optimism if growth wobbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Spotify Technology Narrative

If you are not fully convinced by this view, or simply want to stress test the assumptions yourself, you can quickly craft a personalized thesis in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Spotify Technology.

Looking for more investment ideas?

Before you move on, back yourself with data driven ideas from our screener and give your portfolio the same edge professionals look for every day.

- Capitalize on mispriced opportunities by targeting companies flagged as undervalued through these 906 undervalued stocks based on cash flows before the broader market catches on.

- Ride powerful tech tailwinds by focusing on innovators at the intersection of medicine and machine intelligence using these 30 healthcare AI stocks.

- Harness volatility instead of fearing it by zeroing in on digital asset enablers and infrastructure names via these 81 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPOT

Spotify Technology

Provides audio streaming subscription services worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026