- United States

- /

- Entertainment

- /

- NYSE:SPHR

Does Sphere Entertainment’s Stock Surge Signal Further Gains After Q3 Revenue Beat?

Reviewed by Bailey Pemberton

Trying to make sense of Sphere Entertainment’s latest stock surge? You are not alone. With the shares closing at $63.43 and boasting a 29.7% gain over the past month, investors are wondering whether this momentum is just the beginning or if the best days are already priced in. Year-to-date, the stock has climbed an impressive 52.8%, and over the past year, it is up 40.7%. Looking at a longer timeframe, there is a 192.7% gain in three years and the stock has nearly doubled over five years. Market chatter lately has focused on shifting investor sentiment across the entertainment and media sector, which seems to have driven renewed interest in Sphere Entertainment’s unique business model. Changes in risk perception and optimism about sector transformation have both likely played a part in the recent price moves.

But with excitement running high, the real question for many is whether the stock is undervalued, overhyped, or somewhere in between. Our latest valuation score for Sphere Entertainment is 3 out of 6, suggesting the stock is undervalued by half of the major metrics we track. In other words, the story here is not entirely one-sided, and digging into the details is essential.

We will break down the primary valuation methods to see where Sphere Entertainment stands compared to its peers, and at the end, share an even better way to judge the company’s true worth.

Why Sphere Entertainment is lagging behind its peers

Approach 1: Sphere Entertainment Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them to their value in today's dollars. This approach is widely used because it focuses on how much cash the business is expected to generate over time rather than just looking at simple multiples or recent earnings.

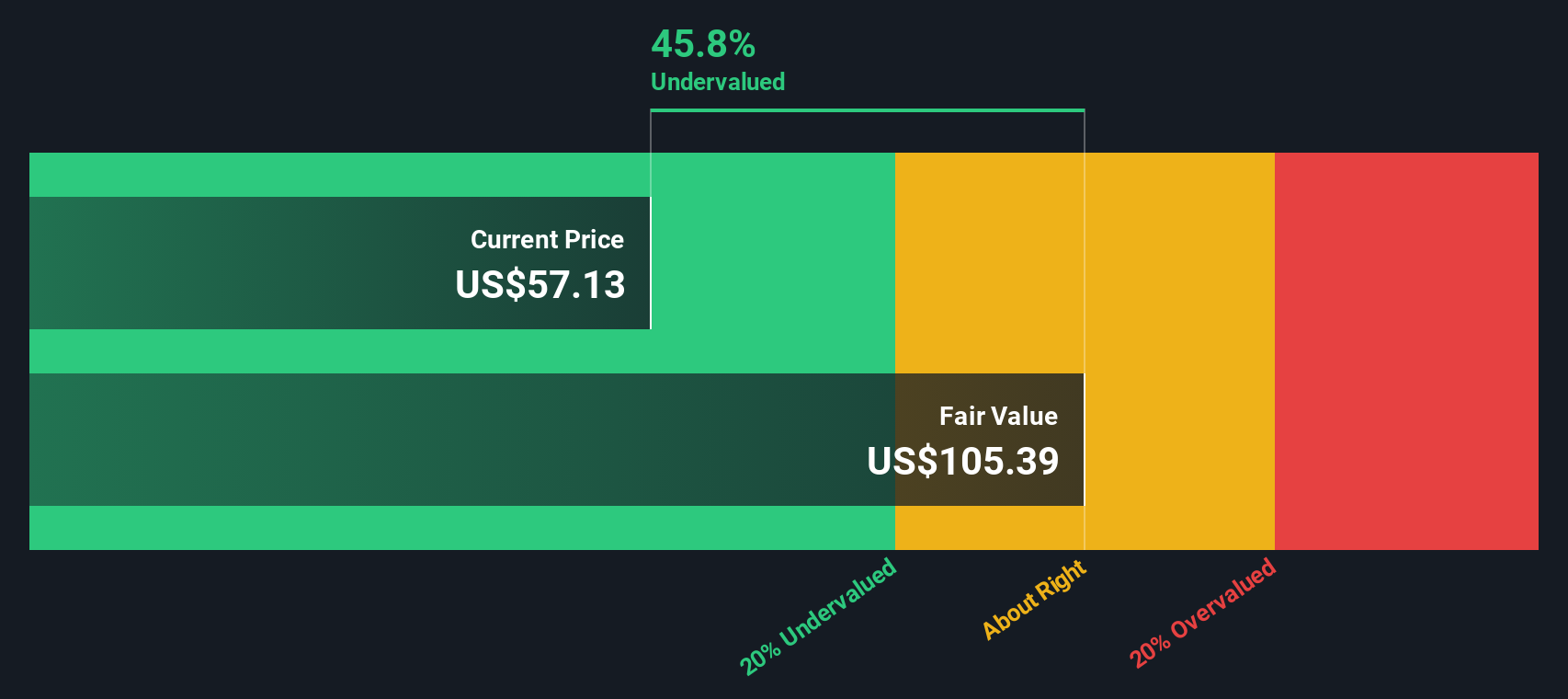

For Sphere Entertainment, the DCF valuation is based on the 2 Stage Free Cash Flow to Equity model. Currently, the company's last twelve months of Free Cash Flow stands at negative $614.6 million, reflecting a phase of investment or operational challenge. Looking forward, analyst consensus and extrapolations suggest that Free Cash Flow is set to rise meaningfully, reaching an estimated $411 million in 2035. Notably, projections for 2028 point to FCF of $224 million, based on available analyst estimates and expert extrapolations beyond that horizon.

This cash flow growth over time is discounted back using market rates to arrive at an estimated intrinsic fair value of $107.75 per share. With Sphere Entertainment's last close at $63.43, the model indicates the stock is currently about 41.1% undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sphere Entertainment is undervalued by 41.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Sphere Entertainment Price vs Sales

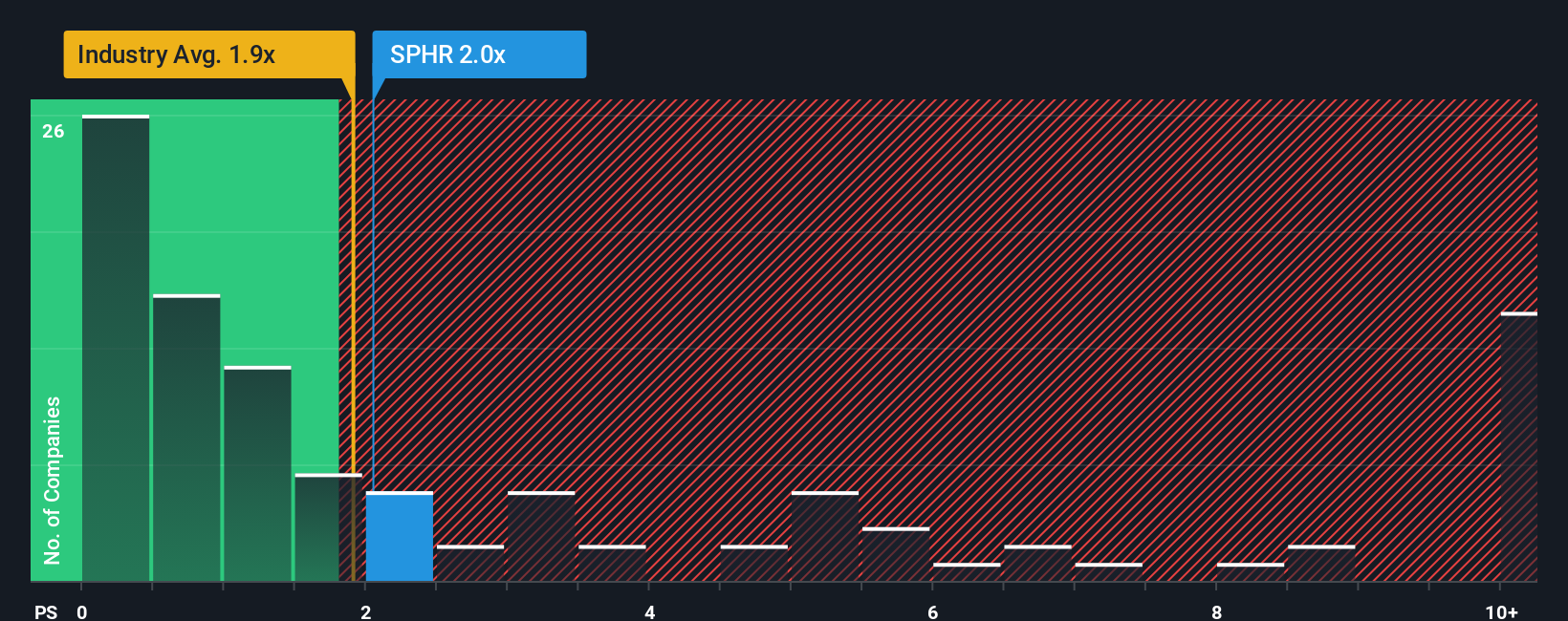

For profitable companies, the Price-to-Sales (PS) ratio serves as a useful valuation metric because it looks at how the market values each dollar of a company's revenue. This is particularly helpful when earnings are volatile or negative, as can often be the case in the entertainment industry. It essentially tells you how much investors are willing to pay for a portion of the company’s sales, which provides a baseline even when profitability is still ramping up.

Looking at Sphere Entertainment, the current PS ratio is 2.19x. This sits just below the peer average of 2.38x and a bit above the industry average of 1.94x. At first glance, the stock does not look dramatically high or low compared to benchmarks, but simply weighing it against competitors or the industry can sometimes miss important context, such as the company’s specific growth prospects or unique risks.

This is where the Simply Wall St "Fair Ratio" comes into play. It adjusts the expected PS ratio for factors like Sphere Entertainment’s earnings growth outlook, its profit margins, how risky the business is relative to peers, as well as its size within the entertainment sector. For Sphere Entertainment, the Fair Ratio is calculated at 1.28x, noticeably below the current PS ratio of 2.19x. This suggests the stock is trading at a premium to what is justified once all relevant factors are considered, making the Fair Ratio a more nuanced and robust benchmark than simple peer or industry comparisons.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sphere Entertainment Narrative

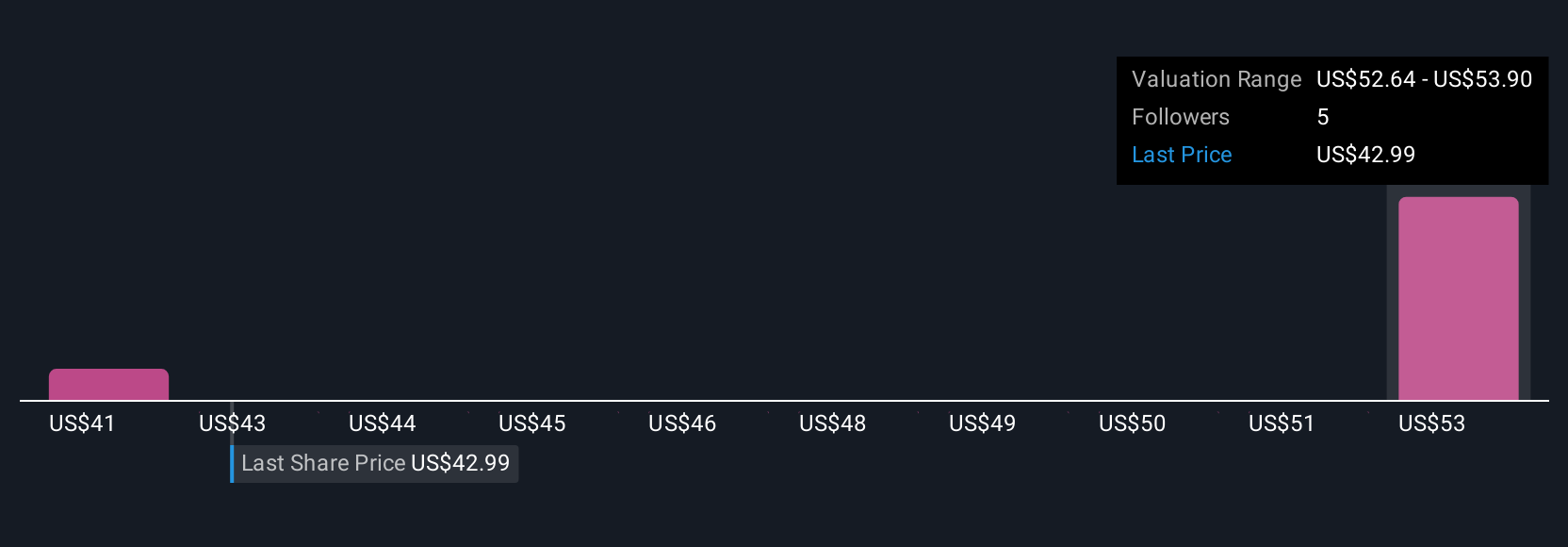

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Simply put, a Narrative is your personal story for a company, connecting what you believe about Sphere Entertainment’s future, such as its potential for immersive tech expansion, earnings, and margins, to the numbers and an estimated fair value.

Instead of focusing only on historical metrics, Narratives let you map your vision of the business onto a real financial forecast. This approach helps you see how today's price compares with your expectations. On Simply Wall St’s Community page, millions of investors use Narratives as a practical, accessible tool to document their perspective and instantly compare Fair Value to the current share price. This makes buy, hold, or sell decisions easier and clearer.

Narratives automatically update with new data, so your investment story stays relevant when news or financial results are released. For example, one investor might be confident about Sphere Entertainment's global venue rollout and premium tech, forecasting revenue growth and setting a high fair value near $75. Another might emphasize the risks of dependency on marquee events or industry shifts, producing a much lower fair value around $35.

Do you think there's more to the story for Sphere Entertainment? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPHR

Sphere Entertainment

Operates as a live entertainment and media company in the United States.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives