- United States

- /

- Interactive Media and Services

- /

- NYSE:SNAP

Snap (SNAP): Exploring Valuation Perspectives After Recent Share Price Fluctuations

Reviewed by Simply Wall St

Snap (SNAP) shares recently posted a small daily gain, closing at $7.95. The stock has faced some swings over the past month, and many investors are watching for signs of where things might head next.

See our latest analysis for Snap.

Snap’s share price has struggled to maintain upward momentum this year. A 1-day increase has offered a small reprieve against a longer trend of negative returns. The stock’s year-to-date share price return sits at -29.27%, and its one-year total shareholder return is down 25.77%. This reflects ongoing investor caution despite periodic rebounds.

If you’re interested in broadening your search beyond Snap, now’s a great time to discover fast growing stocks with high insider ownership.

With Snap’s share price lagging behind both analyst targets and its own historical highs, the big question is whether the market is overlooking hidden value, or if future growth potential is already reflected in today’s price.

Most Popular Narrative: 14.4% Undervalued

According to the most widely followed narrative, Snap's fair value is pegged at $9.28, notably higher than its recent $7.95 close. The gap suggests that the market may be discounting the company’s future prospects more heavily than analysts expect. Here is a catalyst insight from the narrative shaping this valuation outlook:

Accelerating innovation in augmented reality (AR), including the upcoming public launch of Specs AR glasses in 2026 and continuous expansion of the AR developer ecosystem, positions Snap to benefit from both increased user engagement and the creation of premium advertising and subscription revenue streams. This can boost top-line revenue and improve gross margins over time.

Want to know the growth engine analysts believe will drive Snap’s value skyward? The most popular narrative behind this target price is betting on higher margins, bold product launches, and a step-change in monetization. Discover which assumptions about new revenue streams and ambitious profit targets are fueling confidence in this higher fair value.

Result: Fair Value of $9.28 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition from rivals and Snap’s struggle to achieve consistent profitability could quickly challenge this optimistic fair value outlook.

Find out about the key risks to this Snap narrative.

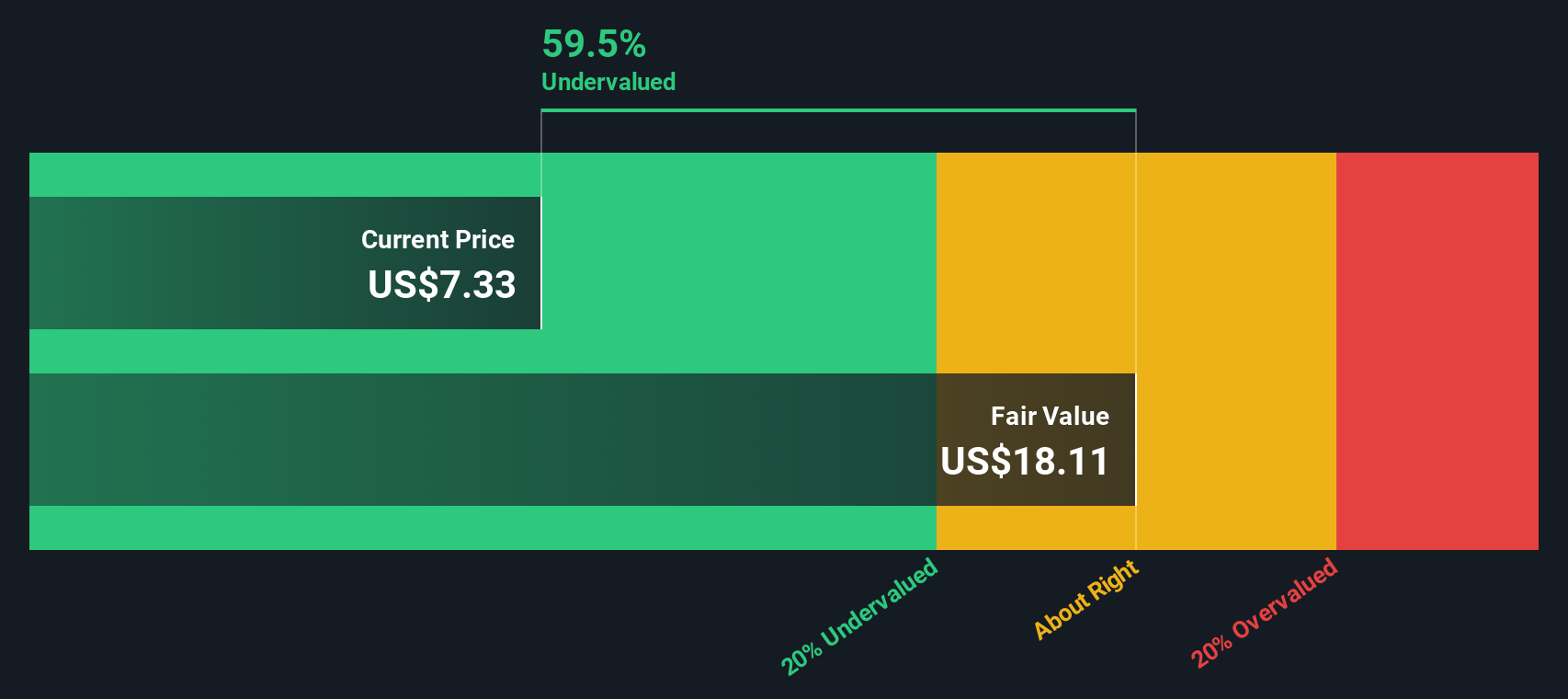

Another View: DCF Model Puts Snap in an Even Brighter Light

While analysts using profit and sales multiples see Snap as modestly undervalued, our DCF model signals a much bigger discount. According to this approach, Snap's shares could be trading at more than 50 percent below fair value, suggesting long-term upside that the market has not fully recognized. Which valuation tells the fuller story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Snap Narrative

If you want to dig deeper, you can quickly craft your own perspective and challenge the consensus in just a couple of minutes. Do it your way.

A great starting point for your Snap research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Uncover unique opportunities in the market and avoid missing out on stocks primed for growth, strong dividends, or disruptive technology trends.

- Capitalize on healthy cash flows by reviewing these 872 undervalued stocks based on cash flows poised for upside as the market revalues them.

- Boost your portfolio with steady income by checking out these 17 dividend stocks with yields > 3% offering attractive yields above 3%.

- Catalyze your strategy with exposure to breakthrough technology by investigating these 27 AI penny stocks making waves in the AI revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNAP

Snap

Operates as a technology company in North America, Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)