- United States

- /

- Interactive Media and Services

- /

- NYSE:SNAP

Snap (SNAP): Exploring Valuation Gaps and Future Growth Potential

Reviewed by Kshitija Bhandaru

Snap (SNAP) shares have faced ongoing pressure in recent months, leaving investors to weigh the company’s recent performance alongside broader market trends. After sliding over the past quarter, Snap’s upcoming strategic moves are drawing fresh attention.

See our latest analysis for Snap.

Snap's share price has trended lower throughout the year, with momentum clearly fading. After a steep 90-day share price return of -23.6%, the total shareholder return for one year stands at -27%. While recent headlines haven’t reversed the mood, the long-term picture highlights the challenges Snap is working to overcome as it looks to regain investor confidence.

If you're open to discovering companies outside the mainstream, this could be the perfect time to check out fast growing stocks with high insider ownership.

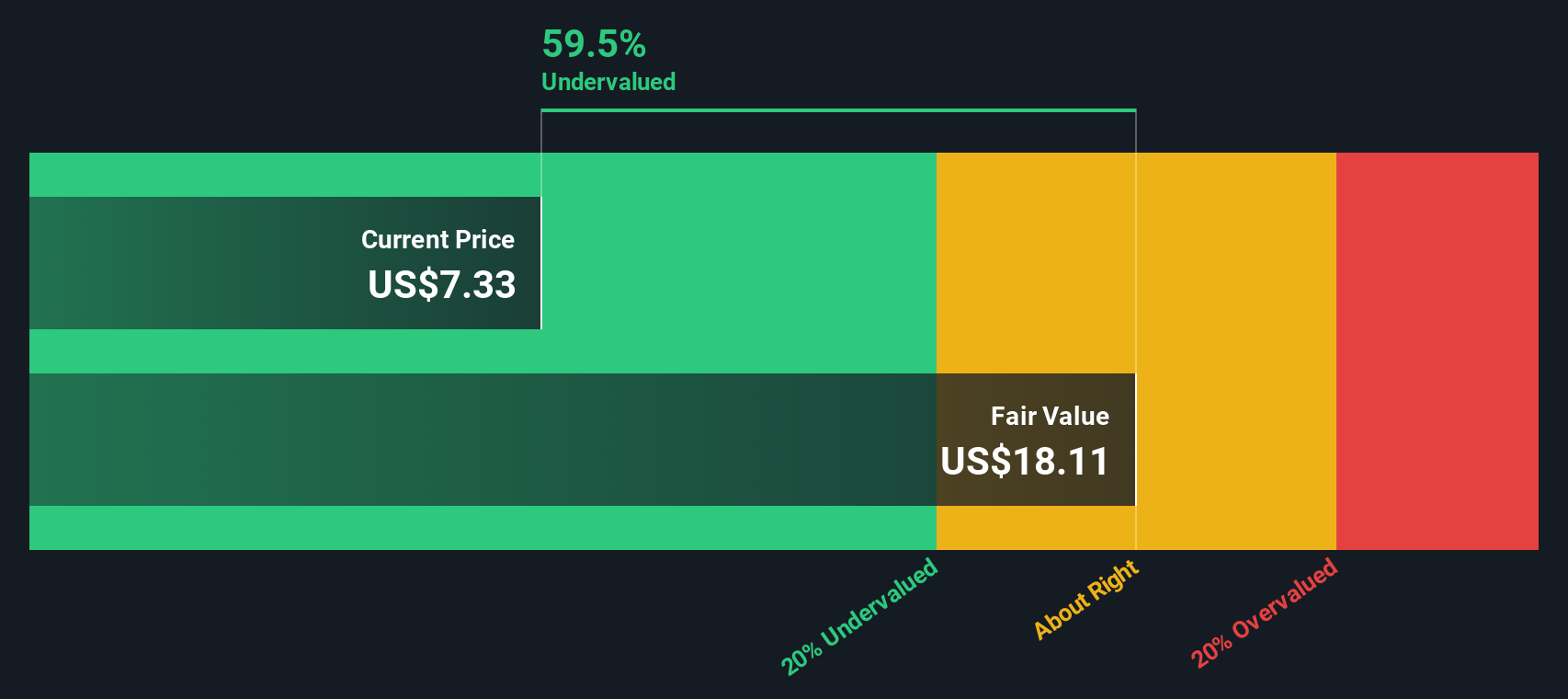

Despite sluggish returns, Snap currently trades notably below analysts’ average price targets. It is even further below some intrinsic value estimates, igniting the debate: does this signal an overlooked bargain or a market bracing for limited growth ahead?

Most Popular Narrative: 17.6% Undervalued

Snap's latest close of $7.65 sits well below the consensus fair value estimate of $9.28, drawing attention to the story behind this gap in expectations. Behind the numbers, bold assumptions about Snap's underlying business model and margin potential are front and center for debate.

Accelerating innovation in augmented reality (AR), including the upcoming public launch of Specs AR glasses in 2026 and continuous expansion of the AR developer ecosystem, positions Snap to benefit from both increased user engagement and the creation of premium advertising and subscription revenue streams. These developments have the potential to boost top-line revenue and improve gross margins over time.

Want to know what triggers this valuation jump? The heart of this narrative is a big bet on future growth and dramatically higher margins, powered by platform shifts and new products. Eager to see the forecast assumptions hidden behind these high expectations? Explore the full story for insights few outsiders know.

Result: Fair Value of $9.28 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent unprofitability and intensifying competition from established rivals could quickly undermine the bullish case for Snap’s long-term value.

Find out about the key risks to this Snap narrative.

Another View: What Does the SWS DCF Model Say?

While Snap’s price appears low compared to analyst targets, our DCF model paints a sharply different picture. Using future cash flow estimates, the SWS DCF model arrives at a fair value of $18.97. This suggests shares could be deeply undervalued if those forecasts play out. Is the market missing something, or are the risks outweighing these projections?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Snap Narrative

If you see the story differently or believe your research leads to fresh conclusions, why not create your own narrative in under three minutes? Do it your way

A great starting point for your Snap research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

There's no reason to limit your research. Some of the most compelling opportunities take just a click to uncover. Use these powerful screeners to get ahead of the crowd and spot trends before everyone else.

- Snap up potential bargains with strong business fundamentals when you check out these 878 undervalued stocks based on cash flows that many investors overlook.

- Capitalize on the AI revolution by tapping into these 24 AI penny stocks driving innovation across industries and reshaping global markets.

- Lock in reliable cash flows by seeking out these 18 dividend stocks with yields > 3% performing above market-average yields for your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNAP

Snap

Operates as a technology company in North America, Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives