- United States

- /

- Interactive Media and Services

- /

- NYSE:SNAP

Can Snap’s Valuation Recover as TikTok Faces Major Uncertainty in 2025?

Reviewed by Bailey Pemberton

If you’re holding Snap or thinking about diving in, you’ve probably felt the roller coaster of its recent stock moves. Just this past week, Snap nudged upward by 1.7%, but the bigger story is its 16.8% surge over the last month. That is a sharp contrast to where things stood earlier in the year, when the stock was down a heavy 24% year-to-date. Looking at the bigger picture, though, Snap still trails with a 5-year return of -68.3%. For anyone weighing their next move, these swings certainly raise the question: are we witnessing signs of a turnaround, or just another blip?

Recent news about TikTok, Snap’s closest rival, might offer some clues behind these shifts in sentiment. With headlines swirling about a dramatically lower valuation for TikTok’s potential U.S. entity, plus uncertainty about its future ownership and operations, investors may be reconsidering Snap’s position in the social media landscape. This revaluation of rival risk could be part of what is driving renewed interest in Snap, hinting at a possible upside that was not on the table just a few weeks ago.

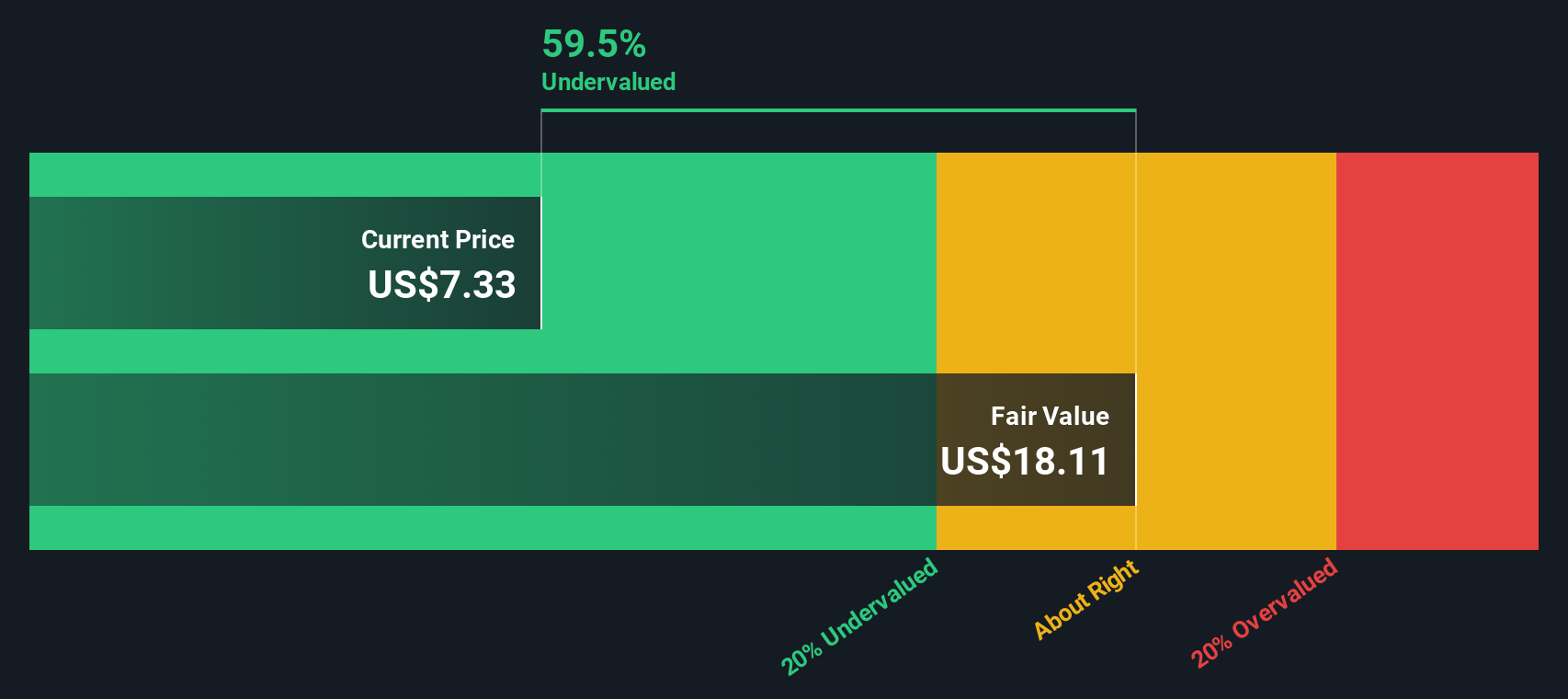

Of course, what really matters is whether Snap is undervalued right now based on tried-and-true valuation methods. Running the numbers, Snap scores a 4 out of 6 on our value checklist, a result that suggests more potential than risk at today’s price point. Let’s dig into the details of each valuation approach, and toward the end, look at an even deeper way to put Snap’s value into perspective.

Why Snap is lagging behind its peers

Approach 1: Snap Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a foundational valuation technique that estimates the value of a company by projecting its future cash flows and discounting them back to their present value. This approach gives investors an idea of what the company’s cash flow stream is worth today, based on expected growth and the time value of money.

For Snap, the model begins with its latest Free Cash Flow (FCF), which stood at $365 million over the last twelve months. Analyst estimates cover the next few years, predicting robust growth. For example, projections reach $1.43 billion in FCF by 2029. Beyond those years, further increases are extrapolated, with FCF expected to keep climbing as the company matures.

After crunching the numbers using the 2 Stage Free Cash Flow to Equity model, the resulting intrinsic value is $19.31 per share. This figure suggests Snap is trading at a 55.8% discount compared to its fair value implied by future cash flows.

The takeaway is straightforward. According to the DCF model, Snap currently appears significantly undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Snap is undervalued by 55.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

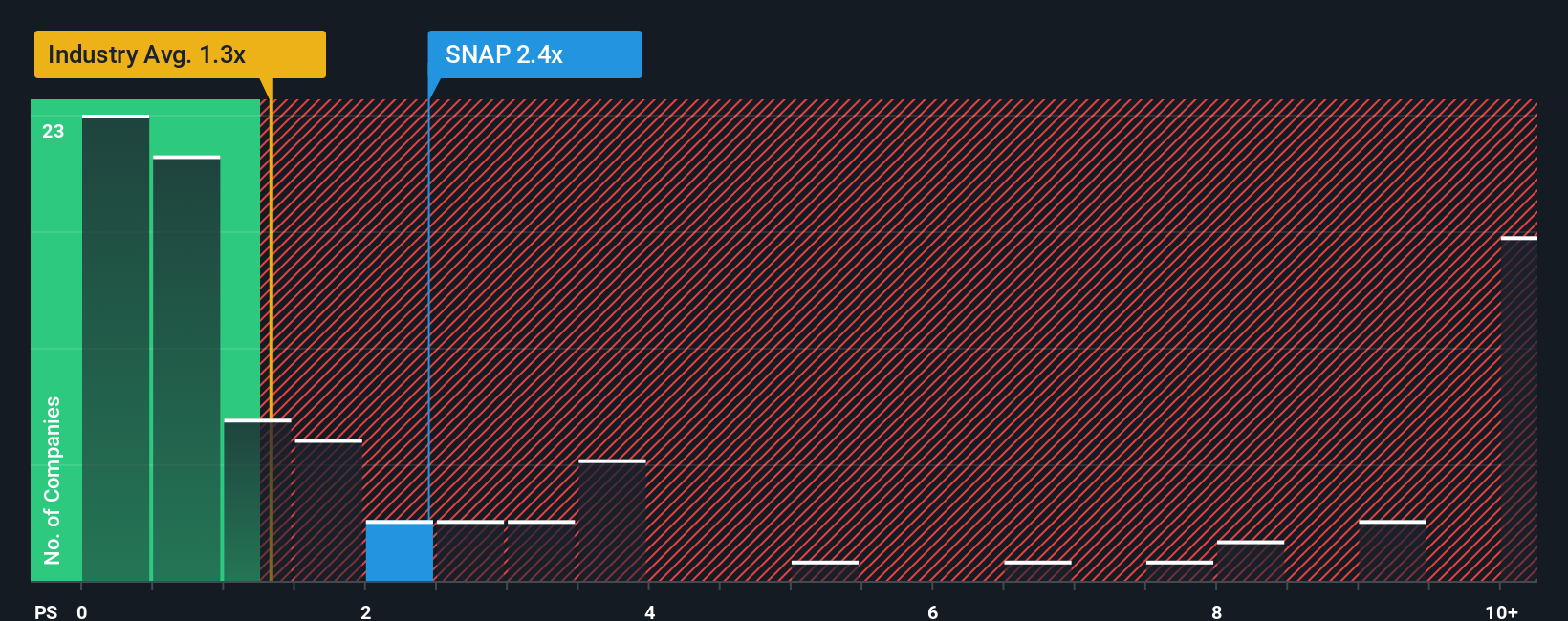

Approach 2: Snap Price vs Sales

For companies like Snap that are not yet profitable, the Price-to-Sales (P/S) ratio is a preferred metric for valuation. Unlike earnings or book value, the P/S ratio is especially useful for high-growth tech firms because it focuses on revenue generation while ignoring the impact of temporary losses or large investments in growth that can obscure the profitability picture.

When assessing what a “normal” or “fair” P/S ratio should be, investors consider both the growth potential of the business and its risk profile. Higher sales growth generally justifies a higher multiple, while increased business risks can put downward pressure on that multiple.

Currently, Snap trades at a P/S multiple of 2.56x. For context, the average for its industry is 1.25x, while close peers overall trade at 3.36x. These numbers suggest Snap is priced below many of its competitors but above the broader industry average.

This is where Simply Wall St's Fair Ratio comes in. The Fair Ratio is not just an average; it is calculated by blending factors such as Snap’s expected earnings growth, its profit margins, risk specific to social media, its market cap, and sector trends. By considering such a comprehensive mix, the Fair Ratio aims to provide a more accurate gauge of what is truly fair compared to simply looking at how Snap stacks up against the crowd.

Snap’s Fair Ratio is calculated at 2.78x. Since Snap’s current P/S ratio is very close to this level, the stock appears to be about right based on this valuation metric.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Snap Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story and perspective about a company, connecting what’s happening in the real world to a financial forecast. This process turns facts, assumptions, and outlooks into a single, fair value estimate you can track over time.

With Narratives, you’re not just following numbers. You are forming a view of how Snap’s future might unfold, then using that view to generate your own fair value. This approach links what you believe about Snap, such as its growth from new AR technologies or the risks of competition and crowded markets, to real financial projections and actionable signals.

Narratives are available on Simply Wall St’s Community page, already used by millions of investors, and are designed to be simple and accessible for everyone. They update dynamically when news breaks or earnings change, keeping your analysis relevant.

For example, some investors see Snap’s AR innovations and global expansion driving a price target as high as $16.0, while more cautious users set theirs at just $7.0, based on concerns about rising costs or flat user growth. This demonstrates there is no single right answer, only the Narrative that best fits your outlook.

Do you think there's more to the story for Snap? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNAP

Snap

Operates as a technology company in North America, Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives