- United States

- /

- Entertainment

- /

- NYSE:SKLZ

Revenues Not Telling The Story For Skillz Inc. (NYSE:SKLZ) After Shares Rise 28%

Skillz Inc. (NYSE:SKLZ) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 45% over that time.

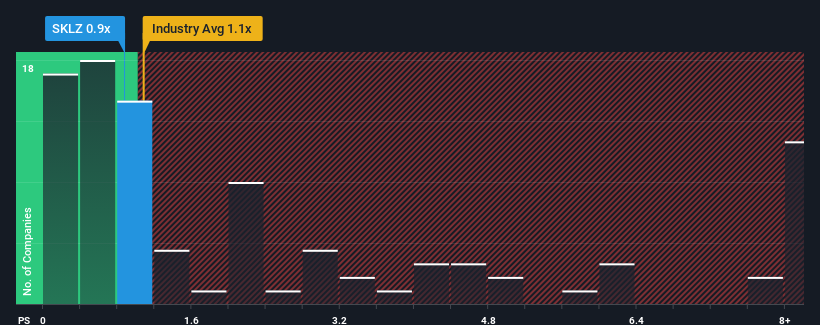

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Skillz's P/S ratio of 0.9x, since the median price-to-sales (or "P/S") ratio for the Entertainment industry in the United States is also close to 1.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Skillz

What Does Skillz's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Skillz's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Skillz will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Skillz's is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 49%. The last three years don't look nice either as the company has shrunk revenue by 15% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 1.7% per year as estimated by the four analysts watching the company. With the industry predicted to deliver 9.5% growth per year, that's a disappointing outcome.

With this in consideration, we think it doesn't make sense that Skillz's P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Final Word

Skillz appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

While Skillz's P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

You always need to take note of risks, for example - Skillz has 3 warning signs we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SKLZ

Skillz

Operates a mobile game platform in the United States, Israel, China, Malta, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives