- United States

- /

- Entertainment

- /

- NYSE:SKLZ

Optimistic Investors Push Skillz Inc. (NYSE:SKLZ) Shares Up 44% But Growth Is Lacking

Skillz Inc. (NYSE:SKLZ) shareholders are no doubt pleased to see that the share price has bounced 44% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 70% share price drop in the last twelve months.

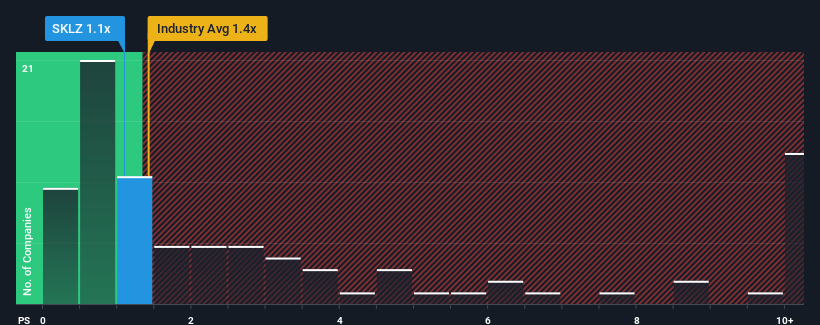

In spite of the firm bounce in price, it's still not a stretch to say that Skillz's price-to-sales (or "P/S") ratio of 1.1x right now seems quite "middle-of-the-road" compared to the Entertainment industry in the United States, where the median P/S ratio is around 1.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Skillz

How Skillz Has Been Performing

Skillz could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Skillz will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Skillz?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Skillz's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 29% decrease to the company's top line. Still, the latest three year period has seen an excellent 125% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 1.6% per year as estimated by the five analysts watching the company. That's not great when the rest of the industry is expected to grow by 10% per annum.

In light of this, it's somewhat alarming that Skillz's P/S sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Key Takeaway

Its shares have lifted substantially and now Skillz's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our check of Skillz's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

It is also worth noting that we have found 3 warning signs for Skillz that you need to take into consideration.

If you're unsure about the strength of Skillz's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SKLZ

Skillz

Operates a mobile game platform in the United States, Israel, China, Malta, and internationally.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives