- United States

- /

- Insurance

- /

- NYSE:AJG

Exploring Undervalued US Stocks With Intrinsic Value Discounts Ranging From 13% To 39.6%

Reviewed by Simply Wall St

The United States stock market has shown robust growth, rising 1.6% over the last week and achieving a 21% increase over the past year, with earnings expected to grow by 15% annually. In this thriving environment, identifying undervalued stocks that offer significant discounts on their intrinsic value can present attractive opportunities for investors seeking potential gains.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Selective Insurance Group (NasdaqGS:SIGI) | $91.87 | $183.64 | 50% |

| Associated Banc-Corp (NYSE:ASB) | $20.25 | $39.54 | 48.8% |

| USCB Financial Holdings (NasdaqGM:USCB) | $12.10 | $23.87 | 49.3% |

| Hollysys Automation Technologies (NasdaqGS:HOLI) | $21.21 | $42.18 | 49.7% |

| DiDi Global (OTCPK:DIDI.Y) | $4.45 | $8.84 | 49.6% |

| HeartCore Enterprises (NasdaqCM:HTCR) | $0.72 | $1.41 | 48.8% |

| Vasta Platform (NasdaqGS:VSTA) | $3.05 | $5.92 | 48.5% |

| Open Lending (NasdaqGM:LPRO) | $5.74 | $11.32 | 49.3% |

| Carter Bankshares (NasdaqGS:CARE) | $12.38 | $24.12 | 48.7% |

| Astronics (NasdaqGS:ATRO) | $18.22 | $36.16 | 49.6% |

Let's uncover some gems from our specialized screener

Datadog (NasdaqGS:DDOG)

Overview: Datadog, Inc. operates a platform for observability and security of cloud applications across North America and internationally, with a market capitalization of approximately $39.42 billion.

Operations: The company generates its revenue primarily from its IT Infrastructure segment, totaling approximately $2.26 billion.

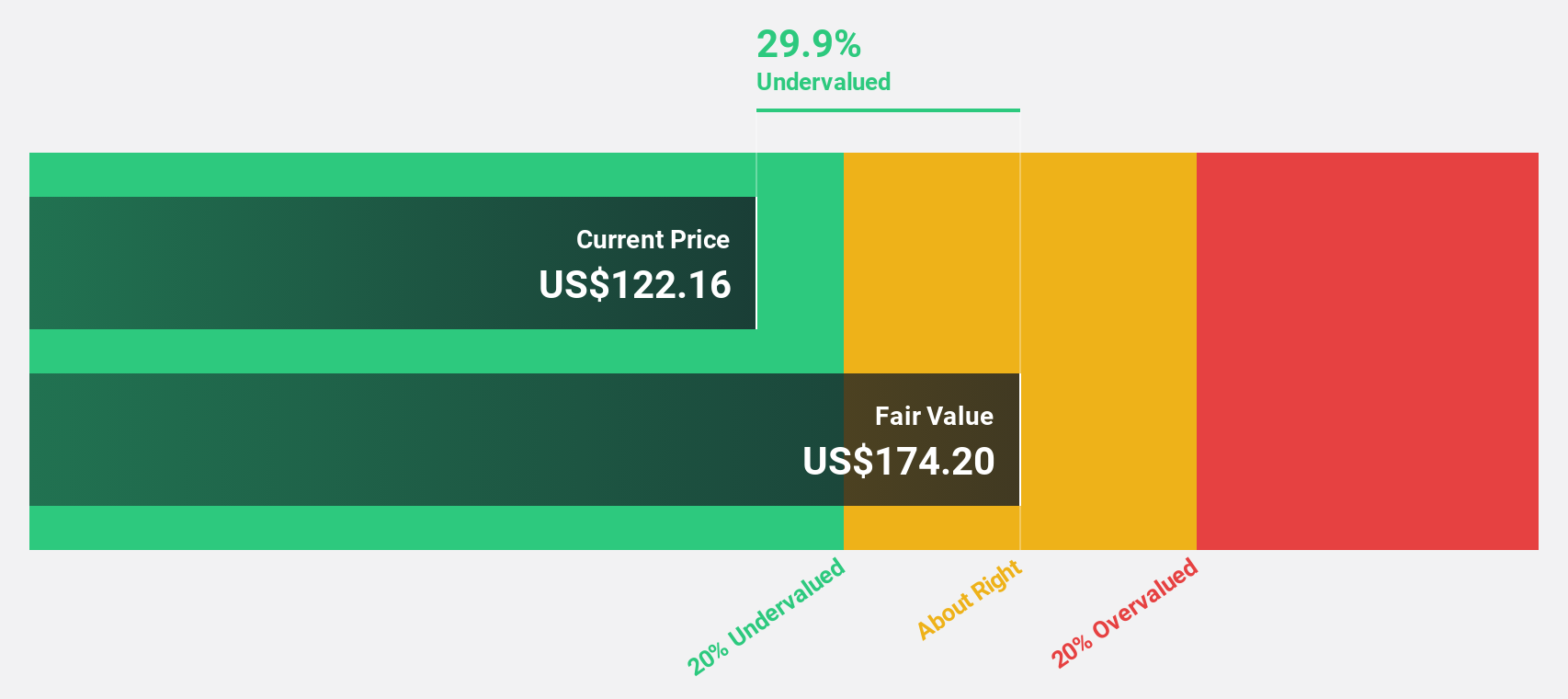

Estimated Discount To Fair Value: 39.6%

Datadog, currently priced at US$117.17, is valued significantly below our calculated fair value of US$194.05, indicating a potential undervaluation of over 20%. Despite recent insider selling and shareholder dilution over the past year, Datadog's financial outlook remains robust with earnings expected to grow by 24.6% annually over the next three years—outpacing the US market average. Additionally, its recent product launch, the Datadog App Builder, enhances its service offering by integrating remediation capabilities directly into monitoring systems, potentially boosting operational efficiency and customer value.

- The analysis detailed in our Datadog growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Datadog.

Arthur J. Gallagher (NYSE:AJG)

Overview: Arthur J. Gallagher & Co. operates globally, offering insurance and reinsurance brokerage, consulting, and third-party claims services in property and casualty; it has a market capitalization of approximately $56.43 billion.

Operations: The company's revenue is primarily generated from its brokerage and risk management segments, which respectively brought in $8.77 billion and $1.31 billion.

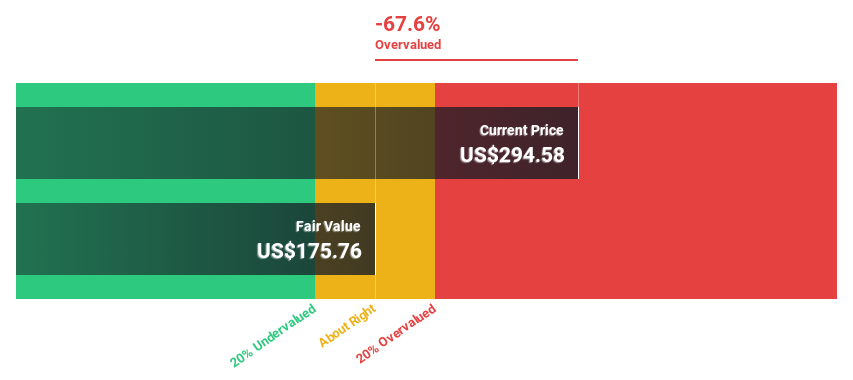

Estimated Discount To Fair Value: 13%

Arthur J. Gallagher & Co., trading at US$261.16, appears modestly undervalued with a fair value estimate of US$300.31, reflecting a potential underpricing based on discounted cash flow analysis. The company's robust first-quarter performance, with revenue and net income significantly up from the previous year at US$3.26 billion and US$608.4 million respectively, underscores its financial health. Expected to outperform the market, AJG's earnings are forecasted to grow by 22.42% annually over the next three years, surpassing broader market growth projections substantially.

- Insights from our recent growth report point to a promising forecast for Arthur J. Gallagher's business outlook.

- Dive into the specifics of Arthur J. Gallagher here with our thorough financial health report.

Sea (NYSE:SE)

Overview: Sea Limited operates in digital entertainment, e-commerce, and digital financial services across Southeast Asia, Latin America, and other regions, with a market capitalization of approximately $42.74 billion.

Operations: The revenue segments for the company include e-commerce at $9.68 billion, digital entertainment at $2.09 billion, and digital financial services at $1.85 billion.

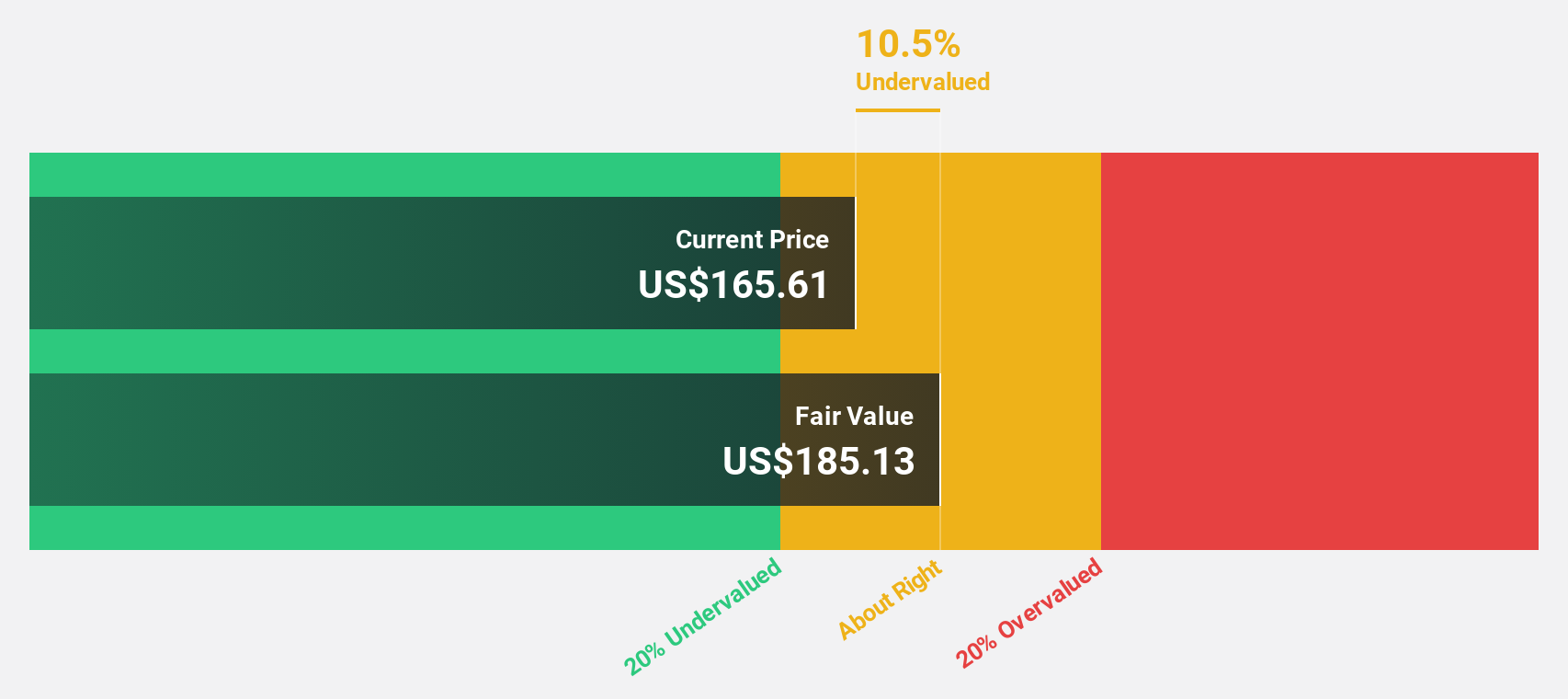

Estimated Discount To Fair Value: 39.6%

Sea Limited, currently priced at US$74.92, is significantly below our fair value estimate of US$124.11, indicating potential undervaluation based on cash flows. Recently becoming profitable and with earnings expected to grow by 41.88% annually over the next three years, SE outpaces the US market's growth forecast substantially. However, recent financials show a shift from net income to a loss of US$23.66 million in Q1 2024, reflecting volatility in its earnings quality due to large one-off items.

- Our expertly prepared growth report on Sea implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Sea with our comprehensive financial health report here.

Taking Advantage

- Dive into all 173 of the Undervalued US Stocks Based On Cash Flows we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AJG

Arthur J. Gallagher

Provides insurance and reinsurance brokerage, consulting, and third-party property/casualty claims settlement and administration services to entities and individuals worldwide.

Excellent balance sheet with reasonable growth potential and pays a dividend.