- United States

- /

- Interactive Media and Services

- /

- NYSE:RDDT

Reddit (RDDT) Valuation in Focus Following Strong Results and New Institutional Interest

Reviewed by Kshitija Bhandaru

Reddit (RDDT) is in the spotlight after drawing fresh institutional interest following impressive quarterly results. With revenue rising and profitability momentum building, the company is attracting attention for its evolving business strategy.

See our latest analysis for Reddit.

Reddit’s share price has seen dramatic swings lately, with a sharp 25% drop over the past month following earlier gains. Yet its total shareholder return over the past year has soared an eye-catching 161%. This momentum signals investor excitement around the company’s rapid revenue growth and evolving profitability, as well as some shifting risk perceptions in response to industry developments and Reddit’s high valuation.

If Reddit’s volatility has you thinking about new growth stories, this is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With a recent 26% pullback and strong growth figures, investors now face a key question: is Reddit’s recent dip an overlooked buying opportunity, or has the market already priced in all of its future upside?

Most Popular Narrative: 10.5% Undervalued

Reddit’s most widely followed narrative suggests its fair value is $222.38, which is notably above the last close of $198.97. This reflects optimism in future growth drivers and improved profitability expectations, supported by incremental upgrades in revenue forecasts.

As digital advertising budgets increasingly prioritize highly engaged, niche communities, Reddit's 84% year-over-year ad revenue growth, broadening advertiser base, and introduction of formats like Dynamic Product Ads position it to capture a greater share of this secular trend. This could potentially lift revenue and net margins over time, especially as ad stack improvements enhance advertiser ROI.

What is behind this bullish forecast? Powerful growth assumptions, bold margin expansion, and an earnings trajectory that only a few platforms dare to project. The mystery is exactly how aggressive these projections are. Discover the numbers that define this premium fair value and see if they stand up to your own scrutiny.

Result: Fair Value of $222.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including a heavy reliance on digital ad revenue and challenges in scaling international user engagement. Both of these factors could restrain Reddit’s future growth.

Find out about the key risks to this Reddit narrative.

Another View: Comparing Market Multiples

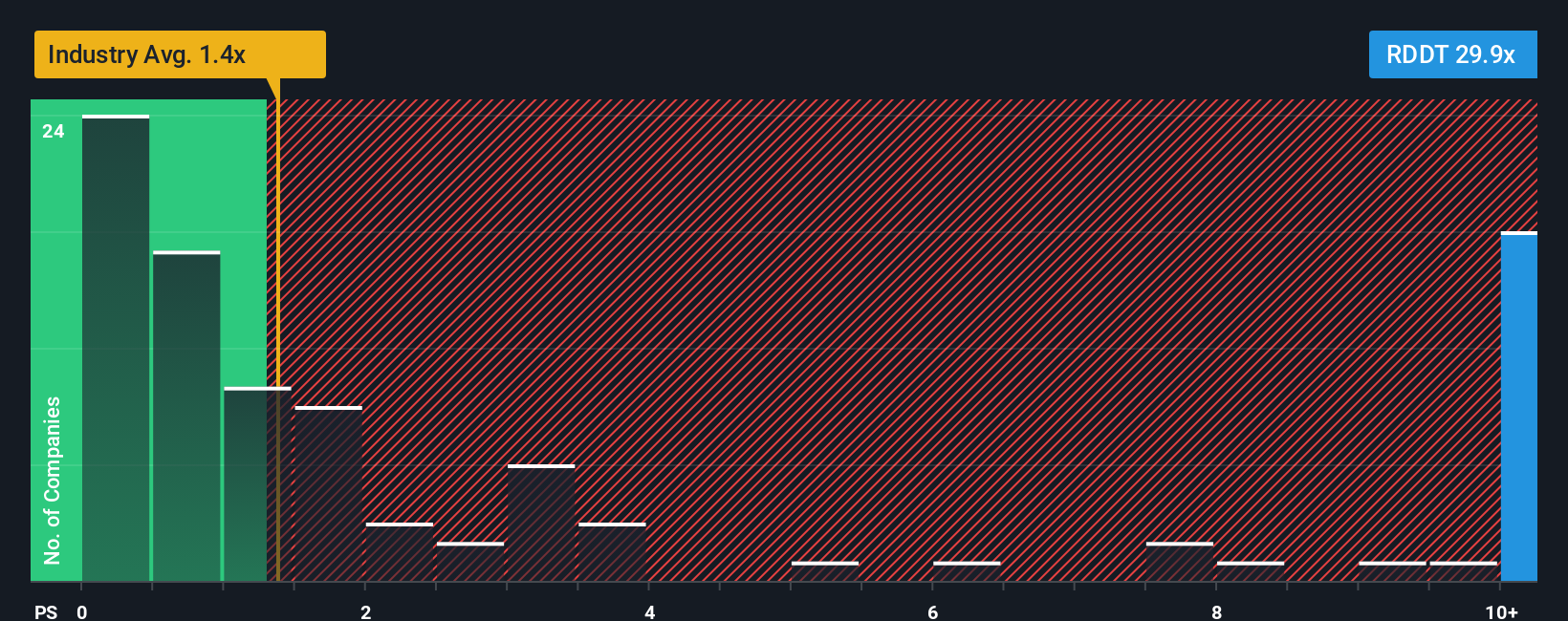

Despite optimism in fair value models, Reddit’s current market price looks expensive when using the price-to-sales ratio. At 22.3x, this stands far above the US industry average of 1.3x, the peer average of 3.2x, and even the fair ratio of 11.5x. This gap suggests real valuation risk if expectations shift. Could the market move closer toward these lower multiples?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Reddit Narrative

If you think the story looks different through your own lens or want to test a thesis of your own, it takes just minutes to build your personalized narrative. So why not Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Reddit.

Looking for more investment ideas?

Take your next step with confidence. The Simply Wall Street Screener makes it easy to pinpoint standout companies based on what truly matters to you. Don’t miss opportunities that could transform your investment journey. Go beyond the headlines and take action today.

- Capture high potential in emerging technologies by tapping into these 24 AI penny stocks that are shaping industries with artificial intelligence breakthroughs.

- Supercharge your portfolio with steady income. Review these 20 dividend stocks with yields > 3% featuring robust yields and proven cash generation.

- Capitalize on underappreciated value plays when you uncover these 868 undervalued stocks based on cash flows offering strong fundamentals at attractive prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDDT

Operates a digital community in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives