- United States

- /

- Interactive Media and Services

- /

- NYSE:RDDT

Reddit (RDDT) Is Up 8.4% After Strong Q2 Earnings and Net Income Turnaround Amid Lawsuits

Reviewed by Simply Wall St

- Reddit, Inc. recently reported strong second-quarter 2025 earnings, with revenue rising to US$499.63 million and net income reaching US$89.3 million, reversing a prior loss in the same period last year.

- This positive performance comes as Reddit faces multiple class action lawsuits over alleged misstatements related to the impact of Google's search algorithm changes on site traffic and advertising revenue.

- We’ll examine how Reddit’s robust financial results, despite ongoing legal scrutiny about search traffic disclosures, update the company’s investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Reddit Investment Narrative Recap

To be a Reddit shareholder, you need to believe that its rapid ad and data growth, paired with international expansion and AI innovation, can keep user engagement high despite intense industry competition and traffic volatility tied to Google Search. The latest earnings, showing a return to profitability and soaring quarterly revenue, do not appear to materially change the short term catalyst, which remains daily active user growth, nor do they resolve the key risk: ongoing dependence on external search traffic. Among the recent announcements, Reddit's addition to several major Russell index benchmarks stands out in relation to the ongoing class action lawsuits concerning Google Search impacts. This new index inclusion could help drive increased institutional ownership and liquidity, supporting the stock in the face of traffic-related legal scrutiny. However, investors should not overlook the persistent uncertainty around Google's search algorithms and how changes might continue to affect Reddit’s growth engine…

Read the full narrative on Reddit (it's free!)

Reddit's narrative projects $3.1 billion revenue and $750.4 million earnings by 2028. This requires 29.1% yearly revenue growth and a $633.5 million increase in earnings from $116.9 million today.

Uncover how Reddit's forecasts yield a $152.01 fair value, a 5% downside to its current price.

Exploring Other Perspectives

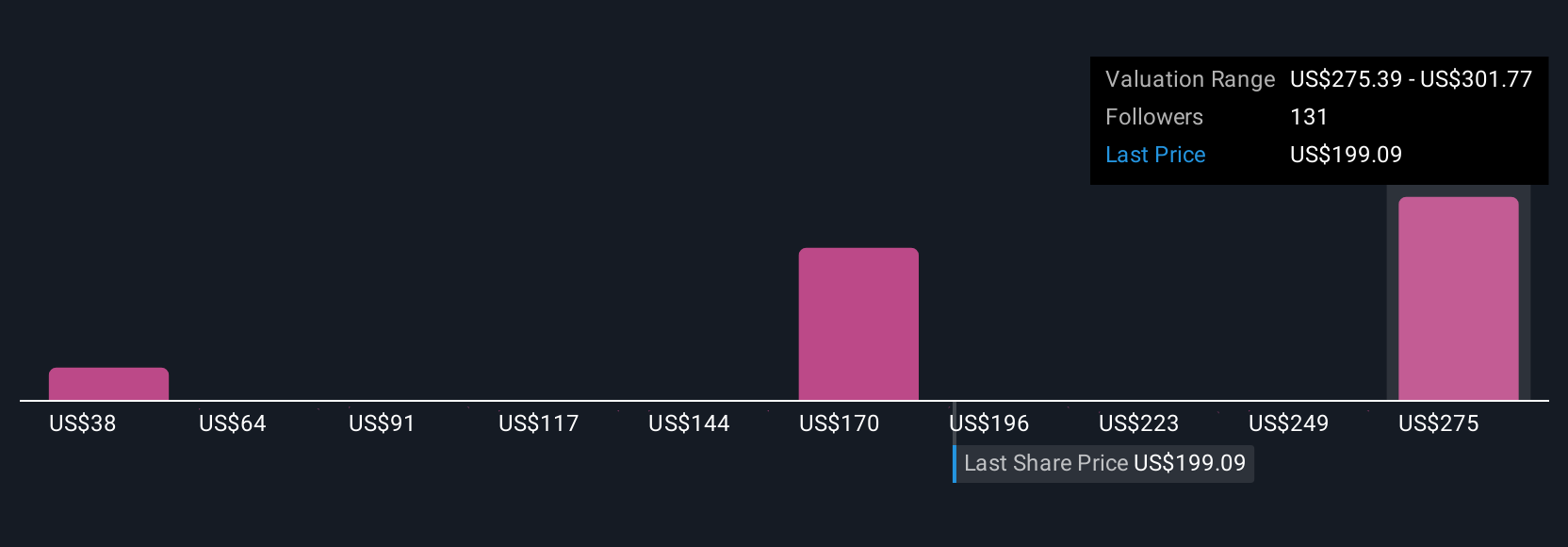

Nineteen Simply Wall St Community members estimate Reddit's fair value between US$38 and US$249.25, revealing a broad range of expectations. With many focused on Reddit’s reliance on Google for user growth, the wide spread underscores how traffic risks weigh on perceptions of future returns.

Explore 19 other fair value estimates on Reddit - why the stock might be worth as much as 55% more than the current price!

Build Your Own Reddit Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Reddit research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Reddit research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Reddit's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDDT

Operates a digital community in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives