Key Takeaways

- International growth and product localization are driving rapid user and advertiser expansion, especially in key non-U.S. markets.

- Expansion into AI-driven products, advanced ad solutions, and data licensing is fueling user engagement, new revenue streams, and improved profitability.

- Overdependence on search-driven growth, scaling moderation, fierce competition, regulatory risks, and monetization pressures threaten sustainable revenue, user engagement, and profitability.

Catalysts

About Reddit- Operates a digital community in the United States and internationally.

- Accelerated international expansion, enabled by machine translation and localized growth playbooks, is unlocking rapidly growing new user segments and advertisers outside the U.S.-especially in markets like France, Spain, and Brazil where user growth is nearly double the international average-providing significant future upside to user growth and ad revenue.

- Deep investments into Reddit's core search functionality, AI-driven products (such as Reddit Answers), and a focus on making discovery and contribution easier are positioned to convert both new and logged-out users into highly engaged, retained daily active users-expanding the platform's addressable audience and driving higher engagement-based revenue.

- Ongoing innovations in targeted ad solutions (including Dynamic Product Ads and conversation/contextual ad formats) and improved machine learning for ad performance are translating into increased advertiser demand, higher ad pricing, and rising ROAS-creating a path to sustained revenue growth and ad yield expansion.

- Diversification into high-margin data licensing for AI/LLM training and market research, supported by growing demand from major partners, is establishing a new, scalable annuity revenue stream with substantial incremental upside for gross margins and overall profitability.

- Continued discipline in operational efficiency and cost control-while investing heavily in engineering, machine learning, and sales coverage-has led to expanding EBITDA and net income margins, indicating the potential for sustained profitability and robust long-term earnings growth even as top-line growth remains strong.

Reddit Future Earnings and Revenue Growth

Assumptions

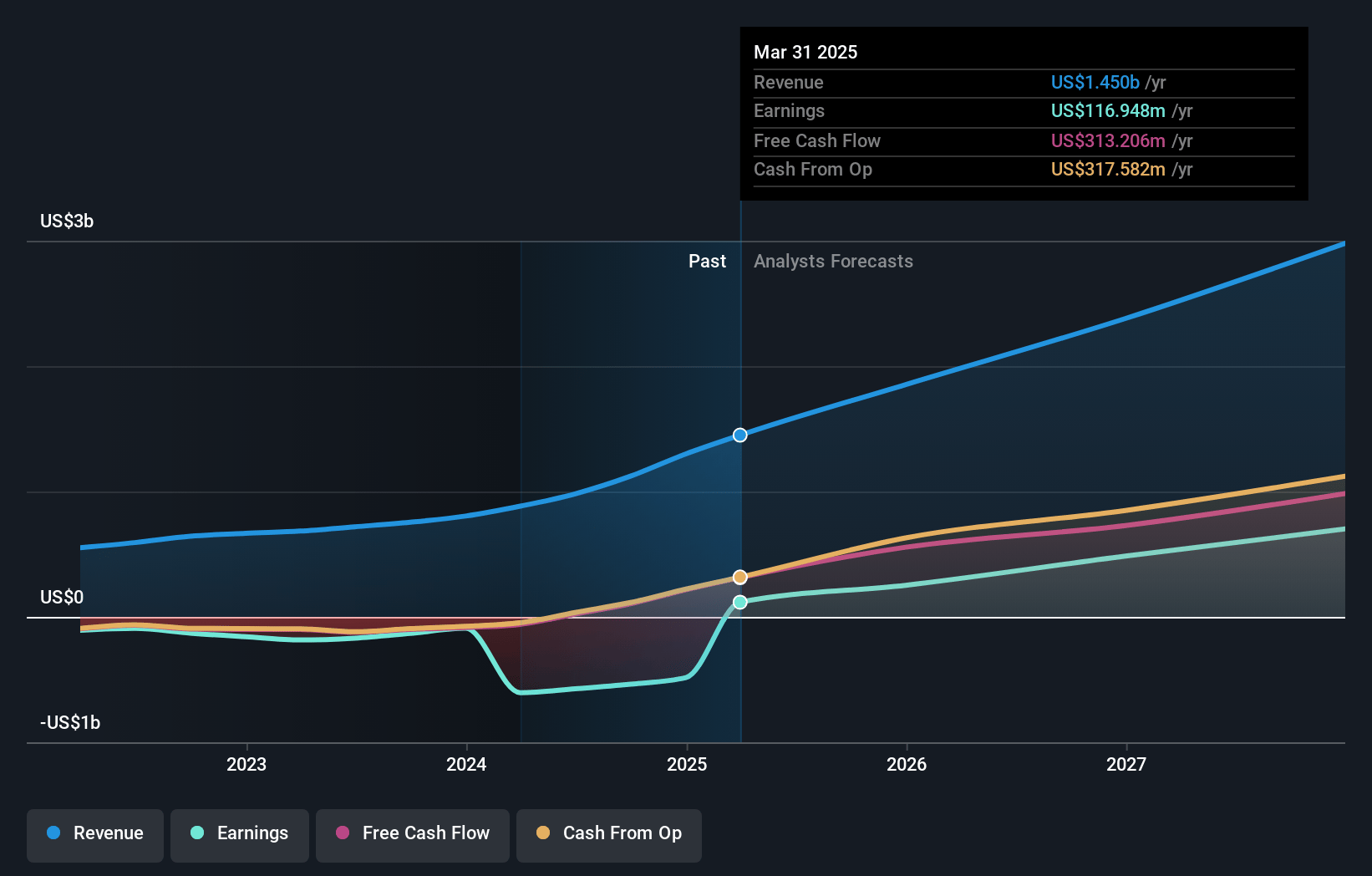

How have these above catalysts been quantified?- Analysts are assuming Reddit's revenue will grow by 29.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.1% today to 24.0% in 3 years time.

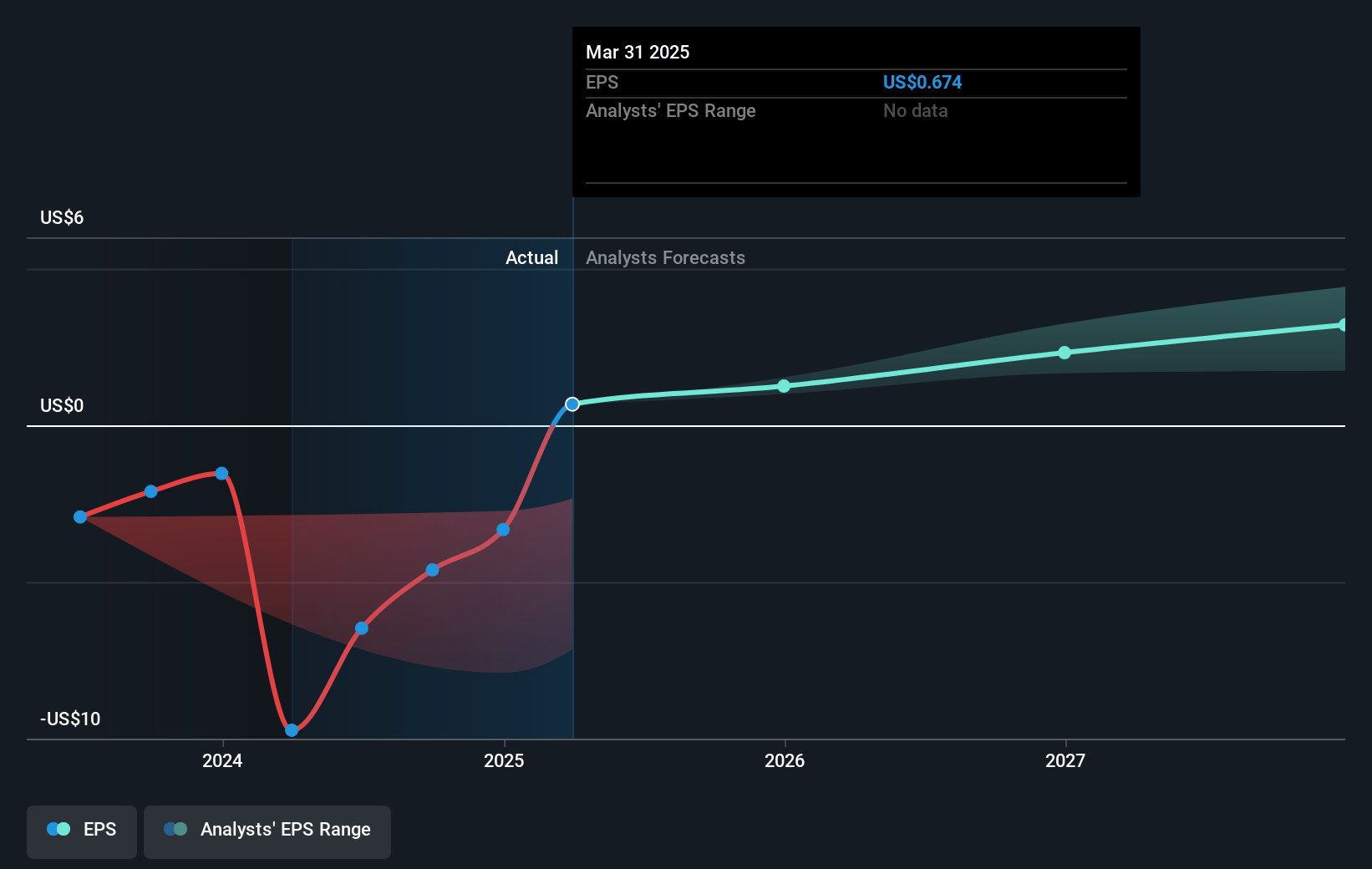

- Analysts expect earnings to reach $748.4 million (and earnings per share of $3.42) by about July 2028, up from $116.9 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $931.9 million in earnings, and the most bearish expecting $370.6 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 56.2x on those 2028 earnings, down from 228.5x today. This future PE is greater than the current PE for the US Interactive Media and Services industry at 16.8x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.56%, as per the Simply Wall St company report.

Reddit Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Reddit's heavy reliance on Google search as a user acquisition channel leaves its growth exposed to ongoing changes in Google's algorithms and the broader evolution of search (e.g., increased LLM/AI-generated answers), introducing risk of traffic volatility and user growth stagnation, which could negatively impact revenue expansion.

- Scaling its volunteer moderator-based content governance model may prove unsustainable as Reddit's user base and international footprint widen, potentially driving increased operational costs or more frequent moderation failures that could deter advertisers, thus compressing net margins and future earnings.

- Persisting industry competition from platforms investing more aggressively in video, AI-driven personalization, and the creator economy (e.g., TikTok, Meta, Discord) could erode Reddit's market share and limit user engagement growth, impeding long-term ad revenue and user monetization potential.

- Regulatory and privacy uncertainties-including increased scrutiny on online communities with high pseudonymity and potential tightening of data sharing for advertising and AI-could raise compliance costs and restrict the value or scalability of Reddit's advertising and data licensing businesses, constraining net margins and incremental revenues.

- Reddit's efforts to strengthen monetization (e.g., new ad formats, premium tools, data licensing) must be carefully balanced against maintaining authentic user experience; aggressive monetization could alienate core users or diminish platform quality, ultimately restraining sustainable revenue and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $149.563 for Reddit based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $220.0, and the most bearish reporting a price target of just $75.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.1 billion, earnings will come to $748.4 million, and it would be trading on a PE ratio of 56.2x, assuming you use a discount rate of 7.6%.

- Given the current share price of $144.8, the analyst price target of $149.56 is 3.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.