- United States

- /

- Interactive Media and Services

- /

- NYSE:RDDT

Reddit (RDDT): Exploring Current Valuation and Growth Outlook After Recent Stock Volatility

Reviewed by Kshitija Bhandaru

See our latest analysis for Reddit.

After a wave of attention following its IPO, Reddit’s stock price has seen bursts of momentum and some cooling off, but the bigger story is its emerging stability. With a 1-year total shareholder return of 1.98%, the stock is sending mixed signals. Recent gains hint at cautious optimism, balanced by a wait-and-see approach from the market.

If you’re looking for fresh opportunities and want to see what other fast-moving companies are catching investor interest, now’s the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With strong revenue and net income growth but a share price near analyst targets, the key question now is whether Reddit is undervalued or if the market has already priced in its next phase. Is this a genuine buying opportunity?

Most Popular Narrative: 8.3% Undervalued

Reddit’s most widely tracked narrative places fair value at $219.15, about 8% above the last close of $200.92. This creates a compelling gap between high future expectations and the current share price, prompting investors to examine the assumptions driving the consensus view.

As digital advertising budgets increasingly prioritize highly engaged, niche communities, Reddit's 84% YoY ad revenue growth, broadening advertiser base, and introduction of formats like Dynamic Product Ads position it to capture a greater share of this secular trend, potentially lifting revenue and net margins over time, especially as ad stack improvements enhance advertiser ROI.

Want to know what powers this optimistic fair value? There are bold projections for explosive growth, rising profitability, and a future profit multiple more often found on market disruptors. The secret behind the numbers and the tension it creates is waiting in the full narrative.

Result: Fair Value of $219.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if digital ad efficacy declines or global expansion slows down, the bullish outlook that currently drives Reddit’s narrative could quickly weaken.

Find out about the key risks to this Reddit narrative.

Another View: Multiples Raise a Red Flag

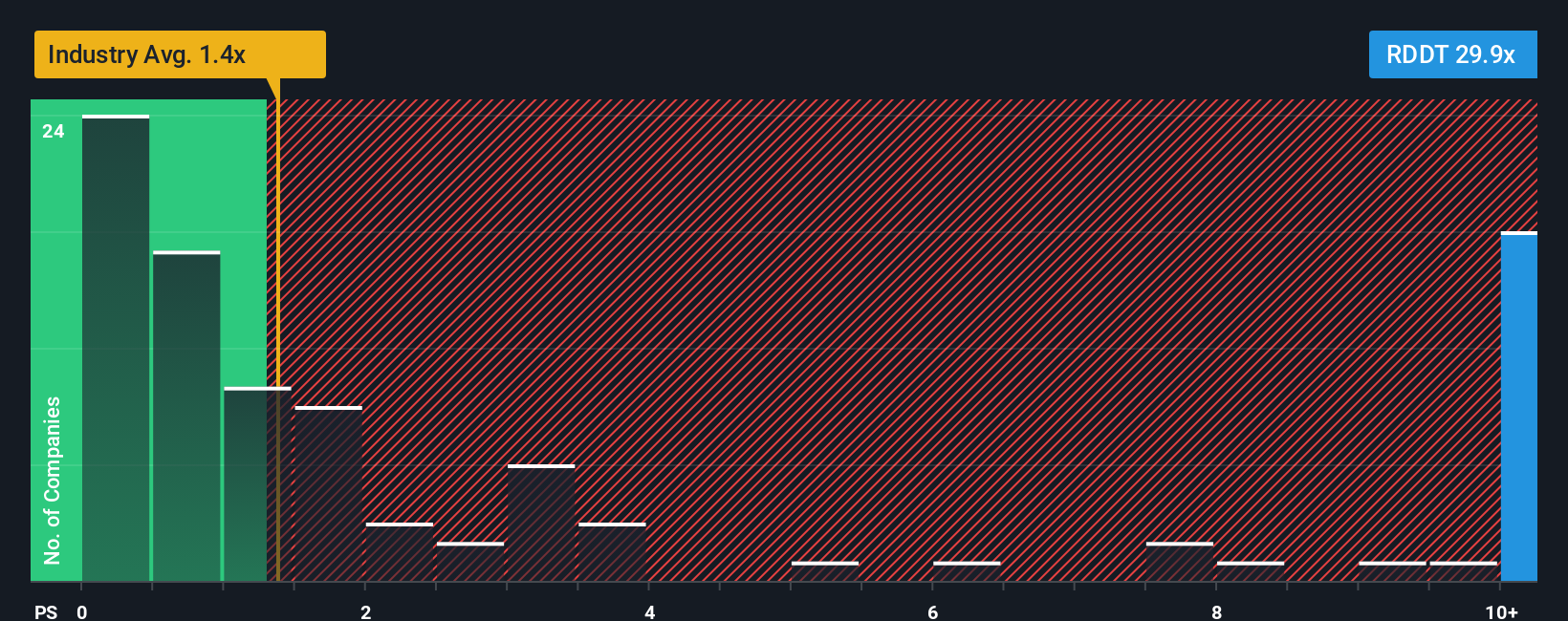

While Reddit looks undervalued based on future growth assumptions, its price-to-sales ratio paints a different story. At 22.5x, the ratio is far above both peers at 3.4x and the industry average of 1.3x, and is also double its fair ratio of 11.5x. This gap suggests the market could be overpaying for near-term potential. Is there real value here, or are expectations running too far ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Reddit Narrative

If the prevailing view doesn’t quite match your take or you’d rather do your own digging, you can build a personalized Reddit thesis in just minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Reddit.

Looking for more investment ideas?

Act now to find the next standout opportunity. The right stock at the right time can make a big difference, so don't miss out on these exciting trends:

- Boost your passive income by targeting reliable yields with these 19 dividend stocks with yields > 3% and see which companies are consistently rewarding shareholders.

- Capitalize on next-generation healthcare tech by checking out these 31 healthcare AI stocks companies that are reshaping the industry with artificial intelligence breakthroughs.

- Spot market mispricings instantly using these 910 undervalued stocks based on cash flows to uncover stocks trading below their true worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDDT

Operates a digital community in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion